Tosoh Corporation's (TSE:4042) Low P/E No Reason For Excitement

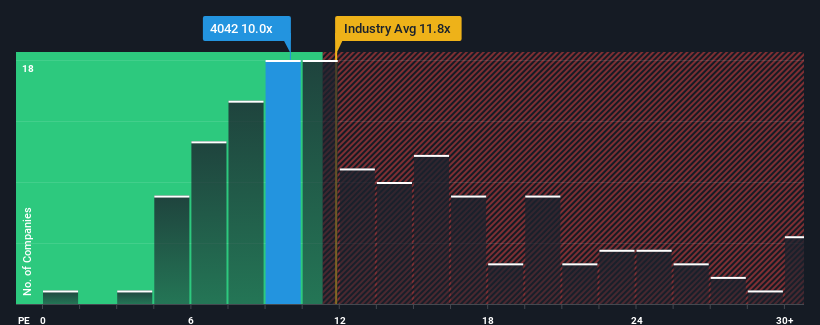

Tosoh Corporation's (TSE:4042) price-to-earnings (or "P/E") ratio of 10x might make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Tosoh certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Tosoh

How Is Tosoh's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Tosoh's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 72%. However, this wasn't enough as the latest three year period has seen a very unpleasant 31% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 7.4% per year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.6% per year, which is noticeably more attractive.

With this information, we can see why Tosoh is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Tosoh's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Tosoh with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Tosoh. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tosoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4042

Tosoh

Manufactures and sells basic chemicals, petrochemicals, specialty products, and fine chemicals.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives