How NOF’s (TSE:4403) Buyback and Dividend Hike Could Reshape Its Value Proposition

Reviewed by Sasha Jovanovic

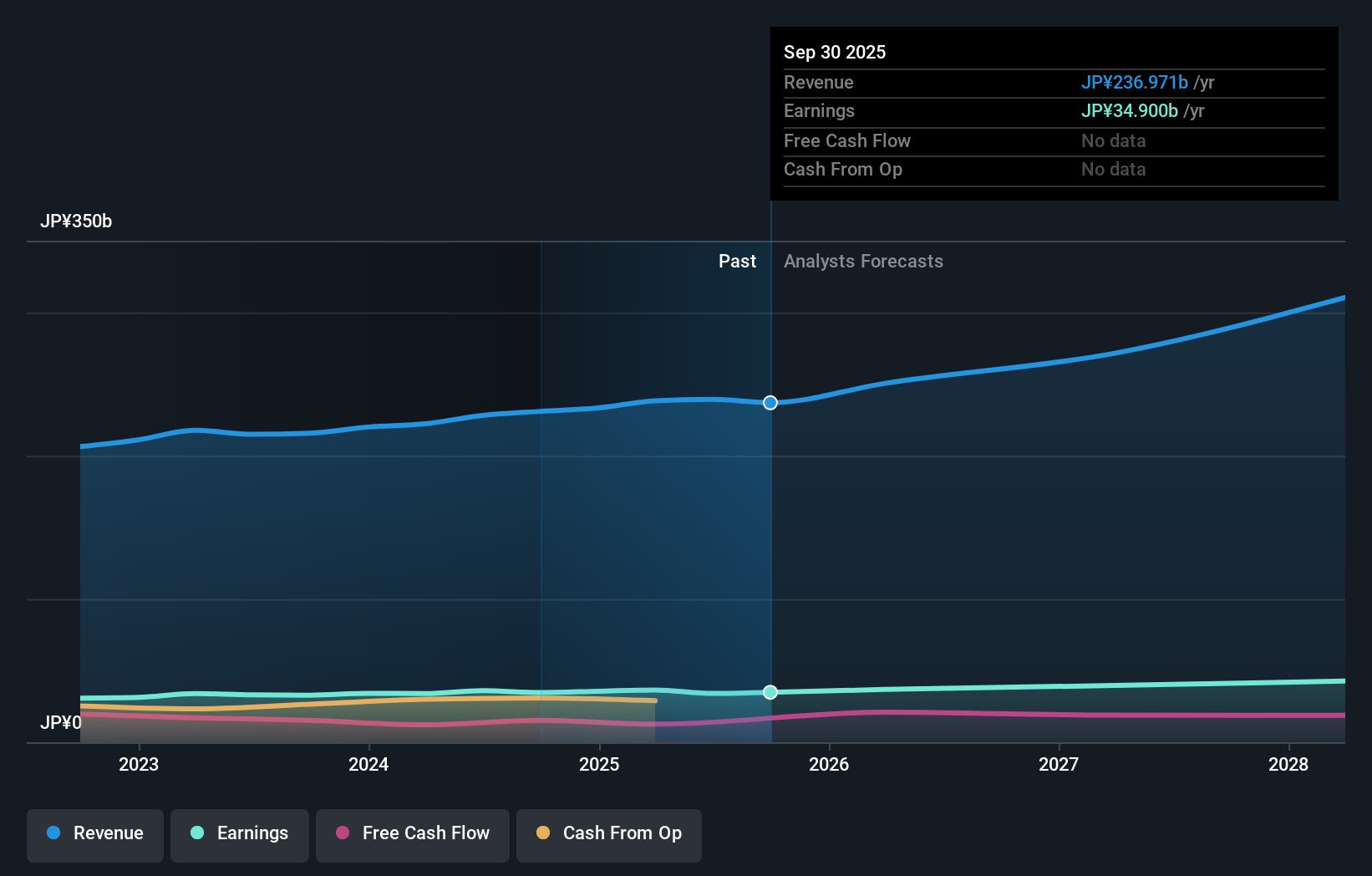

- NOF Corporation announced a comprehensive package including a new share buyback program of up to 2,000,000 shares for ¥5,000 million, increased dividend payments for the fiscal year ending March 2026, and an upward revision to full-year earnings guidance.

- This sequence of shareholder-friendly actions underscores the company's intent to enhance returns despite ongoing challenges in certain business segments.

- We'll explore how the commitment to higher dividends and a share repurchase plan factors into NOF's broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is NOF's Investment Narrative?

For shareholders in NOF, the most compelling big-picture belief centers on the company's ability to deliver consistent returns through cycles of earnings stability and capital returns, while navigating segment fluctuations like we've seen in the Functional Chemicals business. The recent cluster of announcements, higher dividend guidance, the new share buyback program, and revised earnings forecasts, directly addresses the key catalysts and risks previously outlined. The upward revision in earnings guidance and further shareholder distributions reflect management's confidence in offsetting ongoing softness in cosmetics chemicals with robust performance from defense-related products. These moves add positive momentum to investor sentiment in the short term, potentially shifting the risk balance by providing more cushion against operational headwinds. However, the company’s relatively high valuation against industry benchmarks and persistent challenges in some business lines remain important factors for investors to watch.

On the other hand, NOF’s premium price-to-earnings ratio versus industry peers demands close attention.

Exploring Other Perspectives

Explore another fair value estimate on NOF - why the stock might be worth 26% less than the current price!

Build Your Own NOF Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOF research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NOF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOF's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4403

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives