Zeon (TSE:4205): Is the Current Valuation Justified After Recent Share Price Momentum?

Reviewed by Simply Wall St

Zeon (TSE:4205) shares have gained traction lately, attracting attention thanks to steady financial performance and a recent uptick in stock price. Investors may be weighing these results as they look ahead to the months to come.

See our latest analysis for Zeon.

Zeon's shares have built up momentum this year, with a 20.94% year-to-date share price return and a 32.74% total shareholder return over the past twelve months. After a solid rally in recent weeks, investors seem to be signaling renewed confidence in the company’s prospects for the longer term, as reflected by a robust 51.95% total return across the last three years.

If Zeon's upward shift has you interested in what else might be gaining ground, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares trading near their analyst price target and growth steady but not spectacular, investors might wonder if Zeon’s strong run still leaves room for further gains, or if all that optimism is already reflected in the current price.

Price-to-Earnings of 9.5x: Is it justified?

Zeon’s shares are currently trading at a price-to-earnings (P/E) ratio of 9.5x, which stands out when compared to key benchmarks and suggests the market may be underestimating its prospects.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings, serving as a broad gauge of whether a stock’s price reflects its underlying profits. In Zeon’s case, a lower ratio than peers often signals potential value, particularly in the chemicals sector where earnings stability and dividend reliability often attract long-term investors.

At 9.5x, Zeon’s P/E is significantly below the industry average of 12.6x, the peer group average of 26.5x, and also below the estimated fair P/E of 12.8x. This means the market values Zeon’s earnings more conservatively than most of its competitors, possibly due to forecasts of moderate profit growth. There may be room for the valuation to rise if sentiment shifts and the market moves toward the fair P/E level.

Explore the SWS fair ratio for Zeon

Result: Price-to-Earnings of 9.5x (UNDERVALUED)

However, continued weak net income growth or Zeon's shares nearing their analyst price target could limit further upside in the near term.

Find out about the key risks to this Zeon narrative.

Another View: Discounted Cash Flow Perspective

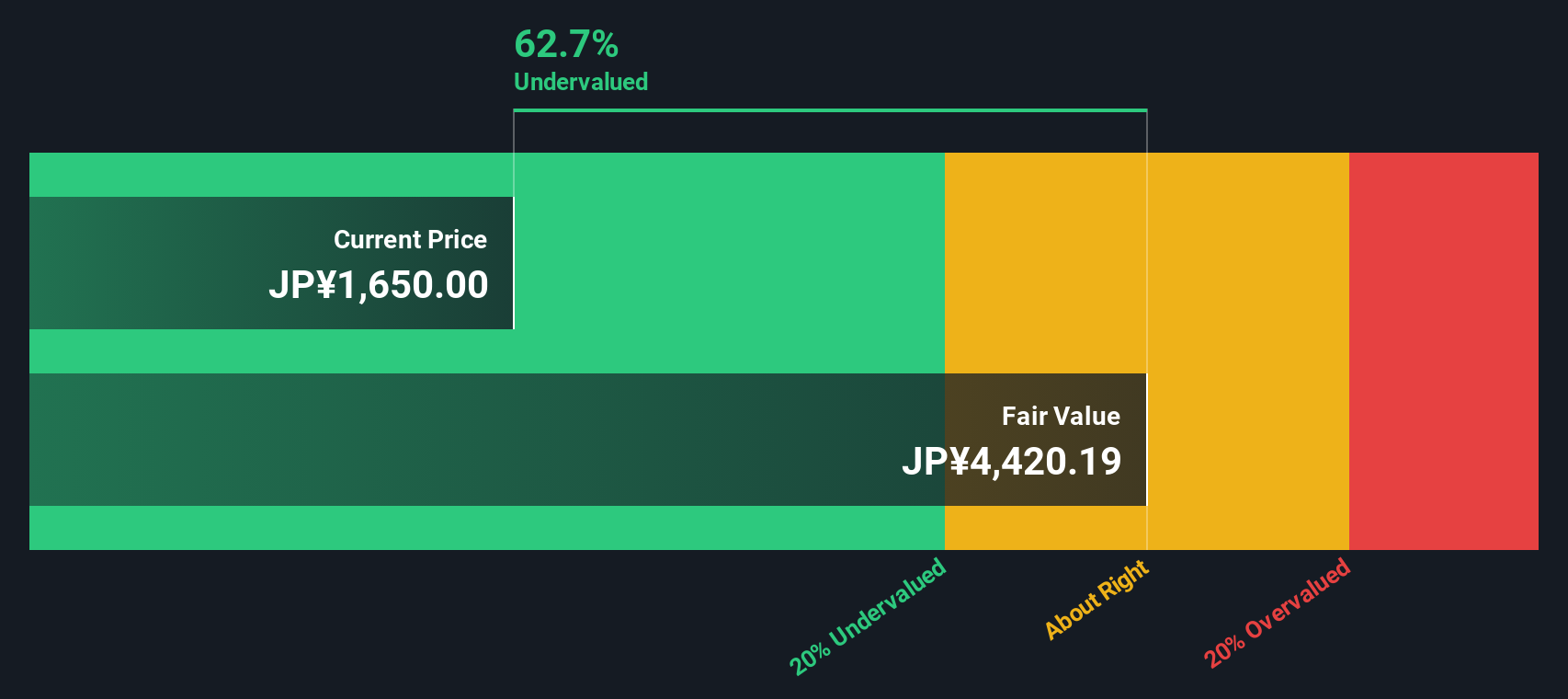

Looking at Zeon's valuation through the lens of our SWS DCF model, the story shifts. The model estimates Zeon's fair value at ¥4,882.72 per share. This suggests the company is trading at a sizable 63.5% discount to its intrinsic value. Is the market simply too cautious, or is there something it is seeing that we are not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zeon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zeon Narrative

If you want to dig deeper or reach your own conclusions, you have the tools to build a complete picture in just a few minutes. Do it your way

A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never wait for the crowd. Try these unique stock searches and you could uncover valuable opportunities before everyone else.

- Boost your income stream by targeting companies with reliable payouts using these 15 dividend stocks with yields > 3% yielding over 3% annually.

- Maximize your potential for future growth by tapping into these 25 AI penny stocks on the cutting edge of artificial intelligence innovation.

- Seize undervalued opportunities with these 913 undervalued stocks based on cash flows that stand out based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4205

Zeon

Engages in the elastomer materials, specialty materials, and other businesses in Japan, North America, Europe, and Asia.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026