A Look at Japan Post Insurance's (TSE:7181) Valuation Following Major Share Buyback Announcement

Reviewed by Simply Wall St

Japan Post Insurance (TSE:7181) has announced a major share buyback program that allows for the repurchase of up to 20 million shares, or about 5% of its share capital. This move is designed to boost capital efficiency and enhance shareholder returns. It signals a proactive step by management that usually captures the interest of investors.

See our latest analysis for Japan Post Insurance.

With momentum clearly building, Japan Post Insurance has seen its share price surge 41.6% so far in 2025. Its one-year total shareholder return stands at an impressive 41.2%. The fresh buyback announcement follows a strong earnings update and a proactive board meeting, both pointing to renewed confidence in long-term growth and capital allocation.

If today's move has you curious about what other compelling stories are unfolding across the market, this could be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership.

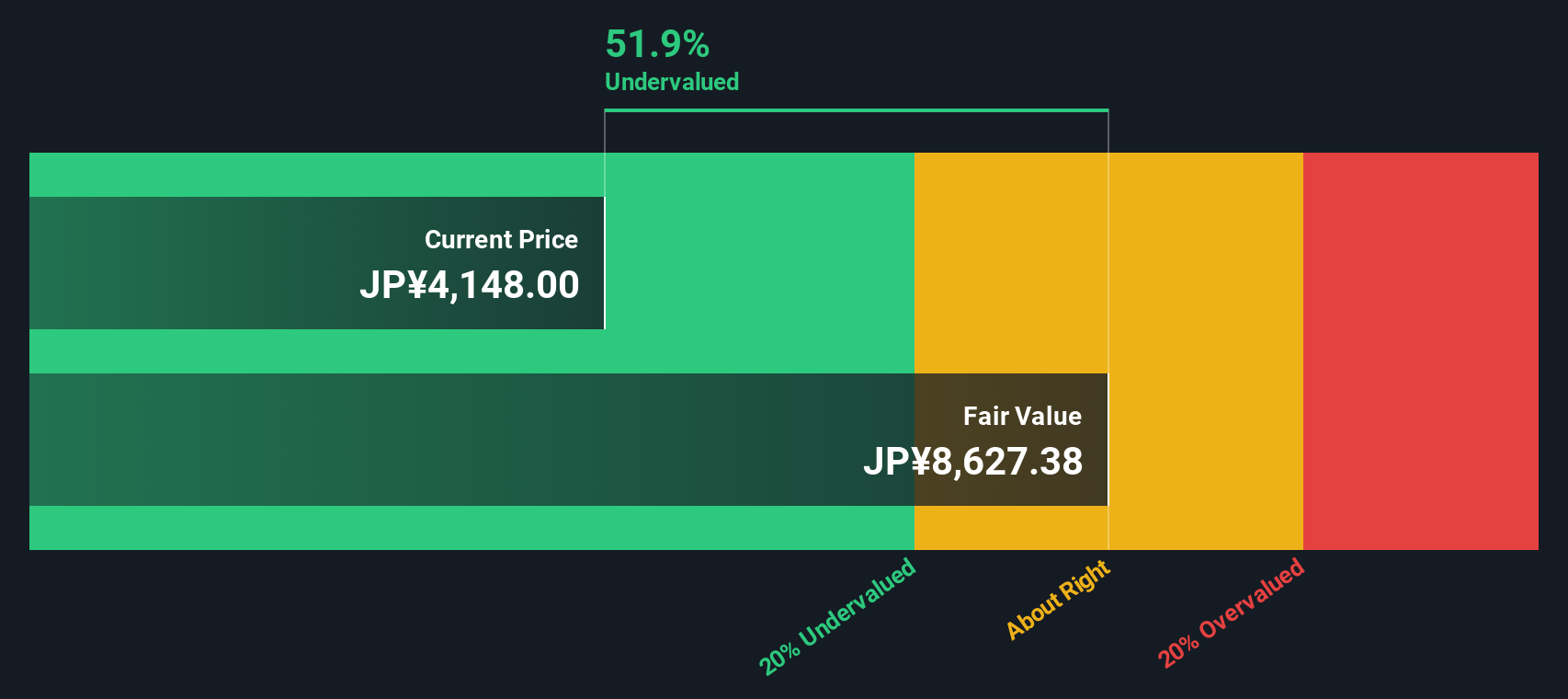

With such strong gains and an aggressive buyback now underway, the key question is whether Japan Post Insurance remains undervalued or if the market has already priced in this future growth potential, leaving little room for upside.

Most Popular Narrative: 1.5% Undervalued

With Japan Post Insurance’s fair value estimate sitting just above the current share price, the crowd’s consensus puts a modest edge in the investor’s favor. Here’s a snapshot of what could be powering that view.

Accelerated adoption of digital technologies and AI is streamlining operations, reducing administrative workloads, and enhancing customer engagement through improved service quality and expanded reach. This supports higher customer retention, lowers expenses, and ultimately boosts net margins.

Curious how tech transformation and next-level efficiency could play into the future value? There’s a surprising financial leap woven into this narrative, one that hinges on digital innovation outpacing industry norms. If you want to know the projections that make this possible, you’ll want to go deeper into the numbers that underpin today’s consensus.

Result: Fair Value of ¥4,211.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as Japan’s shrinking population and persistent market skepticism could quickly temper the case for further upside in Japan Post Insurance shares.

Find out about the key risks to this Japan Post Insurance narrative.

Another View: What Does the SWS DCF Model Say?

While our earlier view was based on multiples, the Simply Wall St DCF model offers a different perspective. According to this cash flow-based approach, Japan Post Insurance is trading well below its estimated fair value. This suggests a potentially much larger upside. Could the market be overlooking future cash potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Japan Post Insurance Narrative

If you think there’s more to the story, or like to dig deeper yourself, you can put together your own analysis in just a few minutes using Do it your way.

A great starting point for your Japan Post Insurance research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next standout investment could be just a click away. Check out these handpicked opportunities before the rest of the market catches on and gains momentum.

- Unlock the potential of breakthrough healthcare technology by checking out these 31 healthcare AI stocks, which is driving innovation in diagnostics, patient care, and advanced medical analytics.

- Pursue consistent income streams by tapping into these 15 dividend stocks with yields > 3%, offering reliable yields and proven dividend growth histories.

- Stay ahead of the curve and ride the wave of market transformation by evaluating these 82 cryptocurrency and blockchain stocks, which is shaping the future of decentralized finance and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7181

Japan Post Insurance

Provides life insurance products and services in Japan.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives