The board of MERF Inc. (TSE:3168) has announced that it will pay a dividend on the 25th of November, with investors receiving ¥10.00 per share. This payment means that the dividend yield will be 3.6%, which is around the industry average.

MERF's Distributions May Be Difficult To Sustain

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. However, prior to this announcement, MERF's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could fall by 20.8% over the next year if the trend of the last few years can't be broken. While this means that the company will be unprofitable, we generally believe cash flows are more important, and the current cash payout ratio is quite healthy, which gives us comfort.

View our latest analysis for MERF

MERF Has A Solid Track Record

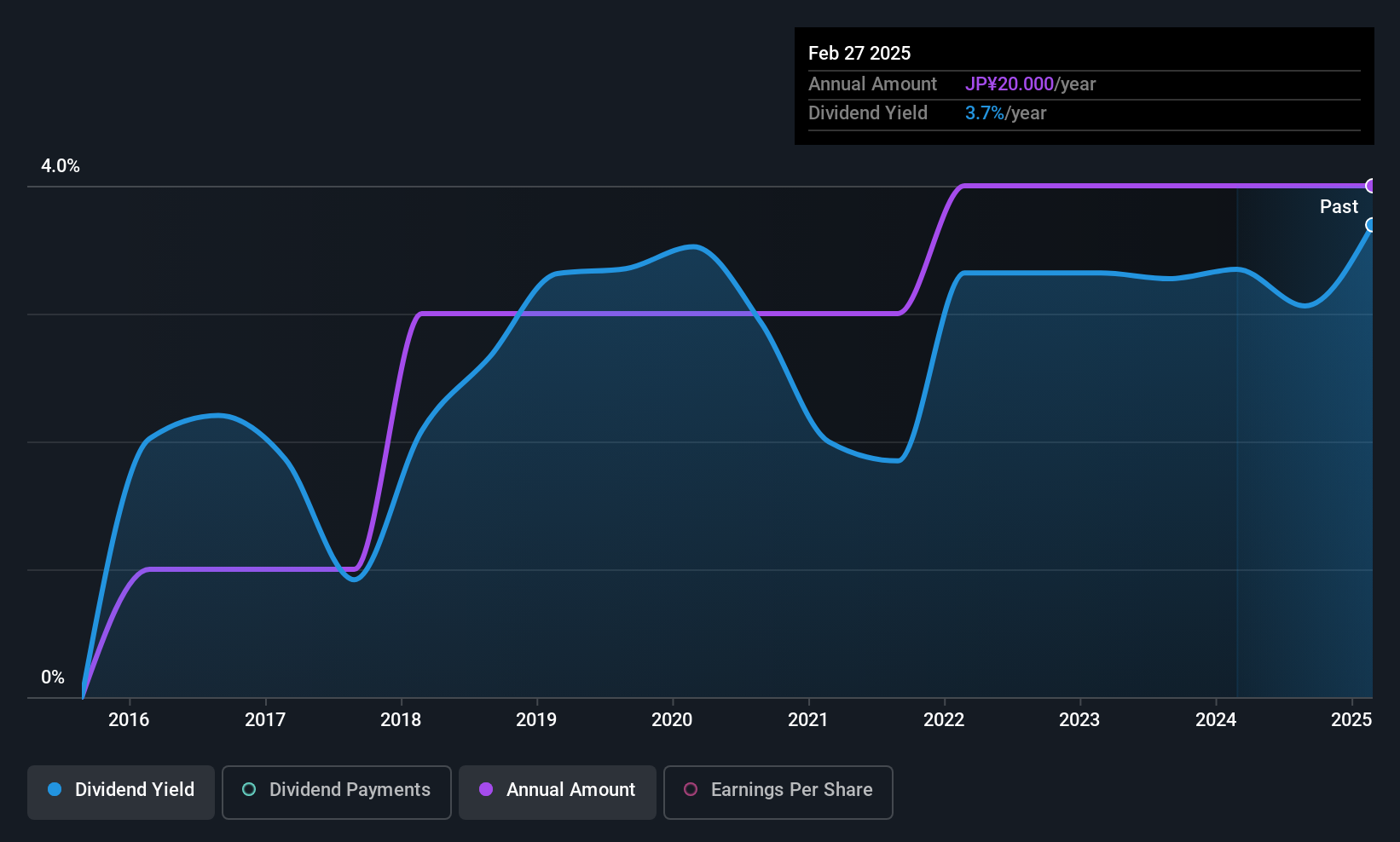

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2015, the dividend has gone from ¥5.00 total annually to ¥20.00. This means that it has been growing its distributions at 15% per annum over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Over the past five years, it looks as though MERF's EPS has declined at around 21% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, MERF has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about. Is MERF not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3168

MERF

Engages in the collection, processing, manufacture, and sale of various metals in Japan, Korea, rest of Asia, Europe, and internationally.

Good value average dividend payer.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026