Japan Post Holdings (TSE:6178): Assessing Valuation Following Lowered Earnings Guidance and Sector Headwinds

Reviewed by Simply Wall St

Japan Post Holdings (TSE:6178) just revised its full-year earnings outlook after facing fresh pressures in its postal and logistics divisions, along with updated forecasts in its insurance business. Investors are watching these changes closely as they reflect evolving sector challenges.

See our latest analysis for Japan Post Holdings.

Japan Post Holdings has seen its 1-year total shareholder return inch up by 1.5%, a modest result given the new earnings guidance and recent moves like a partial disposal in its insurance subsidiary. Short-term share price momentum has softened, reflecting the lowered outlook and ongoing sector pressures. The five-year total shareholder return still paints a picture of strong long-term value creation.

If these recent management changes have you thinking about what else is out there, consider taking your next step and discover fast growing stocks with high insider ownership

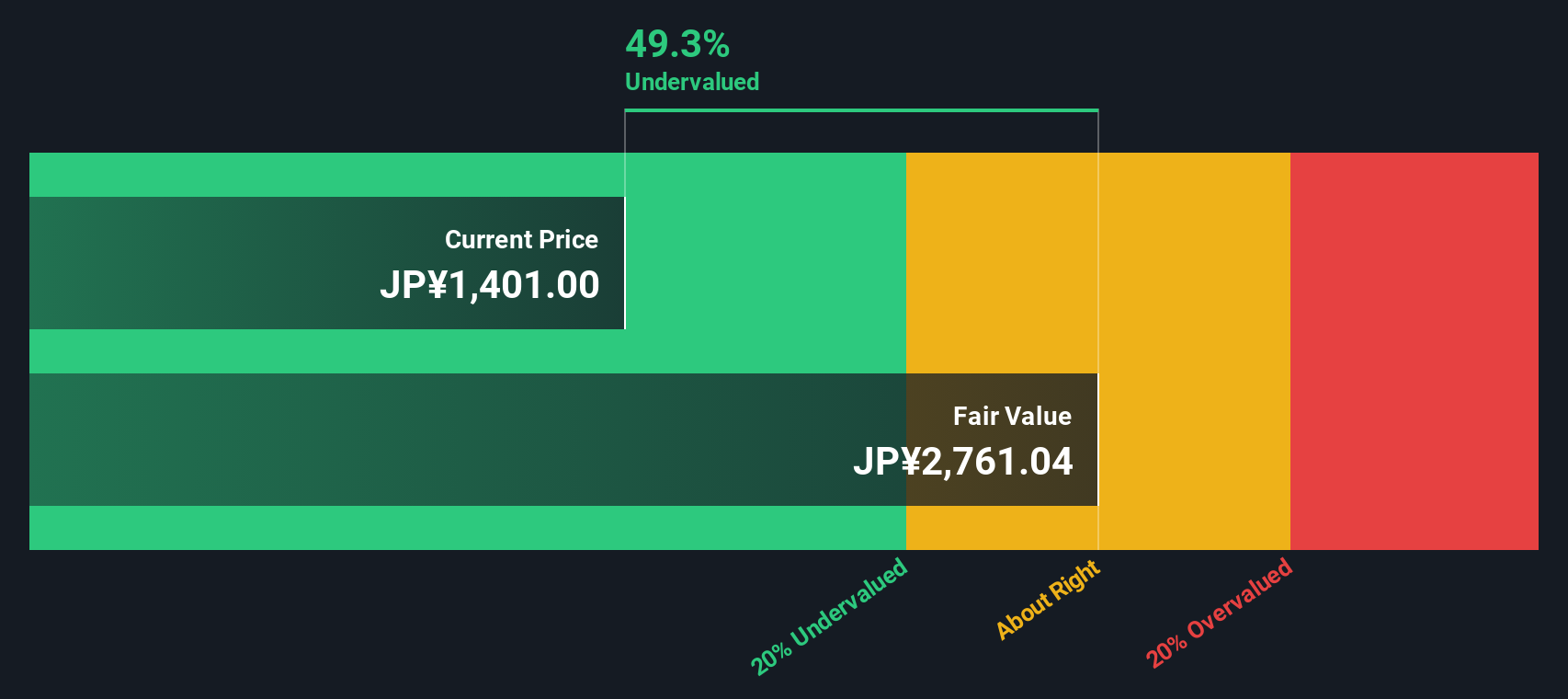

With earnings guidance now lowered and sector headwinds mounting, investors are left to wonder whether Japan Post Holdings is trading at a bargain after this correction or if the market has already accounted for future challenges and growth.

Price-to-Earnings of 11x: Is it justified?

Japan Post Holdings is trading on a price-to-earnings (P/E) ratio of 11x, well under both peer and fair value benchmarks. This suggests the shares are currently undervalued against sector norms.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for each yen of earnings. For insurance companies like Japan Post Holdings, this metric is an important indicator of both performance and market sentiment, especially given sector-specific profit dynamics.

Currently, the P/E of 11x is lower than the estimated fair P/E ratio of 13.3x and the peer group average of 13.5x. This indicates that the market is pricing Japan Post Holdings at a discount to what its earnings potential and sector position might otherwise justify. If the market shifts closer to the fair ratio, there could be significant upside.

However, the stock is considered slightly expensive compared to the wider Asian Insurance industry average P/E (10.8x), putting it in a nuanced position: attractive versus fair value and peers, but not a bargain within the broader industry landscape.

Explore the SWS fair ratio for Japan Post Holdings

Result: Price-to-Earnings of 11x (UNDERVALUED)

However, if weakening sector demand and stagnant annual revenue growth persist or accelerate in the coming quarters, these trends could pressure valuations further.

Find out about the key risks to this Japan Post Holdings narrative.

Another View: Discounted Cash Flow Perspective

Switching gears, our DCF model values Japan Post Holdings at ¥2,190.66 per share. This is about 33.9% higher than its recent price of ¥1,447.50. This approach contrasts sharply with the earnings multiple analysis and suggests the potential for undervaluation. The key question is which method the market will ultimately trust.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Post Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Post Holdings Narrative

Keep in mind, if these perspectives do not align with your own findings or you'd rather dive into the numbers yourself, crafting your own take is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Japan Post Holdings.

Looking for more investment ideas?

Smart investors stay ahead by acting on new opportunities before the crowd does. Don’t miss your chance to uncover stocks making waves across cutting-edge themes.

- Capture high growth potential by checking out these 897 undervalued stocks based on cash flows, which are ripe for a turnaround, backed by strong cash flows and overlooked value.

- Watch game-changing breakthroughs unfold when you browse these 30 healthcare AI stocks, where AI is transforming the future of health and medicine.

- Tap into powerful income streams with these 15 dividend stocks with yields > 3%, as these offer stability and yields beyond what the typical market provides.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6178

Japan Post Holdings

Provides postal, banking, and insurance services in Japan.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives