Tokio Marine (TSE:8766) Is Down 6.4% After Announcing Major Buyback and Dividend Increase Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Tokio Marine Holdings, Inc. recently announced board approval for a sizeable share repurchase program of up to 80 million shares, representing 4.2% of issued share capital, for ¥130.00 billion, alongside an upward revision to its annual dividend forecast to ¥211 per share for the year ending March 31, 2026.

- This combination of enhanced shareholder return initiatives reflects the company’s ongoing emphasis on capital flexibility and commitment to aligning dividends with profit growth.

- We'll explore how the newly authorized share buyback could influence Tokio Marine's transformation and earnings growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Tokio Marine Holdings Investment Narrative Recap

To be a shareholder in Tokio Marine Holdings, you need confidence in their ability to balance disciplined capital management and transformation amid industry change. The recently announced share buyback and dividend increase reinforce capital flexibility, but the biggest near-term catalyst remains the company’s push for higher returns on equity through business-equity divestitures. The principal risk is continued volatility in international investment returns, particularly from North American CRE loans, which the latest news does not materially change.

Among the recent announcements, the updated earnings guidance for fiscal 2026 stands out, with ordinary profit expected at ¥1,230,000 million and net income attributable to owners at ¥910,000 million, or ¥476.96 per share. This update is closely linked to short-term earnings momentum, which remains a key area of focus for investors weighing both profitability and the impacts of capital allocation measures.

However, against these positive signals, investors should be aware of the ongoing risks in international investments, especially as ...

Read the full narrative on Tokio Marine Holdings (it's free!)

Tokio Marine Holdings is projected to reach ¥8,888.8 billion in revenue and ¥979.2 billion in earnings by 2028. This outlook assumes a 3.7% annual revenue growth rate, but forecasts a ¥76.1 billion decrease in earnings from the current ¥1,055.3 billion.

Uncover how Tokio Marine Holdings' forecasts yield a ¥6759 fair value, a 22% upside to its current price.

Exploring Other Perspectives

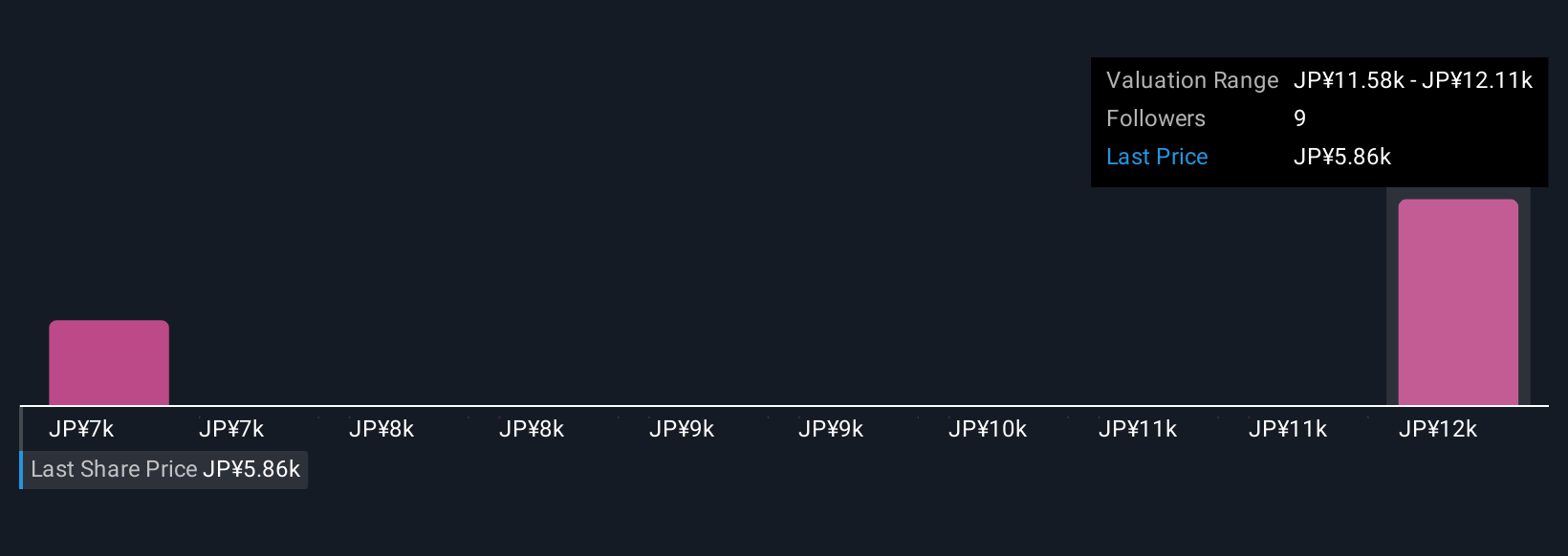

Fair value estimates for Tokio Marine Holdings from two Simply Wall St Community members range widely from ¥6,759 to ¥12,114 per share. This diversity of opinion underscores how closely many are watching the company’s capital redeployment and shifting international risk profile.

Explore 2 other fair value estimates on Tokio Marine Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Tokio Marine Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokio Marine Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tokio Marine Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokio Marine Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokio Marine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8766

Tokio Marine Holdings

Engages in the non-life and life insurance, and financial and general businesses in Japan and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives