Sumitomo Bakelite (TSE:4203) Margin Compression Challenges Market Optimism on Quality Earnings Growth

Reviewed by Simply Wall St

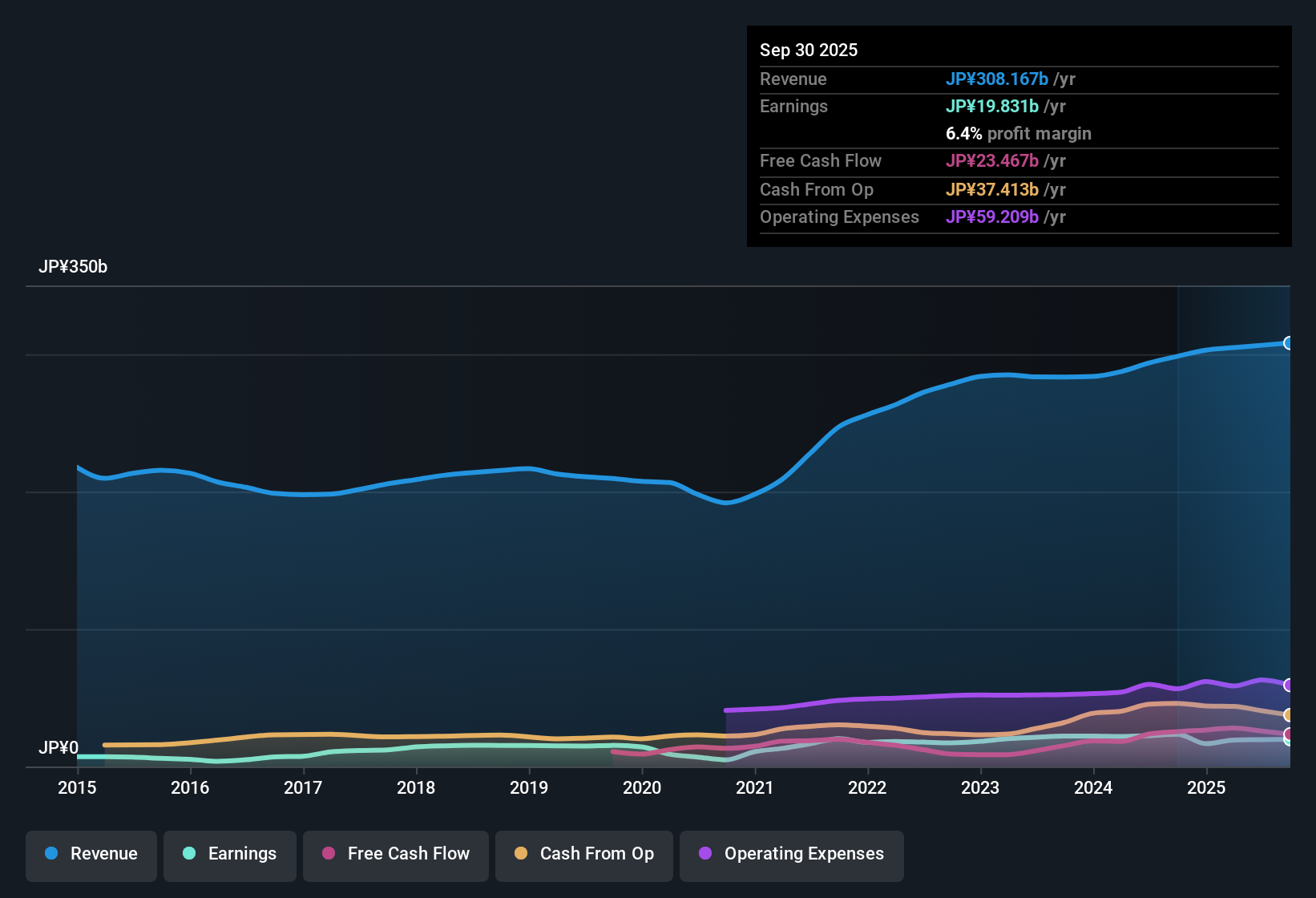

Sumitomo Bakelite (TSE:4203) has posted consistent earnings growth of 11.5% annually over the past five years, while net profit margins currently stand at 6.5%, lower than last year’s 7.7%. Looking ahead, revenue is forecast to rise by 4.1% per year, just behind the Japanese market’s 4.5% average, and EPS is expected to grow at 8.1%, a tick higher than the national average of 7.8%. Investors will likely take note of the company’s quality growth profile and moderate margin compression as they weigh Sumitomo Bakelite’s latest performance.

See our full analysis for Sumitomo Bakelite.Next up, we’ll look at how these numbers match up against the most widely followed market narratives. Some expectations may be confirmed, while others could be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Dip as Earnings Quality Stays Solid

- Net profit margins declined to 6.5% from last year's 7.7%, putting margin compression in focus even as five-year annual earnings growth averaged a robust 11.5%.

- What’s striking for investors is that, despite margin pressure, earnings quality remains high. In recent years, Sumitomo Bakelite has been recognized for innovation in advanced polymers and healthcare materials, which are cited as supporting steady growth prospects.

- Clinical and high-tech product launches could act as growth drivers, though continuing raw material cost fluctuations may test resilience.

- Bears could point out that falling margins make the next few quarters critical for demonstrating that business mix upgrades can offset input headwinds.

Premium Valuation vs. Industry, Discount to Fair Value

- Shares currently trade at a price-to-earnings multiple of 22.1x, topping the Japanese chemicals industry average of 13.1x but closely matching peer average (23x); the latest share price of 4967.00 yen stands well below DCF fair value at 9094.29 yen.

- What’s notable here is that valuation is caught between two narratives. On one hand, trading above the sector may reflect confidence in stable earnings growth, but a share price at almost half of DCF fair value creates tension, suggesting possible upside if future growth pans out.

- With an expected earnings growth rate of 8.1% per year exceeding the domestic market average, there’s a case for the premium, but it is still modest relative to high-growth peers.

- Investors weighing in may grapple with whether the sector premium fully reflects Sumitomo Bakelite’s innovation push or if the sizable DCF gap signals the market is leaving quality on the table.

Dividend Sustainability Flagged as a Watch Item

- Dividend sustainability is the only flagged risk in the filing summary, prompting investors to consider whether payout levels are appropriate alongside revenue and profitability trends.

- The market’s prevailing view is that stable earnings and a growing end-market support ongoing dividends, yet close attention to margin evolution and sector competition remains warranted.

- Continued earnings momentum gives management some flexibility, but tighter margins could become problematic if profitability weakens further.

- This single risk flag does not overshadow the firm’s strengths but signals the need to monitor balance sheet impacts from both expansion efforts and distributions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sumitomo Bakelite's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Margin compression and concern over dividend sustainability suggest that Sumitomo Bakelite may face challenges maintaining payout strength as profitability fluctuates.

If you want to prioritize more dependable income streams, check out these 1984 dividend stocks with yields > 3% and focus on companies offering robust, sustainable dividend yields right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4203

Sumitomo Bakelite

Engages in the research and development, manufacture, and sale of semiconductor materials, plastic products, and life products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives