Kaneka (TSE:4118) Valuation in Focus After Dividend Boost and European Medical Device Launch

Reviewed by Simply Wall St

Kaneka (TSE:4118) just raised its second quarter dividend to ¥80 per share and launched the i-ED COIL medical device in Europe, highlighting both financial strength and ongoing expansion into health care technologies.

See our latest analysis for Kaneka.

Kaneka’s confidence has paid off for shareholders this year, with the stock posting a strong 12.7% year-to-date share price return and an even more impressive 25.1% total shareholder return over the past 12 months. Recent milestones such as the dividend hike and an expanding health care portfolio appear to be fueling positive momentum. This suggests investors are starting to take notice of its growth potential beyond core chemicals.

If Kaneka’s health care push has you curious about other medical device leaders with fresh ideas, check out the full roster with our See the full list for free..

With recent advances and a rising dividend, is Kaneka’s current share price still offering value for new investors, or has the market already factored in its future health care gains?

Price-to-Earnings of 9.8x: Is it justified?

Kaneka's stock trades at a price-to-earnings (P/E) ratio of 9.8x, which is notably below both its Japanese chemicals peers and market average. This suggests potential undervaluation at its latest closing price of ¥4,206.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of Kaneka’s current annual earnings. For a company strengthening its presence in advanced materials and health care innovation, the P/E signals whether the market is pricing in recent growth or overlooking it.

With its 9.8x P/E ratio, Kaneka trades at a discount compared to the Japanese chemicals industry average of 12.3x and the country-wide market average of 13.9x. Its P/E is also below an estimated fair P/E of 15.1x, a level the market could move towards if confidence in growth continues.

Explore the SWS fair ratio for Kaneka

Result: Price-to-Earnings of 9.8x (UNDERVALUED)

However, slowing revenue growth and recent short-term share price volatility could put pressure on Kaneka’s valuation if investor confidence in future gains declines.

Find out about the key risks to this Kaneka narrative.

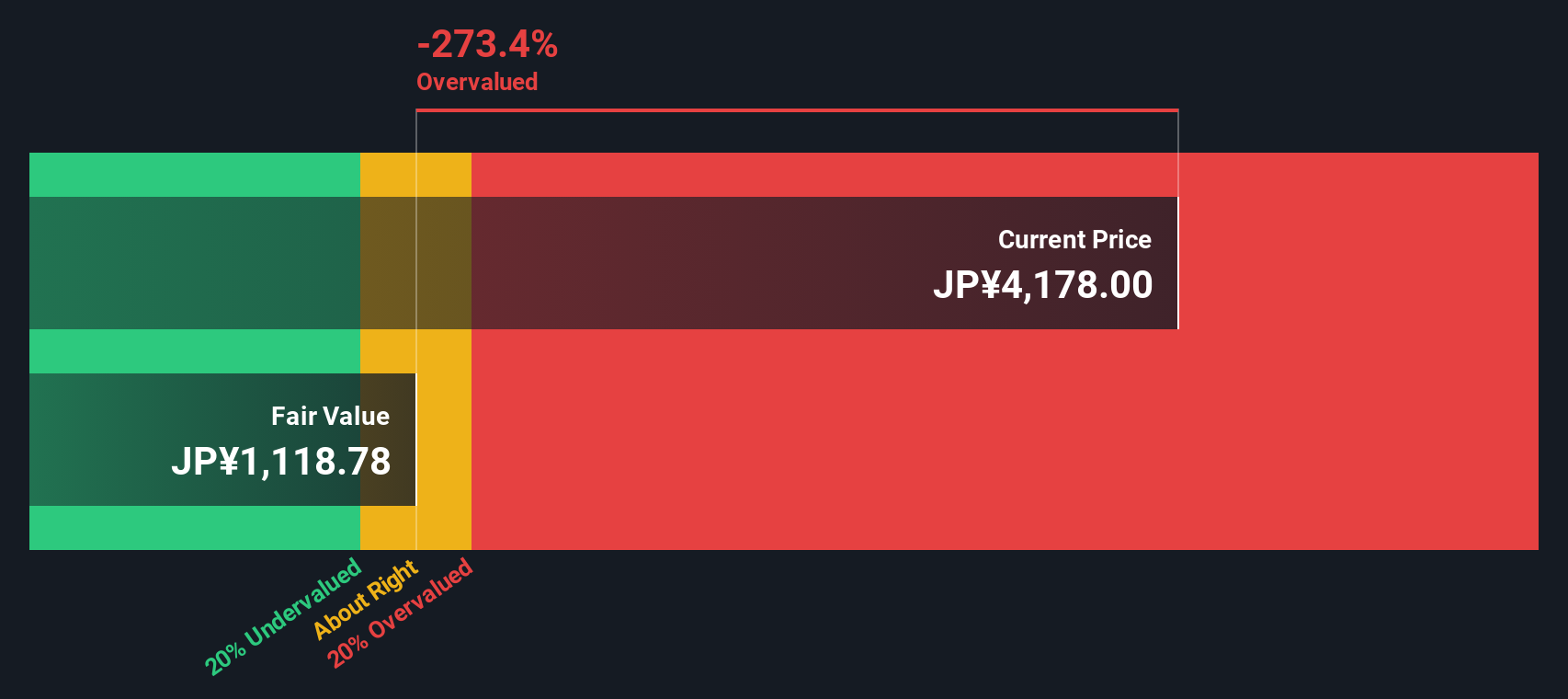

Another View: Discounted Cash Flow Signals Overvaluation

While the low price-to-earnings ratio points to value, our SWS DCF model estimates Kaneka’s fair value at ¥2,079.02, much lower than the current market price of ¥4,206. This method suggests the stock may actually be overvalued. Could the market be too optimistic about future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaneka for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaneka Narrative

If you have a different perspective or want to dive deeper into the numbers, you can analyze the data yourself and create your own narrative in just a few minutes with our tools. Do it your way.

A great starting point for your Kaneka research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s opportunities slip by. Use the power of the Simply Wall Street Screener to spot stocks with real breakout potential you won’t want to miss.

- Spot potential bargains by checking out these 927 undervalued stocks based on cash flows at attractive prices based on strong cash flows and disciplined fundamentals.

- Tap into tomorrow’s technology leaders by evaluating these 26 AI penny stocks changing the game in artificial intelligence innovation.

- Secure reliable income streams by reviewing these 16 dividend stocks with yields > 3% boasting yields above 3%, ideal for building resilient portfolio income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaneka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4118

Kaneka

Engages in the manufacture and sale of polyvinyl chloride (PVC), crosslinked PVC, PVC-PVAc polymers, paste PVC, acryl grafted-vinyl chloride copolymer, and chlorinated PVC in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success