Dai-ichi Life Holdings (TSE:8750): Assessing Valuation Following Upgraded Earnings Outlook and Dividend Forecast

Reviewed by Simply Wall St

Dai-ichi Life Holdings (TSE:8750) just raised its earnings guidance for the coming fiscal year, citing stronger gains on sales of securities. Along with this upgraded outlook, the company also increased its year-end dividend forecast for investors.

See our latest analysis for Dai-ichi Life Holdings.

Momentum has definitely been building for Dai-ichi Life Holdings, with the share price climbing 11.9% over the past month and an impressive total shareholder return of 35.8% over the past year. The revised earnings and dividend outlook has only fueled the stock’s recent rally, which signals renewed confidence from investors in both the company’s growth prospects and risk profile.

If Dai-ichi’s strong performance and dividend boost have you scanning the market for other potential winners, now is a perfect moment to expand your radar and discover fast growing stocks with high insider ownership

With Dai-ichi Life Holdings’ upgraded forecasts and the stock’s recent rally, investors now face a key question: given the run-up and improved outlook, is the current valuation still attractive or is the market already pricing in all the future growth?

Most Popular Narrative: 9.1% Undervalued

Dai-ichi Life Holdings’ fair value is set at ¥1,361 according to the most widely tracked narrative, an appealing premium over the latest close at ¥1,237. As market optimism continues powering the stock, the drivers behind this fair value reveal the broader story.

Expansion in international business, particularly in Asia and Australia, is delivering strong profit growth and improving diversification. This reduces reliance on Japan's mature insurance market and supports higher consolidated revenue and earnings stability. The company's strategic shift toward asset management and alternative investments, along with improving fixed income yields from portfolio rebalancing, is expected to enhance investment spreads and recurring income. This benefits net margins and long-term profitability.

Want to know what else powers Dai-ichi’s estimated upside potential? The model is fueled by ambitious revenue and profit forecasts, betting on marked expansion overseas and new recurring income streams. Find out which underlying trends and financial assumptions might be sparking this valuation surge.

Result: Fair Value of ¥1,361 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low interest rates or ongoing demographic challenges in Japan could undermine Dai-ichi Life’s growth forecasts and put pressure on long-term profitability.

Find out about the key risks to this Dai-ichi Life Holdings narrative.

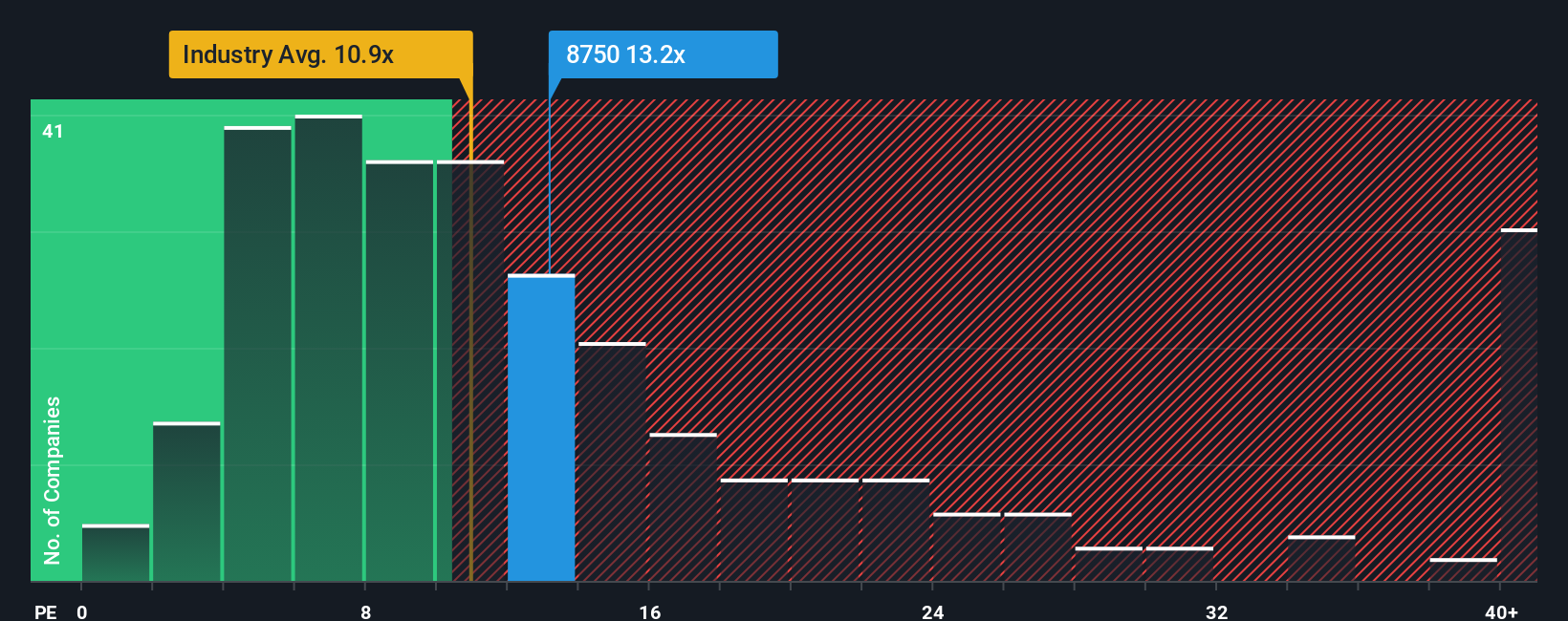

Another View: Market Multiples Paint a Pricier Picture

Looking at Dai-ichi Life Holdings from a market multiples perspective reveals a more expensive stance. Its price-to-earnings ratio stands at 11.1x, which is higher than the Asian insurance industry average of 10.8x but lower than the peer average of 13.8x. However, compared to its fair ratio of 13.5x, there is room for the market to move. This gap suggests both opportunity and risk. Could the shares still have headroom, or is the premium already reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dai-ichi Life Holdings Narrative

If you want to reach your own conclusions or explore a different perspective, you can dive into the latest data and craft a personal narrative of Dai-ichi Life Holdings in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dai-ichi Life Holdings.

Looking for More Investment Ideas?

Why stop here? Opportunities abound for investors who look beyond the obvious. Make your next smart move by weighing these compelling strategies with the Simply Wall Street Screener:

- Accelerate your search for high-yield returns by tapping into these 16 dividend stocks with yields > 3%, which offers reliable income potential above 3%.

- Power up your portfolio with cutting-edge advancements and seize your chance with these 26 AI penny stocks, driving breakthroughs in artificial intelligence.

- Expand your horizons with these 919 undervalued stocks based on cash flows, which stands out for strong fundamentals and attractive valuations before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives