- Japan

- /

- Paper and Forestry Products

- /

- TSE:3880

A Look at Daio Paper (TSE:3880) Valuation Following Strong Profit Recovery and Reaffirmed Dividend Forecast

Reviewed by Simply Wall St

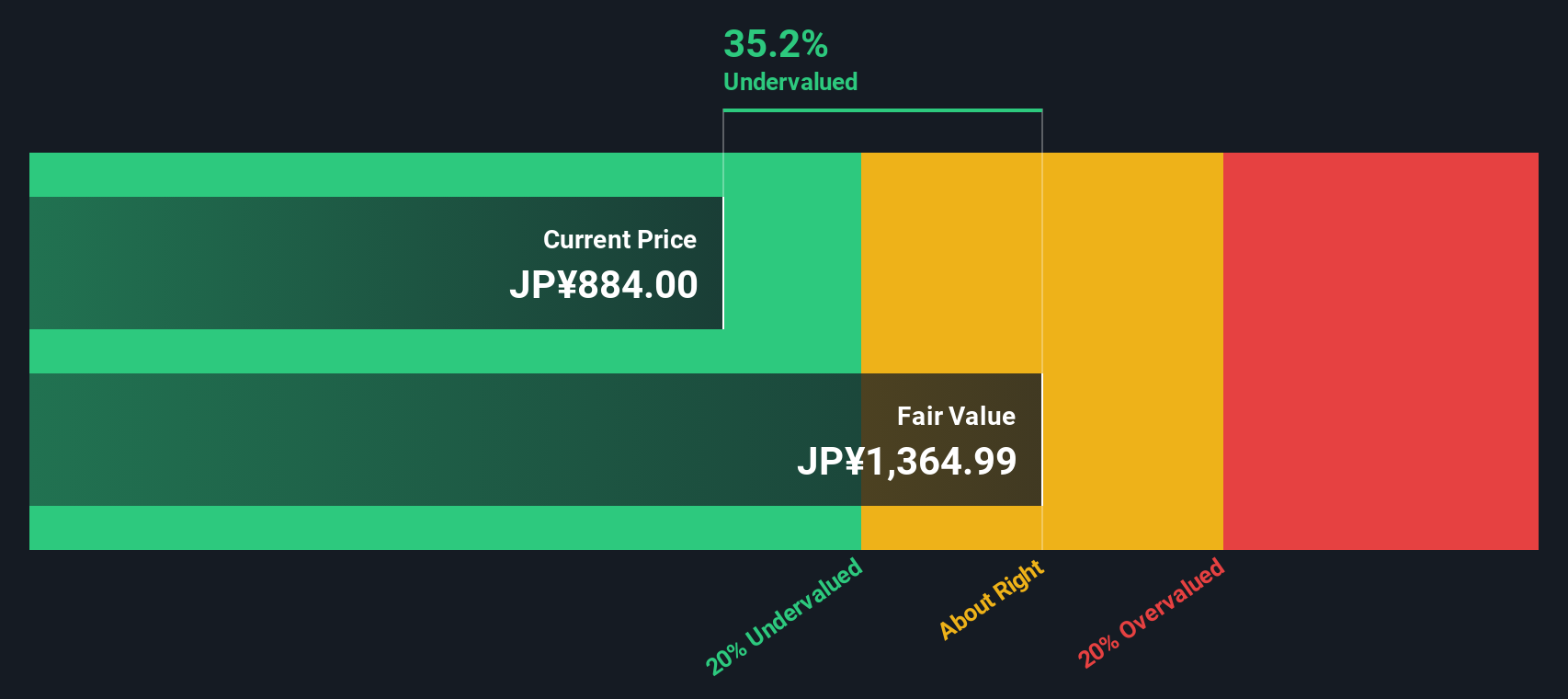

Daio Paper (TSE:3880) just reported financial results for the first half of FY2026, showing a sharp recovery in profitability even though net sales declined. Profit improvements, currency tailwinds, and a renewed dividend outlook are drawing investor attention.

See our latest analysis for Daio Paper.

Daio Paper’s turnaround story is catching the market’s eye, with a recent 3.91% single-day share price jump and a strong 11.23% gain over the past week. This reflects renewed confidence following the latest results. While momentum is returning this year, the long-term total shareholder return still lags. This highlights both the stock’s growth potential and the uphill journey from its earlier lows.

If you’re interested in seeing which other companies are attracting investors’ attention, now’s the perfect time to explore fast growing stocks with high insider ownership.

With profitability rebounding far ahead of sales and a substantial intrinsic discount implied by valuation models, should investors treat Daio Paper’s recent rally as the start of a comeback, or has the market already factored in the upside?

Price-to-Sales of 0.2x: Is it justified?

Daio Paper’s shares currently trade at a price-to-sales ratio of 0.2x, which signals a substantial discount to both local and regional peers, with the last close price at ¥931.

The price-to-sales (P/S) ratio compares a company’s market capitalization to its total revenue. This is a particularly useful metric in sectors where profitability fluctuates, such as paper manufacturing. For Daio Paper, this low P/S ratio suggests the market has set expectations below the industry average, potentially due to recent unprofitability or lingering operational concerns.

When held up against the peer average of 0.4x and the Asian Forestry industry’s much higher 0.8x, Daio Paper’s valuation looks deeply discounted. Even relative to its estimated fair P/S ratio of 0.6x, the current market price stands out as unusually conservative. A significant re-rating could occur if future earnings deliver as forecast.

Explore the SWS fair ratio for Daio Paper

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, muted revenue growth and a history of negative returns over five years could limit near-term gains if profitability momentum stalls.

Find out about the key risks to this Daio Paper narrative.

Another View: Discounted Cash Flow Tells a Similar Story

For a broader perspective, we can also consider the SWS DCF model, which estimates Daio Paper’s fair value at ¥1,361.50. With the actual share price still 31.6% below this figure, the model suggests Daio Paper may be undervalued based on more than just multiples. Could this point to further upward potential, or are there hidden risks yet to play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daio Paper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daio Paper Narrative

If you see the story differently or want to rely on your own analysis, you can build a custom narrative in just a few minutes, so Do it your way.

A great starting point for your Daio Paper research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great investments rarely come from standing still. Take charge of your portfolio and seize the chance to spot tomorrow’s winners with targeted screening tools on Simply Wall Street.

- Uncover high-potential opportunities in cutting-edge artificial intelligence fields by starting your search with these 25 AI penny stocks.

- Zero in on steady passive income possibilities. Use these 16 dividend stocks with yields > 3% to see which companies are rewarding shareholders with robust yields.

- Ride the wave of digital transformation and stay ahead by tapping into these 82 cryptocurrency and blockchain stocks, where major moves in cryptocurrency and blockchain innovation are happening right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3880

Daio Paper

Manufactures and sales paper products in Japan, East Asia, Southeast Asia, Brazil, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives