Tokyo Ohka Kogyo (TSE:4186): Valuation in Focus After UBS Downgrade Follows Strong AI-Driven Growth

Reviewed by Simply Wall St

UBS’s recent downgrade of Tokyo Ohka Kogyo (TSE:4186) from Buy to Neutral caught the market’s attention after the company reported Q3 results. The shift comes even though UBS points out strong growth themes related to AI-driven semiconductor materials.

See our latest analysis for Tokyo Ohka Kogyo.

TOK's share price has climbed an impressive 16.7% over the past month, concluding a year-to-date increase of 60% and contributing to a notable 1-year total shareholder return of 78%. The rise reflects investor enthusiasm for AI-driven semiconductor growth themes, although this week’s more cautious tone from analysts has moderated the excitement slightly.

Curious what else is capturing investor attention in the chip and tech space? Now is a great moment to explore the full landscape with our See the full list for free..

With shares up over 60% this year, the question for investors now is whether Tokyo Ohka Kogyo is undervalued based on its future prospects, or if the recent rally means all the upside is already priced in.

Price-to-Earnings of 24.7x: Is it justified?

Tokyo Ohka Kogyo's current Price-to-Earnings (P/E) ratio stands at 24.7x, which signals the market is willing to pay a substantial premium for its future earnings. For context, the last closing price was ¥6010, a level that appears elevated compared to both fair value models and peer averages.

The Price-to-Earnings ratio is a widely watched metric that compares the share price with the company’s earnings per share, and it often serves as a yardstick for how optimistic the market is about a company’s prospects. In the chemicals sector, where cyclical swings are common, a higher P/E can indicate expectations for sustained growth or superior profitability versus competitors.

Despite robust recent growth, Tokyo Ohka Kogyo’s P/E of 24.7x appears expensive when measured against both its industry peers, who average a lower ratio of 12x, and the fair value P/E estimate of 16.6x for the company. These gaps suggest the current market pricing may be factoring in a lot of improvement already, leaving less room for positive surprises unless future performance outpaces even optimistic forecasts.

Explore the SWS fair ratio for Tokyo Ohka Kogyo

Result: Price-to-Earnings of 24.7x (OVERVALUED)

However, risks remain, including potential earnings disappointments or a slowdown in AI-related demand. Either of these factors could quickly reverse recent optimism.

Find out about the key risks to this Tokyo Ohka Kogyo narrative.

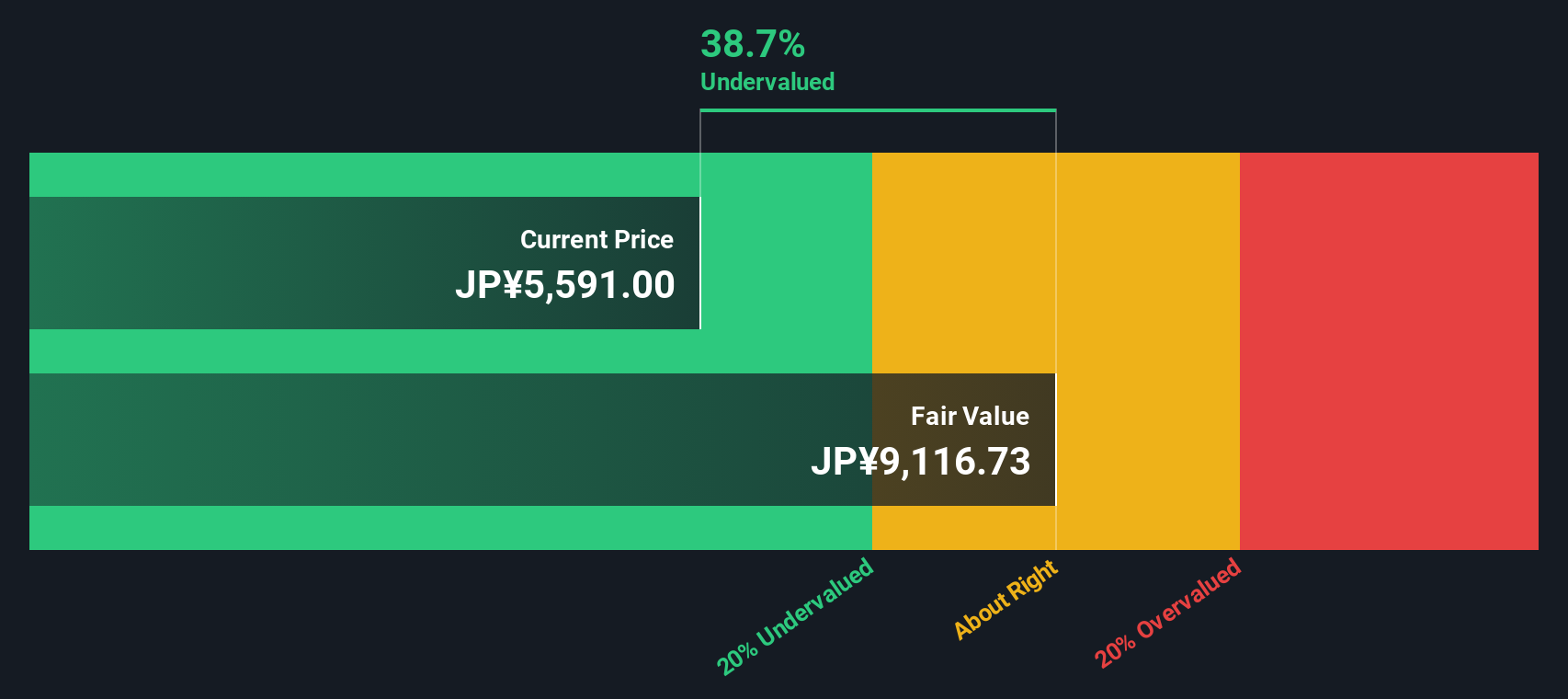

Another View: DCF Model Points to Undervaluation

While the current share price looks expensive based on earnings multiples, the SWS DCF model presents a different picture. According to this method, Tokyo Ohka Kogyo is trading roughly 34% below its fair value estimate. This challenges the notion that all upside is already priced in. Might the market still be underestimating the company's long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Ohka Kogyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Ohka Kogyo Narrative

If you have a different perspective or want to examine the numbers firsthand, you can create your own narrative and insights in just a few minutes with our easy tools. Do it your way.

A great starting point for your Tokyo Ohka Kogyo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly stay a step ahead, so don’t let opportunities pass you by when fresh themes and undervalued gems could be just a click away.

- Unlock the next wave of high-potential companies by checking out these 897 undervalued stocks based on cash flows to see which stocks offer attractive price points based on their fundamentals.

- Capture powerful industry shifts by exploring these 30 healthcare AI stocks which harnesses artificial intelligence to transform healthcare innovation and improve patient outcomes.

- Grow your income stream by exploring these 15 dividend stocks with yields > 3% featuring reliable companies that consistently deliver dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Ohka Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4186

Tokyo Ohka Kogyo

Manufactures and sells chemical products and process equipment in Japan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives