Dividend Cut and Earnings Lift Might Change the Case for Investing in Nippon Shokubai (TSE:4114)

Reviewed by Sasha Jovanovic

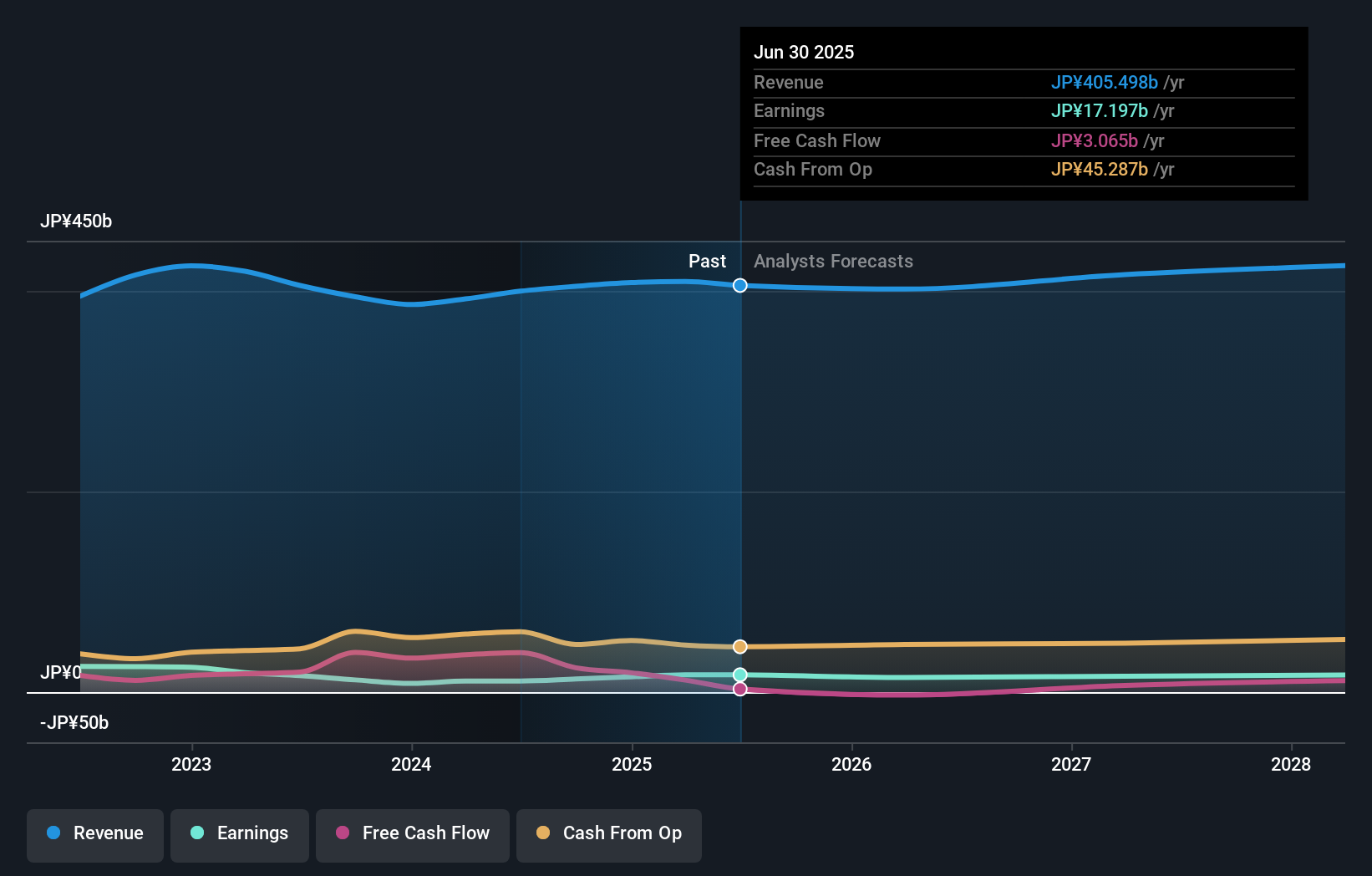

- Nippon Shokubai Co., Ltd. recently announced a reduction in its dividend for both the second quarter ended September 2025 and the fiscal year ending March 2026, alongside a slight increase in earnings guidance for the upcoming fiscal year.

- The combination of a more conservative dividend outlook and a modestly improved profit forecast highlights the company’s changing approach to balancing shareholder returns with operational performance.

- With both dividend policy and earnings guidance shifting, we'll explore how Nippon Shokubai's evolving capital allocation shapes its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Nippon Shokubai's Investment Narrative?

Owning a piece of Nippon Shokubai right now is about believing in its ability to balance earnings growth and prudent capital return despite shifting market fundamentals. The latest cut in dividends, even as management nudges up profit guidance, is a clear sign that protecting operational flexibility has become a pressing priority. For those watching short-term catalysts, this move likely tempers expectations for near-term yield but increases confidence that profitability remains intact, especially as the company continues to invest in expansion and green initiatives. On the risk side, the refreshed dividend policy alongside weaker cash flow coverage makes shareholder returns less certain, while corporate governance questions and below-industry revenue growth forecasts could draw increased scrutiny. Taken together, the new announcements push investors to weigh steady earnings against the ongoing trade-off in payout and structural challenges within the sector. But investor attention may be drawn to the company’s shift on dividend reliability.

Despite retreating, Nippon Shokubai's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Nippon Shokubai - why the stock might be worth less than half the current price!

Build Your Own Nippon Shokubai Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Shokubai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nippon Shokubai research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Shokubai's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shokubai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4114

Nippon Shokubai

Engages in the manufacture and sale of chemical products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives