Assessing UBE (TSE:4208) Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for UBE.

While UBE's share price has slipped by 3% over the past week, this follows a modest 1.8% gain in the last month, showing how investor sentiment can shift quickly. Looking at the bigger picture, the one-year total shareholder return sits at -4.1%. However, patience has been rewarded, as the three- and five-year total returns stand at 34.5% and nearly 60% respectively. Momentum has clearly faded in the short term, but long-term holders still sit on solid gains.

If you’re looking for your next discovery, now’s a great time to broaden your search and check out fast growing stocks with high insider ownership

With UBE’s shares lagging the broader market and trading below analyst price targets, some investors may wonder if the recent weakness is setting up a buying opportunity or if the market has already accounted for future growth prospects.

Price-to-Sales of 0.5x: Is it justified?

UBE trades at a price-to-sales ratio of 0.5x, putting it below both peer and industry averages. With a closing share price of ¥2,269.5, this multiple signals that the market may be pricing in lower expectations for UBE compared to its competition.

The price-to-sales ratio measures how much investors are willing to pay per yen of revenue. In sectors like chemicals, where profits fluctuate, it helps simplify valuation by focusing on sales instead of unstable profits.

UBE’s price-to-sales ratio is lower than the Japanese Chemicals industry average of 0.6x. Its fair price-to-sales ratio is also estimated at 0.5x. This suggests the current market price may reflect a reasonable balance among the company’s prospects, its scale, and sector dynamics. If the market shifts toward the fair price-to-sales ratio, UBE’s valuation might not move significantly from here.

Explore the SWS fair ratio for UBE

Result: Price-to-Sales of 0.5x (ABOUT RIGHT)

However, declining annual revenue and recent market underperformance could signal deeper challenges ahead. This makes short-term volatility a notable risk for UBE investors.

Find out about the key risks to this UBE narrative.

Another View: What Does Our DCF Model Say?

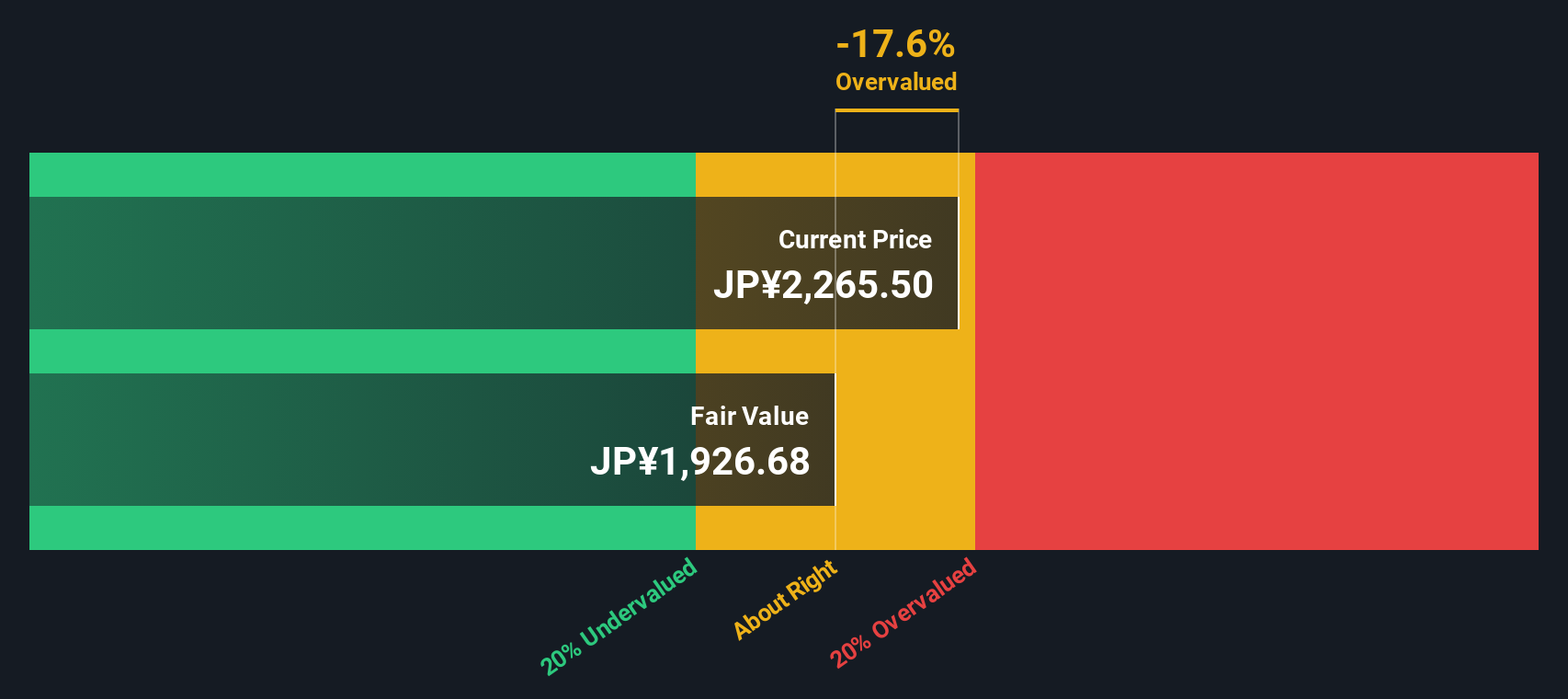

Looking at UBE from the perspective of our SWS DCF model, the current share price of ¥2,269.5 sits above our estimated fair value of ¥1,940.36. This suggests UBE could be overvalued by around 17%. Does the market see potential others might be missing, or could there be downside risk ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UBE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UBE Narrative

If you think there’s another side to the story or want to explore the numbers for yourself, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your UBE research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Start your next big move by using the Simply Wall Street Screener to pinpoint stocks with unique opportunities that might just give your portfolio an edge.

- Spot untapped value by reviewing these 840 undervalued stocks based on cash flows with strong cash flow and compelling long-term outlooks.

- Maximize your income potential by evaluating these 22 dividend stocks with yields > 3% offering solid yields above market averages and a proven history of rewarding shareholders.

- Get ahead of financial trends by researching these 81 cryptocurrency and blockchain stocks at the intersection of technology and global finance, offering exposure to innovation within the digital asset space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4208

UBE

Engages in the materials and machinery businesses in Japan, Asia, Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives