- Japan

- /

- Paper and Forestry Products

- /

- TSE:3896

Investors Still Waiting For A Pull Back In Awa Paper & Technological Company, Inc. (TSE:3896)

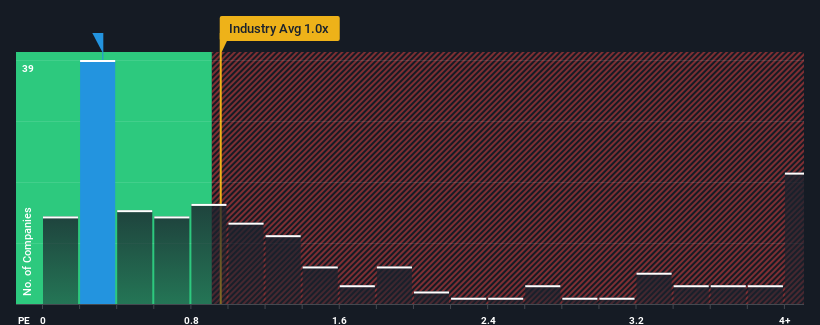

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Forestry industry in Japan, you could be forgiven for feeling indifferent about Awa Paper & Technological Company, Inc.'s (TSE:3896) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Awa Paper & Technological Company

How Has Awa Paper & Technological Company Performed Recently?

It looks like revenue growth has deserted Awa Paper & Technological Company recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on Awa Paper & Technological Company will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Awa Paper & Technological Company will help you shine a light on its historical performance.How Is Awa Paper & Technological Company's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Awa Paper & Technological Company's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Awa Paper & Technological Company's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Awa Paper & Technological Company's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Awa Paper & Technological Company's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Awa Paper & Technological Company (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Awa Paper & Technological Company, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3896

Awa Paper & Technological Company

Engages in the manufacture and sale of papers in Japan and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives