- Japan

- /

- Paper and Forestry Products

- /

- TSE:3880

Daio Paper (TSE:3880): Assessing Valuation After Recent Momentum Shift in Share Price

Reviewed by Simply Wall St

Price-to-Sales Ratio of 0.2x: Is it justified?

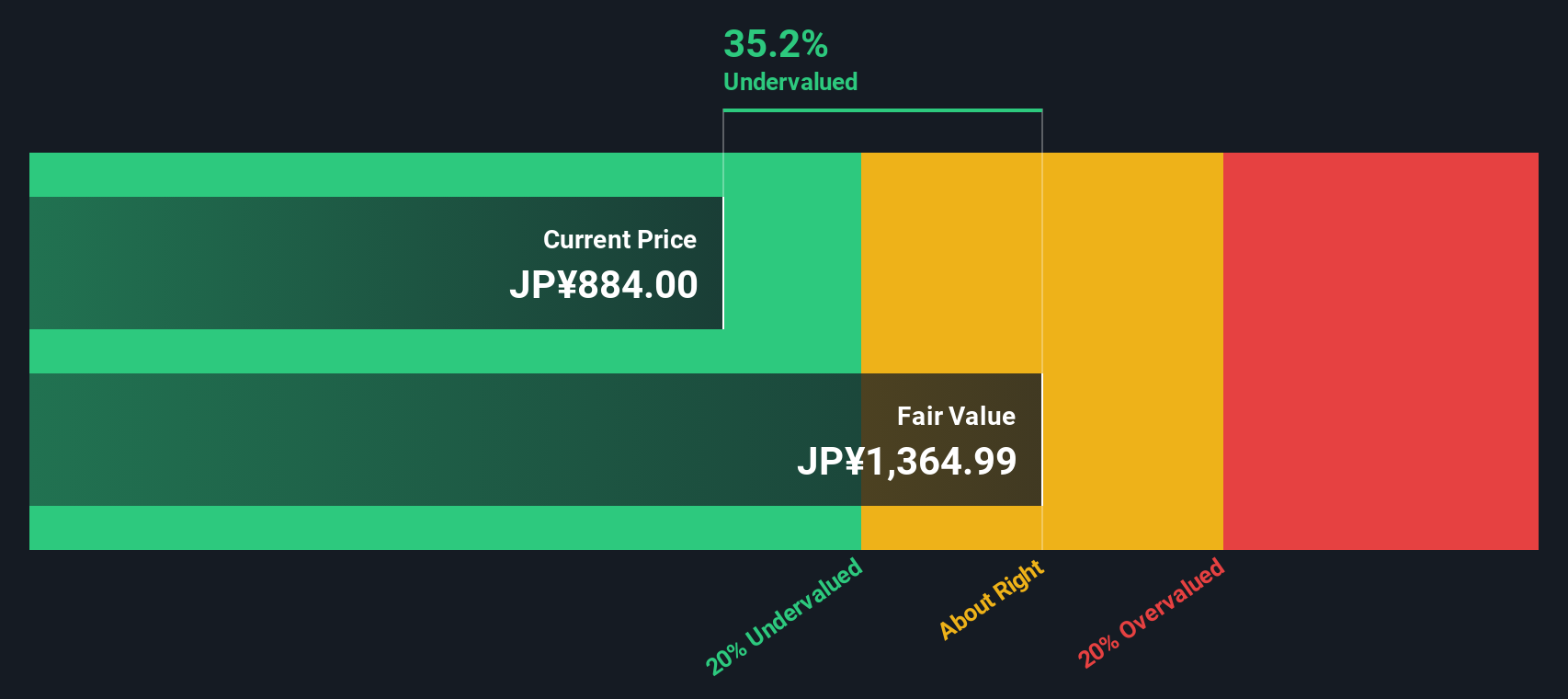

Daio Paper is currently trading at a price-to-sales ratio (P/S) of 0.2x. This is substantially below both the Asian Forestry industry average of 0.8x and its own fair price-to-sales estimate of 0.5x. This significant discount suggests the stock is undervalued based on industry standards for this key multiple.

The price-to-sales ratio compares a company’s market capitalization to its total revenue, offering insight into how much investors are willing to pay for a unit of sales. It is especially relevant for unprofitable firms like Daio Paper, where traditional profit-based multiples may not offer a complete picture.

The low P/S multiple signals that the market may be underappreciating Daio Paper’s current revenues in the context of its sector. While the company is unprofitable, this valuation suggests there could be meaningful upside potential if the company’s financial performance stabilizes or improves in line with sector norms.

Result: Fair Value of ¥1,364.99 (UNDERVALUED)

See our latest analysis for Daio Paper.However, Daio Paper's persistent unprofitability and its sluggish long-term returns remain key risks that could limit the sustainability of any upward momentum.

Find out about the key risks to this Daio Paper narrative.Another View: Our DCF Model Perspective

Aside from multiples, our DCF model offers a different way to look at value. According to this method, Daio Paper also appears undervalued. But do these two approaches agree for the right reasons, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daio Paper Narrative

If you would like to challenge these views or reach your own conclusions, you can quickly build your own perspective based on the latest data. Do it your way

A great starting point for your Daio Paper research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your portfolio get stuck in a rut. Open up new opportunities by checking out exciting market niches that could deliver your next breakthrough win.

- Unlock growth potential by scanning for undervalued stocks using undervalued stocks based on cash flows. Spot companies where the market may be missing something big.

- Boost your passive income with shares offering high yields by tapping into dividend stocks with yields > 3%. See which businesses reward their investors best.

- Ride the innovation wave by targeting the future of technology through AI penny stocks. Find firms pushing the boundaries of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3880

Daio Paper

Manufactures and sales paper products in Japan, East Asia, Southeast Asia, Brazil, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives