Japan Pure Chemical (TSE:4973) Earnings Boosted by ¥1.2B One-Off Gain, Raising Quality Questions

Reviewed by Simply Wall St

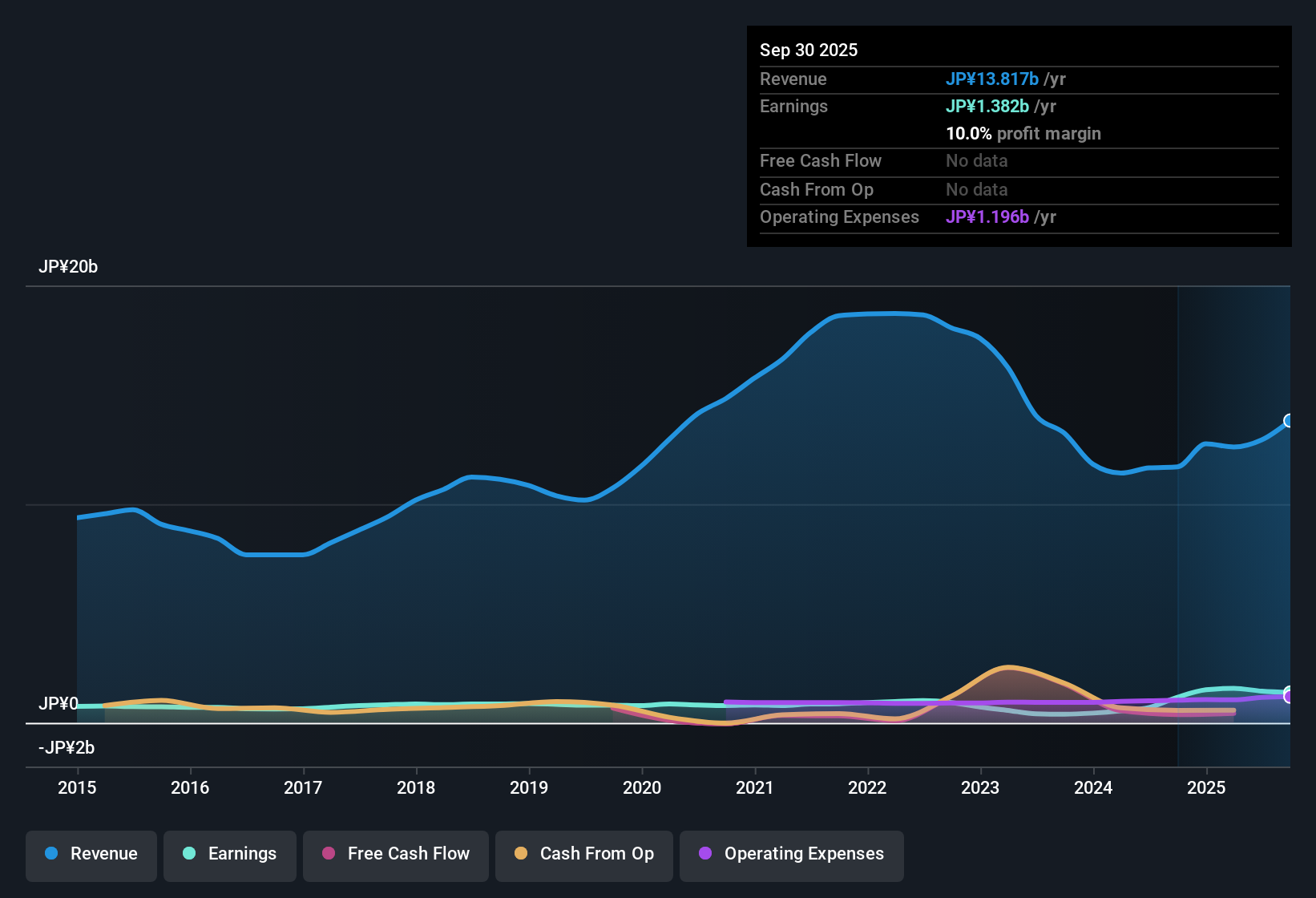

Japan Pure ChemicalLtd (TSE:4973) posted earnings growth of 18.2% over the past year, topping its 5-year average growth rate of 10.6%. Net profit margins held steady at 10%, with revenue expected to climb 7.1% per year, outpacing the wider Japanese market’s forecast of 4.4%. While the most recent financials got a lift from a one-off gain of ¥1.2 billion, the company’s consistent growth track record and strong value proposition are central for investors monitoring the top line momentum.

See our full analysis for Japan Pure ChemicalLtd.Next, we will examine how these performance figures compare with the current narratives shaping investor sentiment, highlighting where the stories align and where expectations could differ.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Inflates Reported Profits

- The company's latest 12-month net profit includes a ¥1.2 billion one-off gain, making the spike in earnings partly non-recurring and potentially overstating underlying profitability compared to previous years.

- What is surprising is that, despite steady net profit margins at 10%, the inclusion of this one-off gain means the recent 18.2% earnings growth appears stronger than the underlying trend. This could mislead investors who expect this pace to continue.

- While historic five-year annual earnings growth rates averaged 10.6%, not all drivers behind the recent jump are expected to last.

- This highlights the importance of separating core business strength from temporary boosts when evaluating future growth prospects.

Growth Forecasts Show Moderate Upside

- Forward guidance calls for earnings to grow at 7.5% per year and revenue at 7.1% per year. This suggests continued but not rapid expansion, as earnings growth is forecast just below the Japanese market's expectation of 8% per year.

- Bulls often highlight the above-market revenue growth forecast as a key positive, but the more modest earnings guidance challenges a strongly bullish outlook.

- Revenue growth exceeding the wider market's 4.4% annual rate does support optimism around sales momentum.

- However, with profit growth projecting slightly slower than peers, the prospects for significant upside are somewhat tempered by these more measured targets.

Valuation Looks Attractive Despite Industry Premium

- The stock trades slightly above domestic chemical industry multiples but stands out as good value both on a discounted cash flow basis (DCF fair value of ¥9,709.48) and relative to peers, while trading at a current share price of ¥3,300.

- The prevailing view is that although valuation is richer than some sector names, the combination of strong fundamentals and forecasted growth gives the company an attractive risk/reward profile.

- DCF analysis provides a large margin of safety compared to the current trading level, which adds confidence for value-focused investors.

- Stable profit margins and a long-term growth record further support the case for a fair premium over sector averages.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Pure ChemicalLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Japan Pure ChemicalLtd’s recent earnings surge was partially driven by a one-off gain. Future profit growth forecasts are trailing market expectations.

If you want companies that consistently expand earnings and revenue without relying on one-time windfalls, focus on steady performers using stable growth stocks screener (2101 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4973

Japan Pure ChemicalLtd

Develops, manufactures, and sells metal plating chemicals for electronic devices in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives