Nippon Kayaku (TSE:4272): Is the Stock Still Undervalued After Upgraded Forecasts and Profit Surge?

Reviewed by Simply Wall St

Nippon Kayaku (TSE:4272) has revised its full-year outlook following stronger than expected results from its semiconductor and automotive business segments. The company’s latest earnings also show a marked jump in profit and a newly increased dividend.

See our latest analysis for Nippon Kayaku.

Nippon Kayaku's upbeat revision and soaring profits have supercharged its momentum. The company has seen a 1-month share price return of 9.5% and a total shareholder return of 29% over the past year. Investors appear to be reassessing the company’s growth prospects in light of its latest earnings surprise and dividend boost.

If positive surprises like these have you curious about what other opportunities are out there, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With profits jumping and management sounding upbeat, is Nippon Kayaku still trading at an attractive valuation, or are investors already factoring in the next phase of its growth?

Price-to-Earnings of 10x: Is it justified?

Nippon Kayaku trades at a price-to-earnings (P/E) ratio of 10x, putting its valuation below both its industry peers and the overall Japanese market at the most recent closing price of ¥1,512. This suggests the market is pricing in a relatively cautious outlook despite the company’s recent outperformance.

The price-to-earnings ratio measures what investors are willing to pay for each yen of current profits, reflecting future growth and perceived risk. For materials and chemical companies like Nippon Kayaku, the P/E can also mirror cyclical trends and investor expectations for earnings consistency.

With Nippon Kayaku’s P/E sitting well below the Japanese market average of 14.2x and the chemicals industry average of 12.7x, the stock stands out as attractively valued. The company’s P/E is not only cheaper than its direct competitors but also below what statistical models indicate it could be, with a “fair” P/E ratio estimated at 12.3x. This gap may close if recent growth proves sustainable.

Explore the SWS fair ratio for Nippon Kayaku

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, slowing net income growth and potential cyclicality in the chemicals sector could temper optimism if momentum does not continue in coming quarters.

Find out about the key risks to this Nippon Kayaku narrative.

Another View: What Does the DCF Model Say?

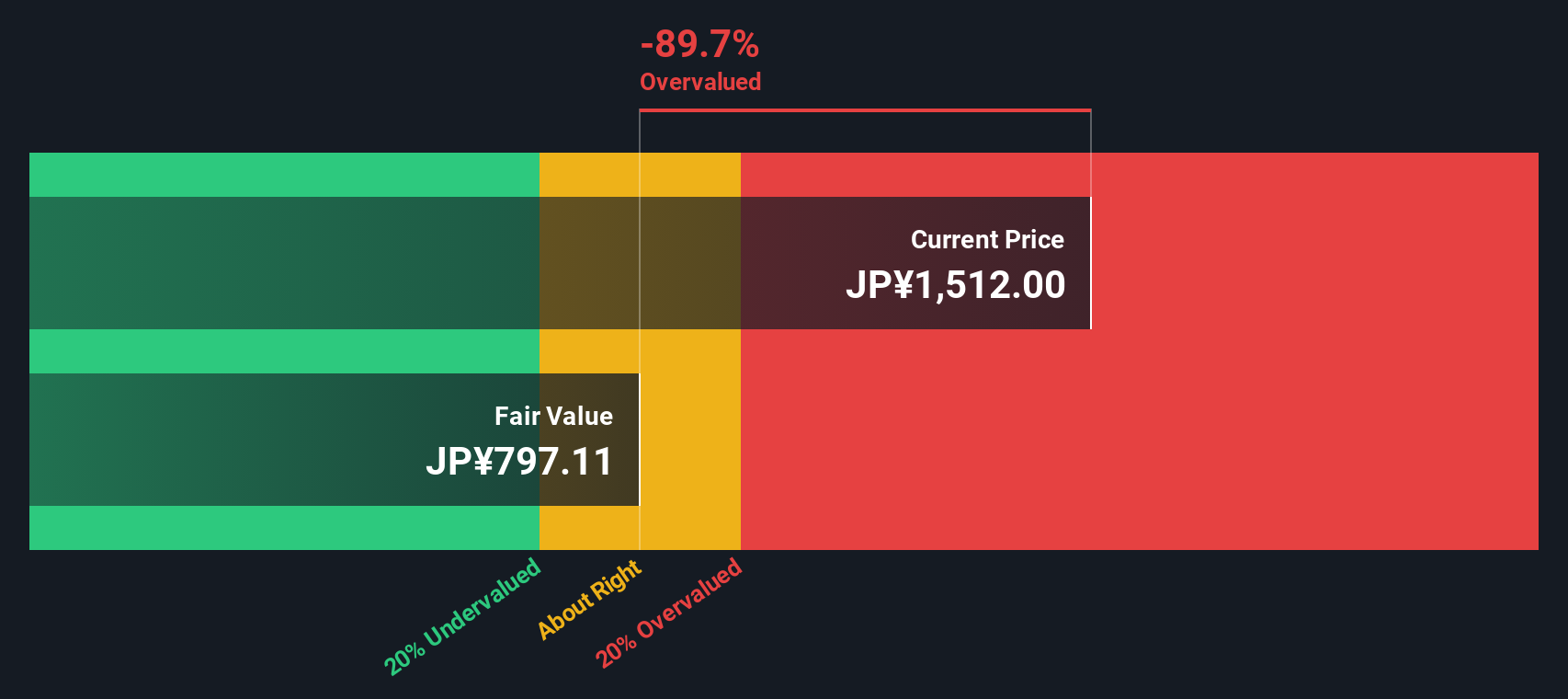

While traditional valuation metrics like the price-to-earnings ratio point to Nippon Kayaku trading below its industry and market averages, our DCF model paints a more cautious picture. According to the SWS DCF model, the shares are currently trading above their fair value estimate. This suggests the recent momentum may have run ahead of fundamentals. Could the current share price be factoring in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Kayaku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Kayaku Narrative

If you want to test your own assumptions or approach the data from a fresh angle, building a custom narrative is quick and easy to do yourself. Do it your way

A great starting point for your Nippon Kayaku research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Winning in the market means staying ahead of trends and spotting tomorrow’s biggest opportunities before everyone else. Real investors never settle for just one idea. Give yourself a real edge by expanding your search with these standout stock screens:

- Supercharge your income by targeting these 16 dividend stocks with yields > 3% offering yields above 3 percent for powerful cash flow potential.

- Benefit from healthcare disruption and find your edge with these 31 healthcare AI stocks pioneering medical innovation through artificial intelligence breakthroughs.

- Unlock tomorrow’s growth by zeroing in on these 26 quantum computing stocks set to transform computing, cryptography and high-performance data analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Kayaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4272

Nippon Kayaku

Engages in mobility and imaging, fine chemicals, and life sciences businesses in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives