Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6785

3 High-Performing Japanese Dividend Stocks With Yields Up To 3.3%

Reviewed by Simply Wall St

Amidst a backdrop of economic contraction and cautious monetary policy signals from the Bank of Japan, Japanese equities have shown resilience, with indices like the Nikkei 225 and TOPIX registering gains. In such an environment, dividend stocks can be particularly appealing for investors seeking steady returns in a landscape marked by uncertainty.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.52% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.60% | ★★★★★★ |

| Globeride (TSE:7990) | 3.52% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.49% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 3.50% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.40% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.15% | ★★★★★★ |

| Innotech (TSE:9880) | 4.00% | ★★★★★★ |

Click here to see the full list of 373 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Tomen Devices (TSE:2737)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tomen Devices Corporation, an electronics trading company based in Japan, has a market capitalization of approximately ¥48.90 billion.

Operations: Tomen Devices Corporation generates ¥0.15 billion in revenue from its operations in Japan and ¥0.26 billion internationally.

Dividend Yield: 3.3%

Tomen Devices offers a modest dividend yield of 3.34%, slightly below the top quartile of Japanese dividend payers. Despite a history of increasing dividends over the past decade, the company's dividend track record has been marked by volatility and unreliability. Financially, Tomen's dividends are supported by earnings with a payout ratio of 64.9% and cash flows with a cash payout ratio of 39.3%. However, recent financial results show declining profit margins year-over-year from 1.2% to 0.6%.

- Click here and access our complete dividend analysis report to understand the dynamics of Tomen Devices.

- The analysis detailed in our Tomen Devices valuation report hints at an inflated share price compared to its estimated value.

SuzukiLtd (TSE:6785)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Suzuki Co., Ltd. specializes in manufacturing and selling connectors for car electronics parts in Japan, with a market capitalization of ¥21.20 billion.

Operations: Suzuki Co., Ltd. generates its revenue primarily from the production and sales of connectors used in automotive electronics within Japan.

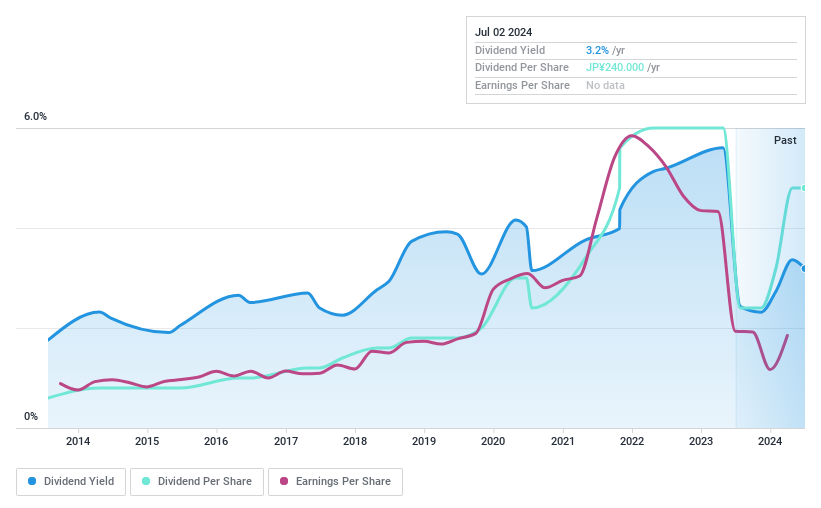

Dividend Yield: 3.1%

SuzukiLtd maintains a conservative payout ratio of 18.7%, ensuring dividends are well-supported by earnings. Additionally, dividends are comfortably covered by cash flows with a cash payout ratio of 26.6%. Despite trading at a 31.1% discount to its estimated fair value and offering stable dividends for the past decade, SuzukiLtd's dividend yield of ¥3.11% remains slightly below the top quartile in Japan's market, where yields average around ¥3.36%. Earnings are expected to grow by 12.15% annually, enhancing future dividend potential.

- Delve into the full analysis dividend report here for a deeper understanding of SuzukiLtd.

- Our valuation report unveils the possibility SuzukiLtd's shares may be trading at a discount.

Dai-ichi Life Holdings (TSE:8750)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dai-ichi Life Holdings, Inc. operates globally, offering insurance products primarily in Japan and the United States, with a market capitalization of approximately ¥3.70 trillion.

Operations: Dai-ichi Life Holdings, Inc. generates its revenues primarily from insurance product sales in Japan and the United States.

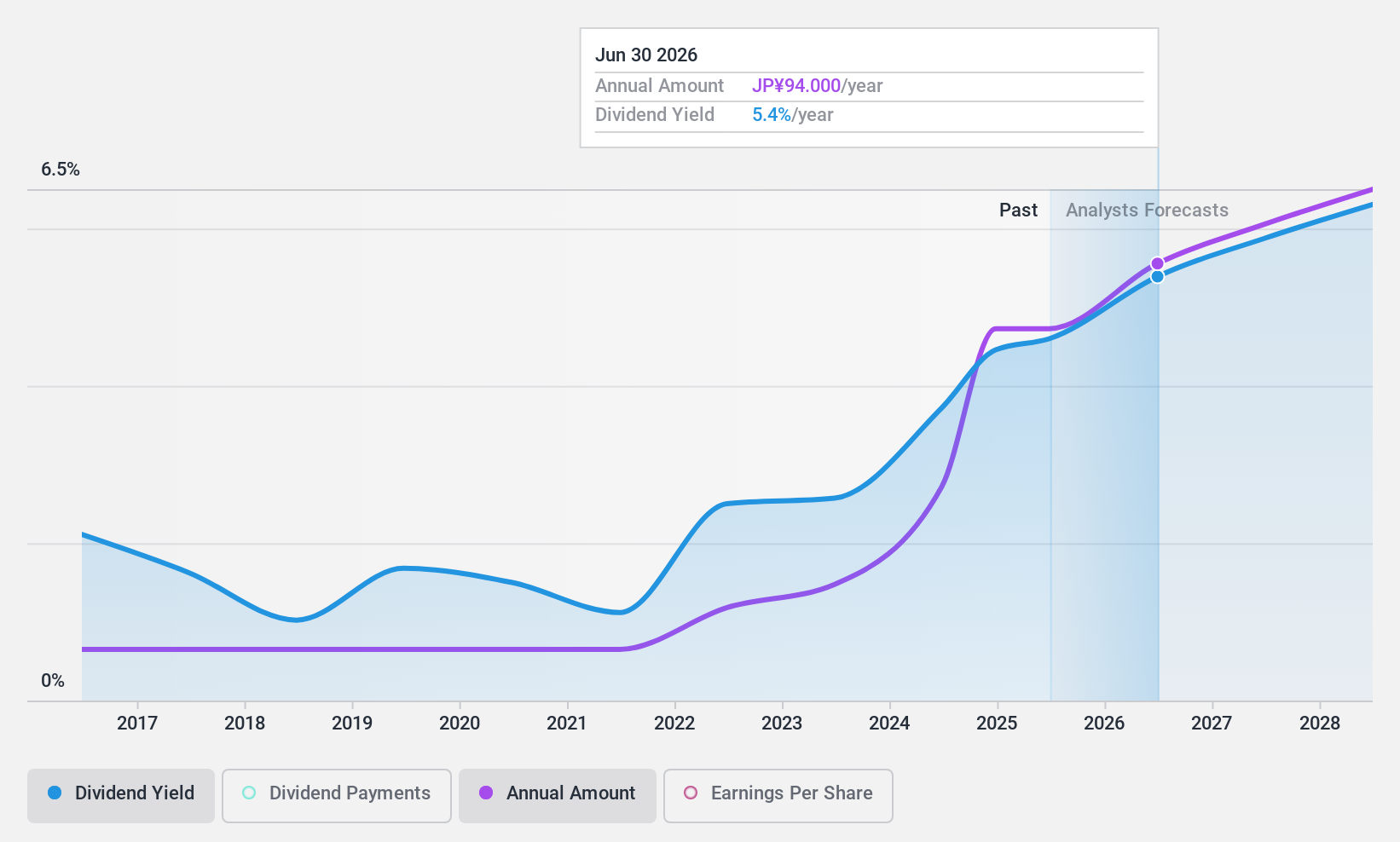

Dividend Yield: 3.1%

Dai-ichi Life Holdings has demonstrated a consistent dividend policy with recent fluctuations: a decrease to ¥61.00 for FY 2025 from ¥113.00 in FY 2024, despite an earlier increase from ¥83.00 the previous year. The company's dividends are well-supported by earnings, with a payout ratio of 34.3%, and cash flows, evidenced by a cash payout ratio of 12.7%. Additionally, Dai-ichi is actively enhancing shareholder value through substantial share buybacks, having repurchased shares worth ¥119.99 billion recently, indicating strong capital management and commitment to returning value to shareholders.

- Take a closer look at Dai-ichi Life Holdings' potential here in our dividend report.

- According our valuation report, there's an indication that Dai-ichi Life Holdings' share price might be on the cheaper side.

Summing It All Up

- Explore the 373 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether SuzukiLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6785

SuzukiLtd

Manufactures and sells connectors for car electronics parts in Japan.

Flawless balance sheet, undervalued and pays a dividend.