Tosoh (TSE:4042): Valuation Perspective as Impairment Loss Weighs on Near-Term Profits

Reviewed by Simply Wall St

Tosoh (TSE:4042) has announced it will take an impairment loss on fixed assets at subsidiary Tosoh SMD, Inc. Lower shipments in the U.S. semiconductor sector are impacting the company’s bottom line.

See our latest analysis for Tosoh.

While the news of an impairment loss adds a cautious note, Tosoh’s share price has held steady, most recently closing at ¥2,205. Its one-year total shareholder return stands at an impressive 20.8%. Momentum has built steadily over the past three and five years, with total returns above 62%, even as recent short-term share price moves have been mixed.

If you’re watching how global manufacturing shifts are impacting stocks, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock currently trading below analyst targets and a sizable intrinsic discount, the key question is whether these headwinds are already reflected in Tosoh’s valuation, or if there is real upside for new investors.

Price-to-Earnings of 14.4x: Is it justified?

At the latest closing price of ¥2,205, Tosoh trades at a price-to-earnings (P/E) ratio of 14.4x, placing it notably below the peer average of 28.8x. This suggests the market is valuing Tosoh’s ongoing profitability much lower than its sector peers.

The P/E ratio shows what investors are willing to pay for each yen of current earnings. For a chemicals manufacturer like Tosoh, it serves as a quick check on how the market views its earnings strength and growth potential. With a P/E that is considerably beneath peers, the implication is clear: the market may be underestimating expected earnings, or perhaps factoring in concern about forward prospects.

However, compared to the broader JP Chemicals industry average of 13.2x, Tosoh’s 14.4x is slightly above, suggesting the company commands a modest premium over the sector baseline. Against its 'fair' P/E of 16.8x, there is room for the market to close the valuation gap should future performance improve or sentiment shift.

Explore the SWS fair ratio for Tosoh

Result: Price-to-Earnings of 14.4x (UNDERVALUED)

However, persistent headwinds in the U.S. semiconductor sector and potential volatility in global demand could present challenges to Tosoh’s earnings outlook in the near term.

Find out about the key risks to this Tosoh narrative.

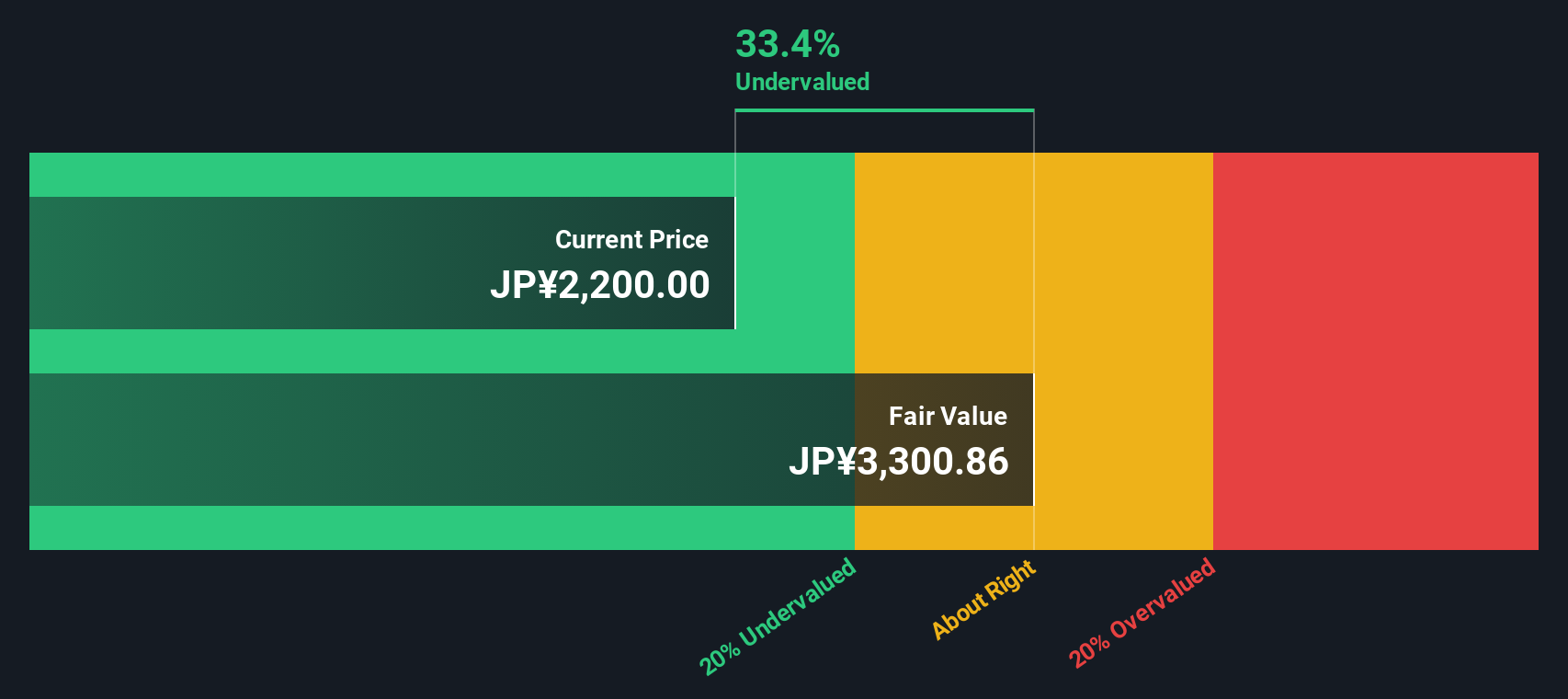

Another View: SWS DCF Model Points to Undervaluation

Looking from a different angle, our DCF model estimates Tosoh’s fair value at ¥3,306.91 per share. This suggests the stock is trading more than 33% below what its future cash flows are worth. Can this wide gap persist, or will the market catch up?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tosoh for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tosoh Narrative

If you have your own angle on Tosoh, or want to dig into the numbers firsthand, you can build your own story from scratch in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tosoh.

Looking for more investment ideas?

Smart investors never stand still. Maximize your advantage by hand-picking opportunities in sectors brimming with growth, yield, and breakthrough potential through Simply Wall Street.

- Boost your portfolio’s income by reviewing these 24 dividend stocks with yields > 3% with strong yields above 3%, perfect for investors seeking reliable returns.

- Spot early movers in transformative technology by pinpointing these 26 AI penny stocks pushing the boundaries of artificial intelligence innovation.

- Capitalize on undervalued opportunities by targeting these 848 undervalued stocks based on cash flows that the market may be missing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tosoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4042

Tosoh

Manufactures and sells basic chemicals, petrochemicals, specialty products, and fine chemicals.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives