ISE Chemicals (TSE:4107) Margin Expansion Reinforces Bull Case Despite Valuation Premium and Volatile Shares

Reviewed by Simply Wall St

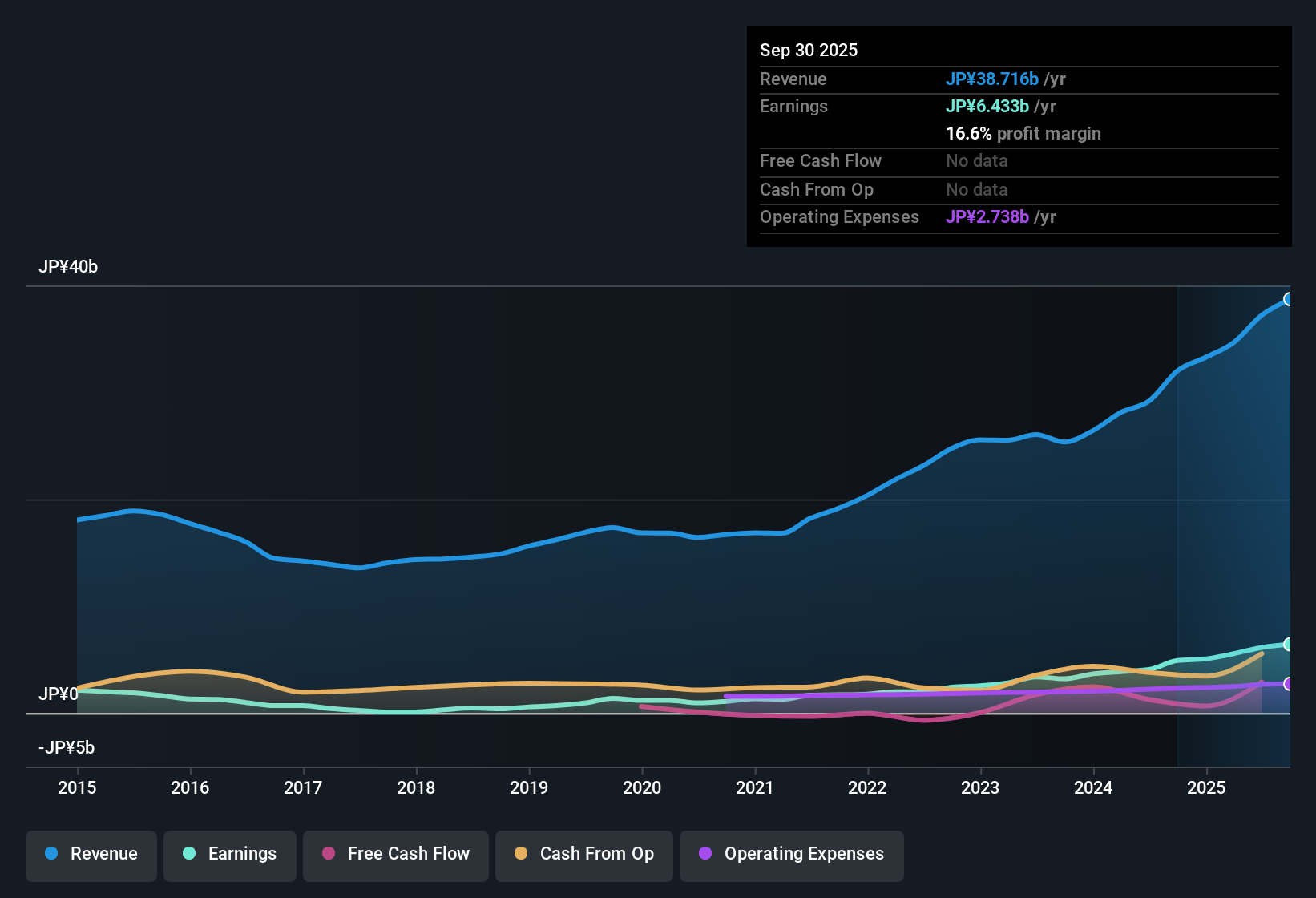

ISE Chemicals (TSE:4107) delivered average annual earnings growth of 32.6% over the past five years, with the latest year coming in at 30.9%. Net profit margins rose to 16.6% from last year’s 15.3%, reflecting improved profitability amid a stable trend of high-quality earnings. While profit trends look robust, the stock’s 25x Price-To-Earnings Ratio marks a clear premium to both its peers and the broader Japanese chemicals industry, and shares have been volatile in recent months, giving investors a mix of reward and risk in the near term.

See our full analysis for ISE Chemicals.Next, we’ll see how these headline results compare with the major narratives investors are following. This will show which numbers back up the story, and where expectations might get re-examined.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Touch 16.6% Despite Cost Pressures

- Net profit margins for ISE Chemicals climbed to 16.6%, up from last year's 15.3%, underscoring improved profitability even as industry-wide input costs remain a recurring challenge.

- The prevailing view emphasizes that margin stability is a particular strength. Maintaining a 16.6% margin aligns the company with sector leaders and strongly supports the argument that operational discipline offsets some cost headwinds.

- Robust margin expansion reinforces confidence in earnings durability, even if raw material costs rise.

- This resilience distinguishes ISE Chemicals from chemical peers that have seen sharper margin declines under similar conditions.

P/E Ratio at 25x Flags a Valuation Premium

- ISE Chemicals is trading at a Price-To-Earnings Ratio of 25x, which stands out against its peer group’s 17.4x and the broader Japanese chemicals average of 13x. This highlights a significant valuation premium.

- The current premium raises debate over whether growth rates and high-quality earnings fully justify such a high multiple. The narrative notes that investors may grow cautious of paying a premium if sector trends moderate.

- P/E multiples that outpace industry norms can attract growth-focused buyers, but also invite scrutiny if growth slows.

- The lack of further community narratives leaves open whether investors will continue rewarding the company’s track record or seek out less expensive alternatives.

Share Price Volatility Weighs on Sentiment

- The share price has seen notable instability over the past three months, diverging from steady operational performance and creating uncertainty for investors focused on capital preservation.

- This tension highlights how solid fundamentals are not always mirrored by the stock price, especially when broader market sentiment remains in flux and input costs are in focus.

- Downside risk becomes more pronounced as short-term price swings can shake out less patient investors even when earnings quality remains high.

- For long-term holders, the question becomes whether short-term volatility is noise or a signal of changing appetite for valuation risk.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ISE Chemicals's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While ISE Chemicals’ elevated valuation and recent share price swings highlight impressive past growth, they also raise concerns about whether investors are taking on too much risk for future rewards.

If high valuations and market volatility give you pause, discover these 840 undervalued stocks based on cash flows to find companies with attractive pricing and potential upside without taking on additional risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4107

ISE Chemicals

Engages in the iodine and natural gas, and metallic compound businesses in Japan.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives