Shin-Etsu Chemical (TSE:4063) Margin Decline Tests Bullish Narratives Despite Fair Value Upside

Reviewed by Simply Wall St

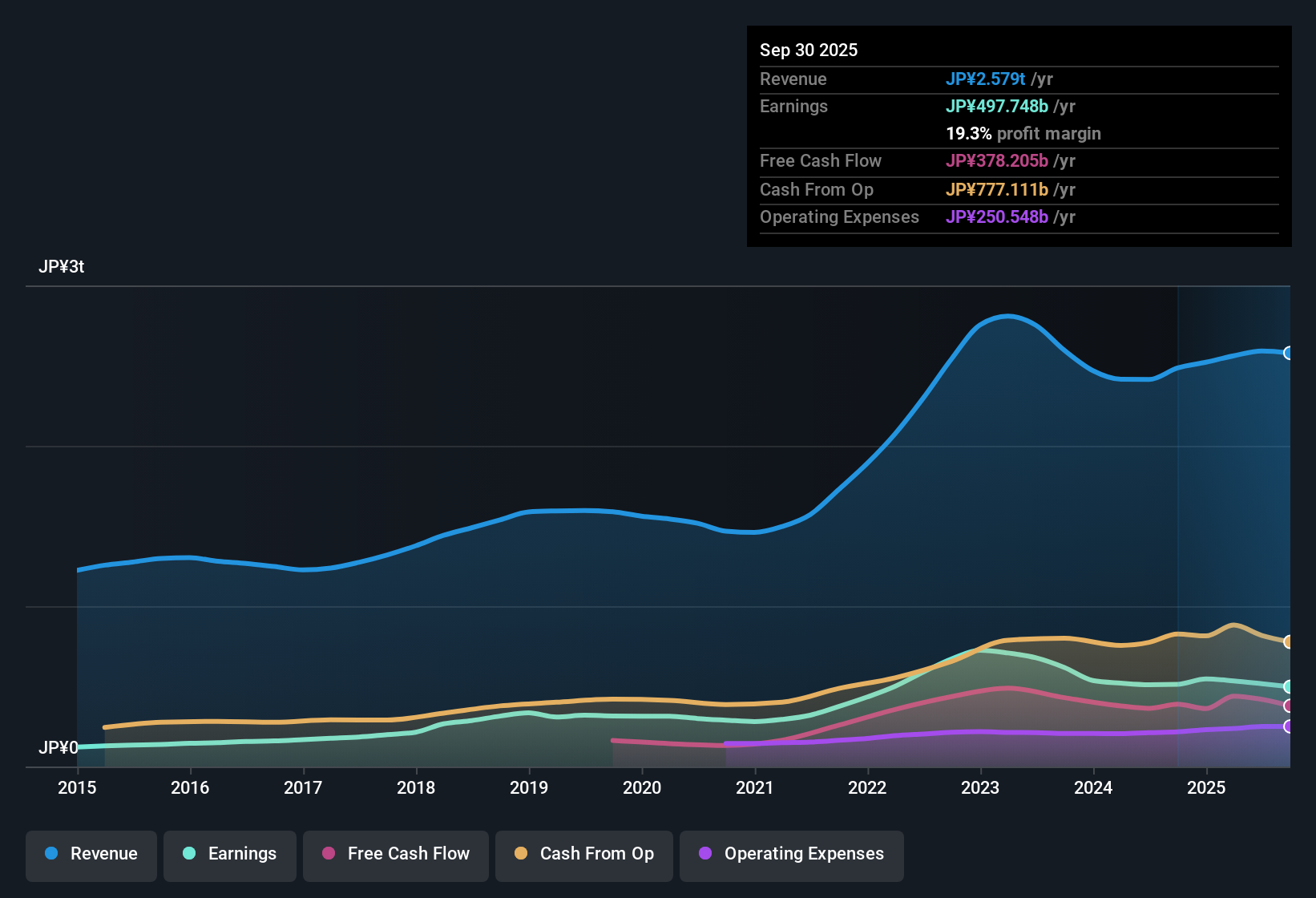

Shin-Etsu Chemical (TSE:4063) posted a net profit margin of 19.3%, down from last year’s 20.6%, with earnings expanding at an average rate of 8.9% per year over the past five years despite a recent dip in yearly earnings. Looking ahead, analysts expect annual earnings growth of 7.75% and revenue growth of 4.6% per year, just edging out the broader Japanese market’s 4.4% revenue forecast. Mixed signals in the data, with solid long-term performance but a slight squeeze on margins, have caught the attention of investors. This highlights both the draw of continued growth and a note of caution on current profitability.

See our full analysis for Shin-Etsu Chemical.Next, we’ll see how these results measure up against the most widely held narratives for Shin-Etsu on Simply Wall St. Some long-held market views may hold up under scrutiny, while others could get tested by the latest data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Slip to 19.3%, Growth Pace Shows Resilience

- Net profit margin fell to 19.3% from last year’s 20.6%. However, average annual earnings growth over five years remained strong at 8.9%, signaling the company’s ability to keep expanding overall profits despite current pressure on margins.

- While recent results show a negative shift in yearly earnings, analysis underscores how ongoing investments in innovation and sector leadership support continued growth, especially given Shin-Etsu’s positioning in critical markets.

- The combination of robust long-term earnings growth and only a modest dip in profitability challenges any simplistic bearish view focused solely on shrinking margins.

- Stable demand drivers and well-managed operations, as noted across reports and media, help keep Shin-Etsu’s growth outlook ahead of many peers.

Dividend Sustainability Questioned Amid Growth Outlook

- Though the company remains on track for 7.75% earnings growth per year, available risk data highlight that the main concern for investors currently is whether Shin-Etsu can maintain its dividend at current levels, rather than falling behind on growth.

- Concerns over dividend sustainability are more prominent than those regarding fundamental profitability or revenue trends, based on the latest flagged risks.

- There is no sign in the results of a dramatic drop in operational strength, so the main risk identified is about how cash flows will be allocated moving forward.

- Shin-Etsu’s ability to outpace the Japanese market in revenue growth makes dividend caution all the more important for investors who value both yield and expansion.

DCF Fair Value of ¥6,369 Signals Undervaluation

- The current share price of ¥4,905 is trading below an estimated DCF fair value of ¥6,368.61, highlighting a notable gap that may offer upside for value-focused investors, even with a price-to-earnings ratio of 18.5x, which is lower than the peer average but higher compared to the industry’s 13.3x.

- This gap between share price and DCF fair value suggests that Shin-Etsu’s resilient business model and sector momentum are not yet fully reflected, despite wider industry caution.

- Trading below fair value and at a discount to many peers suggests the shares could attract renewed interest if growth trends continue.

- Advocates point out that discounted cash flow analysis gives more weight to the company’s stable leadership in high-growth segments such as semiconductors and advanced materials, compared to short-term margin fluctuations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shin-Etsu Chemical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shin-Etsu’s growth outlook is solid. However, persistent concerns about whether it can reliably maintain its current dividend make income stability less certain.

If dependable yield matters most to you, check out these 1995 dividend stocks with yields > 3% to find companies with higher, more sustainable dividends and robust distributions backed by stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4063

Shin-Etsu Chemical

Provides infrastructure, electronics, and functional materials in Japan.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives