- Japan

- /

- Metals and Mining

- /

- TSE:1515

Investors Aren't Entirely Convinced By Nittetsu Mining Co., Ltd.'s (TSE:1515) Earnings

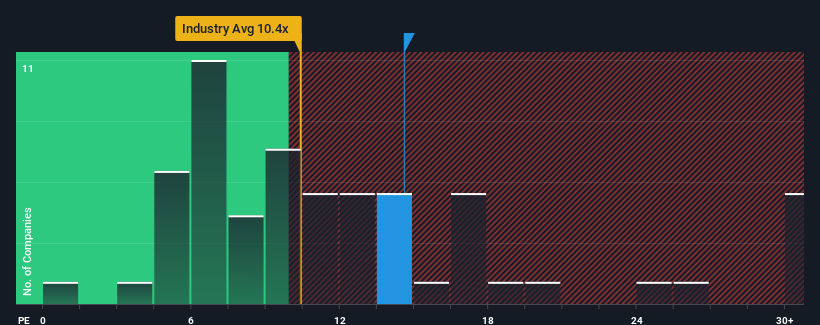

It's not a stretch to say that Nittetsu Mining Co., Ltd.'s (TSE:1515) price-to-earnings (or "P/E") ratio of 14.6x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Nittetsu Mining over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Nittetsu Mining

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Nittetsu Mining's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 76% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 9.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Nittetsu Mining is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Nittetsu Mining revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Nittetsu Mining has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nittetsu Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1515

Nittetsu Mining

Engages in mining activities in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026