Toray Industries (TSE:3402) Valuation: Assessing Buybacks and Dividend Hike After Strategic Shareholder Return Moves

Reviewed by Simply Wall St

Toray Industries (TSE:3402) just unveiled a sizable share repurchase program, aiming to reduce its outstanding shares and boost capital efficiency. This move arrives together with a dividend increase, drawing investor interest for several reasons.

See our latest analysis for Toray Industries.

The latest surge in Toray Industries’ share price, with a 1-day return of 9.4% and a 7-day jump of 11.4%, reflects growing investor optimism following the buyback and dividend hike announcements. Despite softer interim results, the momentum has gathered pace, with a total shareholder return of 17.4% over the last year and an impressive 106.9% over five years. This highlights how strategic actions can quickly shift sentiment for both the short term and the long term.

If Toray’s recent momentum caught your attention, now’s the perfect time to broaden your search and see what else is possible with fast growing stocks with high insider ownership.

But with these strategic moves and a recent rally, is Toray Industries’ current valuation offering investors a rare buying opportunity, or has the market already taken the company’s future growth prospects into account?

Most Popular Narrative: 5.1% Undervalued

With Toray Industries' fair value estimated at ¥1,095 based on the most widely followed narrative, its recent close price of ¥1,039 leaves a small but meaningful gap for investors seeking upside. This narrative explores earnings potential, strategic reforms, and key growth catalysts that could influence future performance.

The company's policy to accelerate capital efficiency by reducing cross-shareholdings, with proceeds directed towards share buybacks, is expected to enhance earnings per share by reducing the outstanding share count. The demand recovery and improved utilization rates in high-margin segments like Performance Chemicals and Carbon Fiber Composite Materials are likely to positively impact revenue and net margins in the future.

Curious about the bold financial projections supporting this price? The narrative relies on radical operational reforms and ambitious margin expansion targets. Which growth levers and future profit expectations shape this compelling story? Dive in to uncover the specifics behind this fair value calculation.

Result: Fair Value of ¥1,095 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, foreign exchange challenges and slower earnings growth in certain segments could quickly sway expectations around Toray Industries’ outlook.

Find out about the key risks to this Toray Industries narrative.

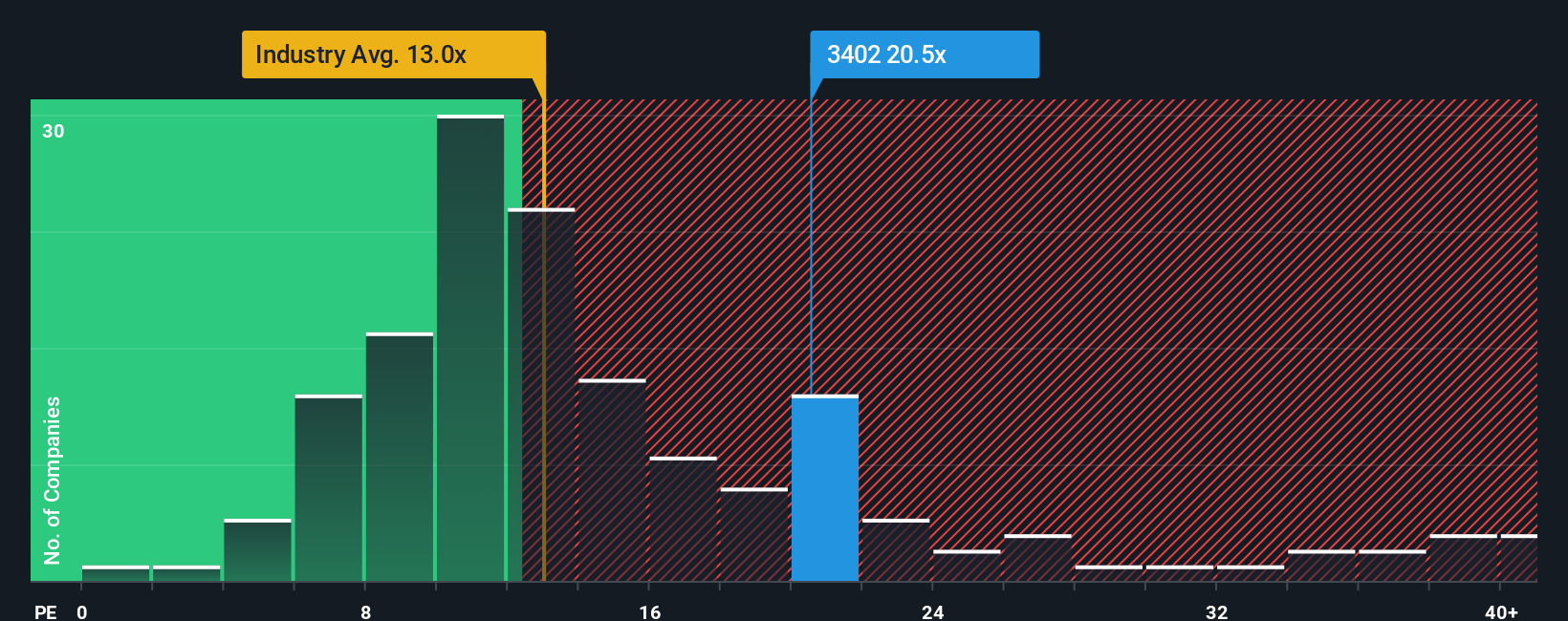

Another View: Multiples Raise a Red Flag

While the consensus narrative suggests Toray Industries is undervalued, our look at valuation based on the price-to-earnings ratio tells a different story. Toray’s P/E ratio stands at 22.9x, which is much higher than the Japanese Chemicals industry average of 12.8x and even above its own fair ratio of 20.6x. This signals the market is paying a premium for Toray and raises the bar for future earnings to justify the price. Is this optimism sustainable, or could expectations be set a bit too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toray Industries Narrative

If the analysis so far doesn't match your perspective or you'd rather investigate on your own, try building a personalized narrative from scratch in just a few minutes. Do it your way.

A great starting point for your Toray Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Don’t miss out on fresh ideas, unique themes, and standout companies. See what you’ve been overlooking with these essential screens:

- Scout market disruptors by tracking these 25 AI penny stocks, which are changing the landscape through artificial intelligence, automation, and transformative digital solutions.

- Unlock stable income streams when you review these 16 dividend stocks with yields > 3% that can help boost your portfolio with yields over 3% and reliable payout histories.

- Position yourself for future breakthroughs by following these 26 quantum computing stocks, which are pioneering advancements in computing, cryptography, and next-generation tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toray Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3402

Toray Industries

Manufactures, processes, and sells fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering products, and life science products in Japan, China, North America, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives