Should Sompo Holdings' (TSE:8630) New Share Buyback Prompt a Review of Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Sompo Holdings, Inc. announced on November 19, 2025, the authorization of a new share repurchase program of up to 24,000,000 shares (2.64% of share capital) for ¥77,000 million, valid through March 31, 2026, as part of its shareholder return policy.

- This move follows the completion of a previous buyback plan, highlighting the company's consistent commitment to enhancing shareholder value.

- Let's explore how consistent share repurchase actions are shaping Sompo Holdings' investment narrative and shareholder return profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sompo Holdings' Investment Narrative?

To be a shareholder in Sompo Holdings, investors need to believe in the value of steady capital return policies and stable core insurance operations despite a slow-growth environment. The newly authorized ¥77 billion buyback, announced on November 19, 2025, broadens the company’s consistent pace of returning capital through repurchases, even as the dividend guidance for the upcoming year ticks slightly lower. This move reinforces Sompo’s shareholder focus and may provide some downside support to the share price, particularly given the recent modest price retreat. However, since the previous buyback was already reflected in market expectations, and with no immediate earnings surprises, the impact of this fresh program on near-term catalysts, such as M&A developments or the execution of international restructuring, looks limited. Risks remain, particularly around integration of potential acquisitions and modest growth forecasts, as well as relative valuation versus peers, which should be watched closely in light of management's capital allocation decisions. On the other hand, integration risk from new acquisitions remains an important consideration for investors.

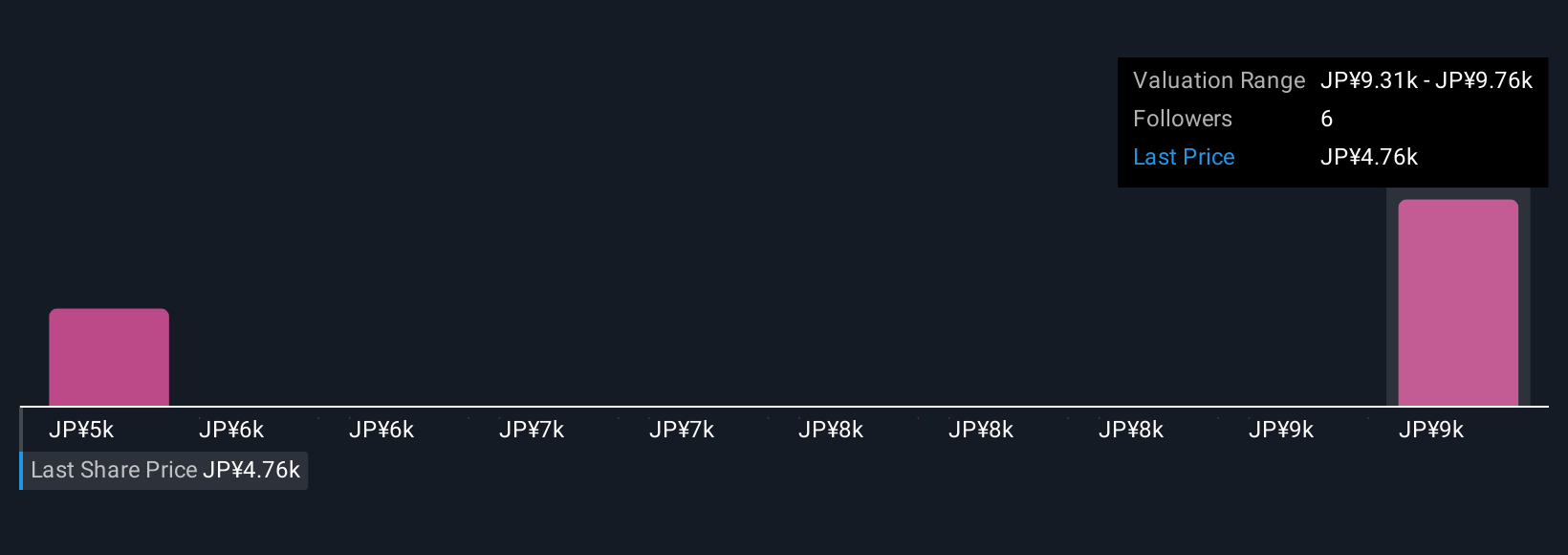

Despite retreating, Sompo Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Sompo Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Sompo Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sompo Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sompo Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sompo Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8630

Sompo Holdings

Provides property and casualty insurance services in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives