- Japan

- /

- Energy Services

- /

- TSE:6369

Asian Dividend Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism amid mixed economic signals, Asian indices have shown resilience, with domestic liquidity and strategic policy shifts bolstering investor confidence. In this environment, dividend stocks stand out as attractive options for investors seeking steady income streams, particularly in regions where market conditions favor stable returns and growth potential.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.28% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.79% | ★★★★★★ |

| NCD (TSE:4783) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.93% | ★★★★★★ |

| Daicel (TSE:4202) | 4.26% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.50% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.40% | ★★★★★★ |

Click here to see the full list of 1052 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

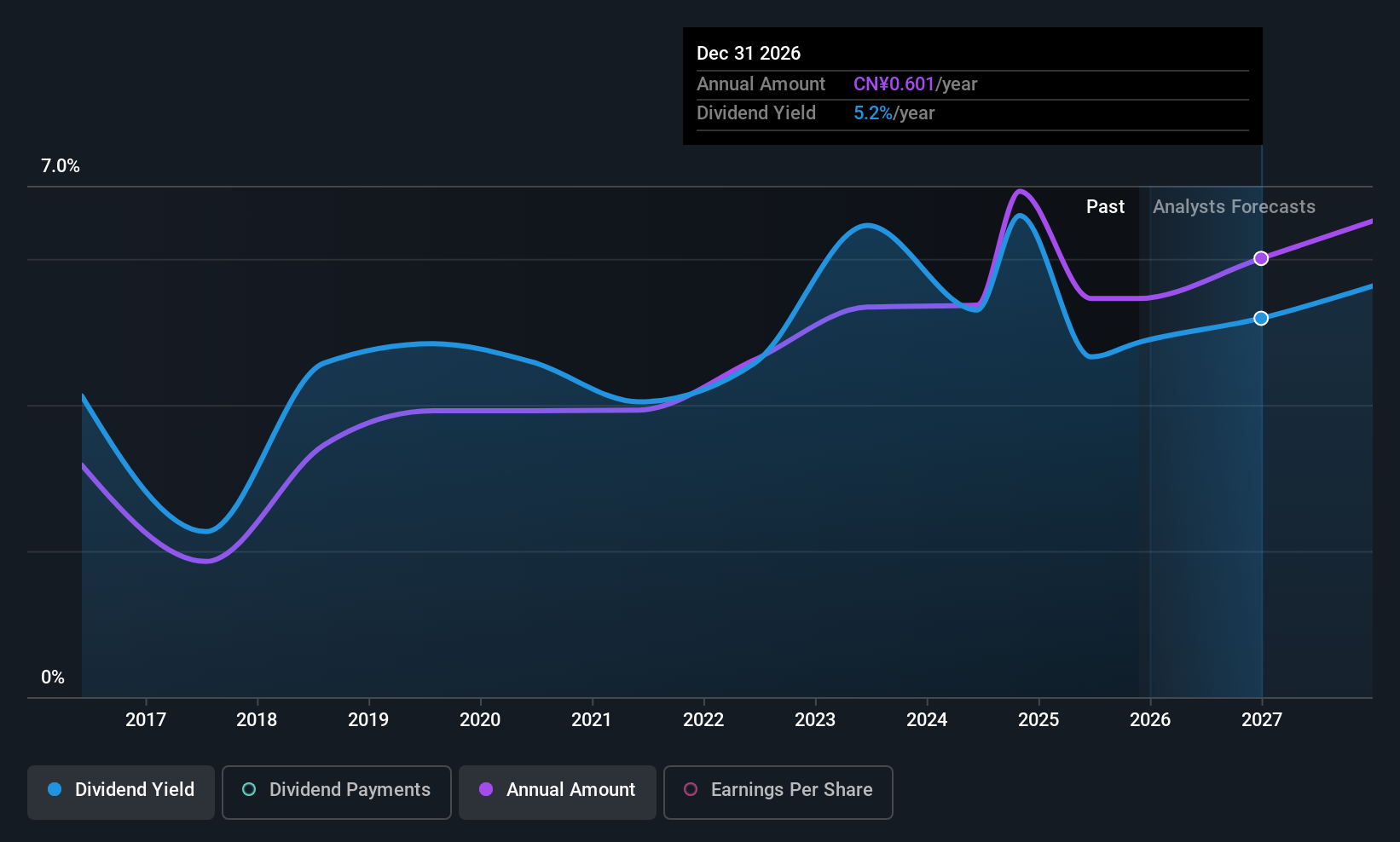

Bank of Nanjing (SHSE:601009)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Nanjing Co., Ltd. offers a range of financial products and services in China, with a market cap of approximately CN¥139.21 billion.

Operations: Bank of Nanjing Co., Ltd. generates revenue primarily through its Corporate Banking segment (CN¥22.93 billion), Treasury Operations (CN¥12.81 billion), and Personal Banking Business (CN¥5.51 billion).

Dividend Yield: 4.8%

Bank of Nanjing's recent earnings report shows net income growth to CNY 12.62 billion, supporting its dividend payments, which are currently well-covered with a low payout ratio of 10.8%. Despite a history of volatile dividends, the bank's yield is among the top 25% in China at 4.85%. The forecast suggests continued earnings coverage for dividends in three years at a 32% payout ratio, although shareholder dilution occurred last year.

- Delve into the full analysis dividend report here for a deeper understanding of Bank of Nanjing.

- Insights from our recent valuation report point to the potential undervaluation of Bank of Nanjing shares in the market.

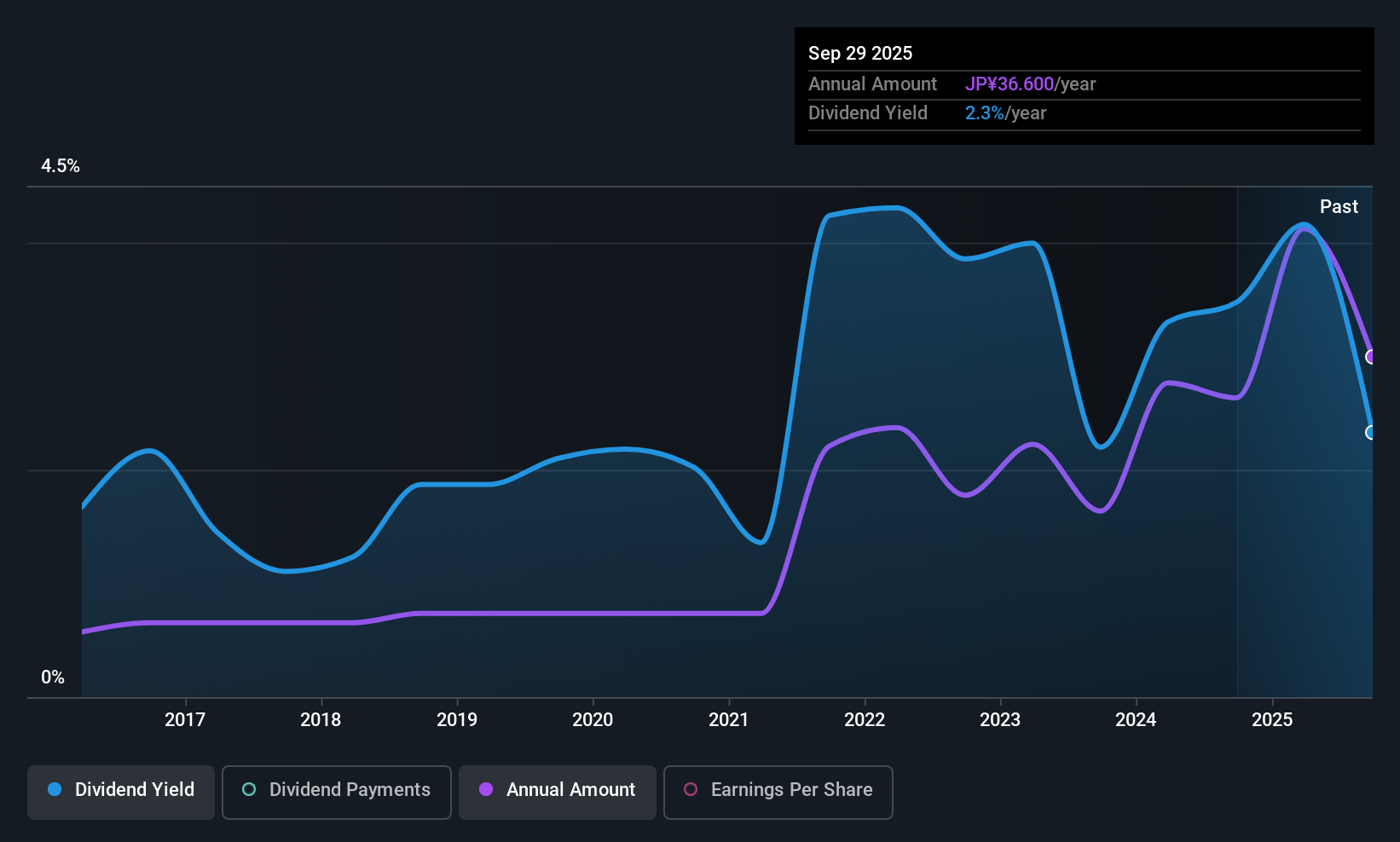

Nittetsu Mining (TSE:1515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nittetsu Mining Co., Ltd. is involved in mining activities both in Japan and internationally, with a market cap of ¥140.36 billion.

Operations: Nittetsu Mining Co., Ltd. generates revenue through its mining operations conducted both domestically in Japan and internationally.

Dividend Yield: 10.2%

Nittetsu Mining's dividend yield of 10.25% ranks among the top 25% in Japan, yet its sustainability is questionable due to a high cash payout ratio of 644%, indicating dividends are not well-covered by free cash flows. Recent board decisions include a share split and changes to the Articles of Incorporation, potentially affecting future dividend forecasts. Historically, dividends have been volatile and unreliable despite growth over the past decade, raising concerns about long-term stability.

- Click to explore a detailed breakdown of our findings in Nittetsu Mining's dividend report.

- Our expertly prepared valuation report Nittetsu Mining implies its share price may be too high.

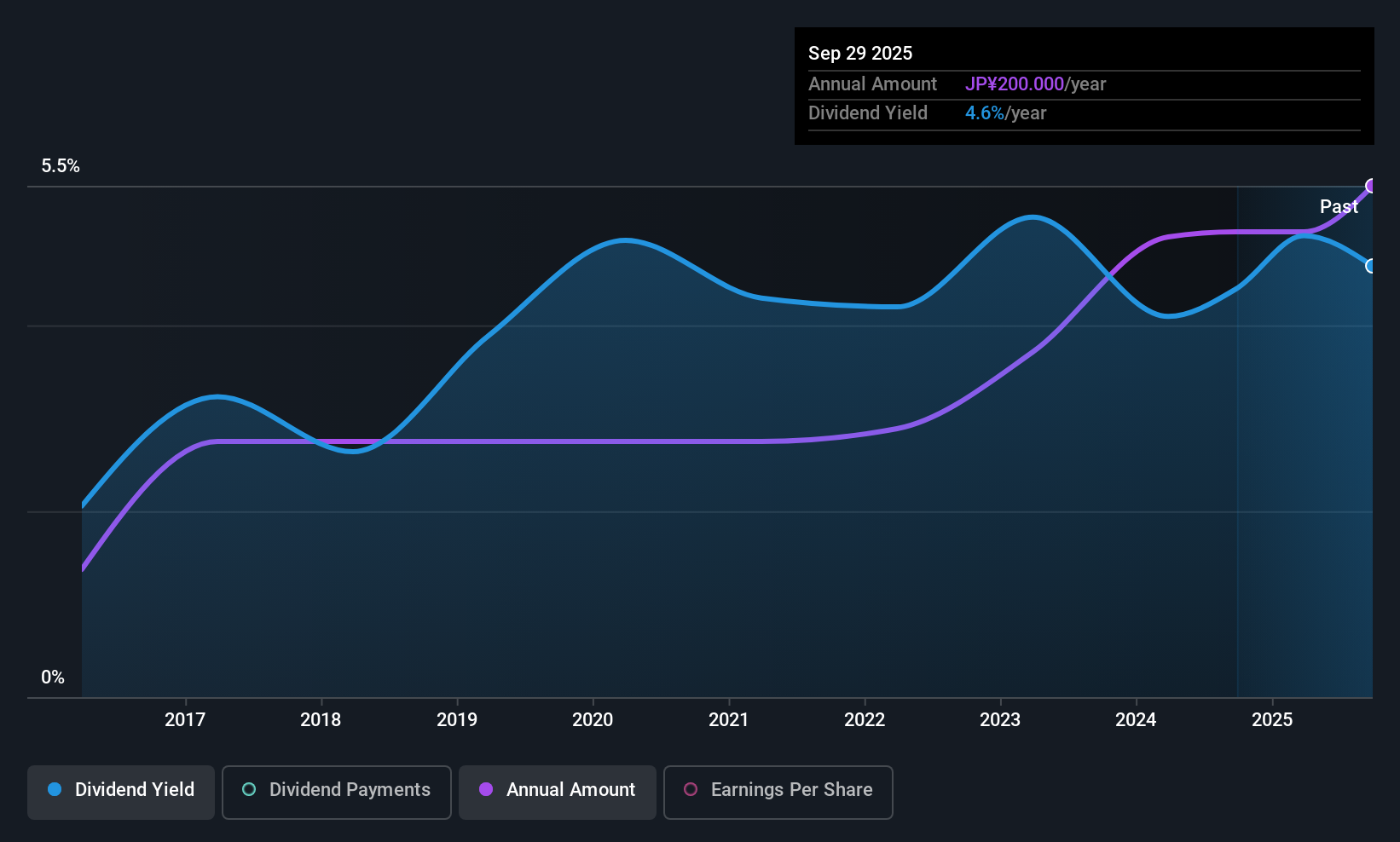

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Kanetsu K.K. operates in plant and machinery, material handling systems, and other businesses across Japan, Southeast Asia, and internationally with a market cap of ¥37.17 billion.

Operations: Toyo Kanetsu K.K.'s revenue segments include the Plant Business generating ¥10.58 billion, the Future Creation Project contributing ¥10.04 billion, and the Logistics Solution Business bringing in ¥36.12 billion.

Dividend Yield: 4.2%

Toyo Kanetsu K.K.'s dividend yield of 4.16% is competitive within Japan's top 25% of dividend payers, supported by a manageable payout ratio of 51.8% and cash payout ratio of 48.9%. However, its dividends have been volatile over the past decade, raising concerns about reliability despite recent growth. The company recently revised its earnings forecast upward due to strong project performance in logistics and plant businesses, which could positively impact future dividends if sustained.

- Unlock comprehensive insights into our analysis of Toyo Kanetsu K.K stock in this dividend report.

- Our expertly prepared valuation report Toyo Kanetsu K.K implies its share price may be lower than expected.

Taking Advantage

- Click here to access our complete index of 1052 Top Asian Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Kanetsu K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6369

Toyo Kanetsu K.K

Engages in plant and machinery, material handling systems, and other businesses in Japan, Southeast Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success