- Japan

- /

- Personal Products

- /

- TSE:4967

Is Recall-Driven Profit Pressure Altering the Investment Case for Kobayashi Pharmaceutical (TSE:4967)?

Reviewed by Sasha Jovanovic

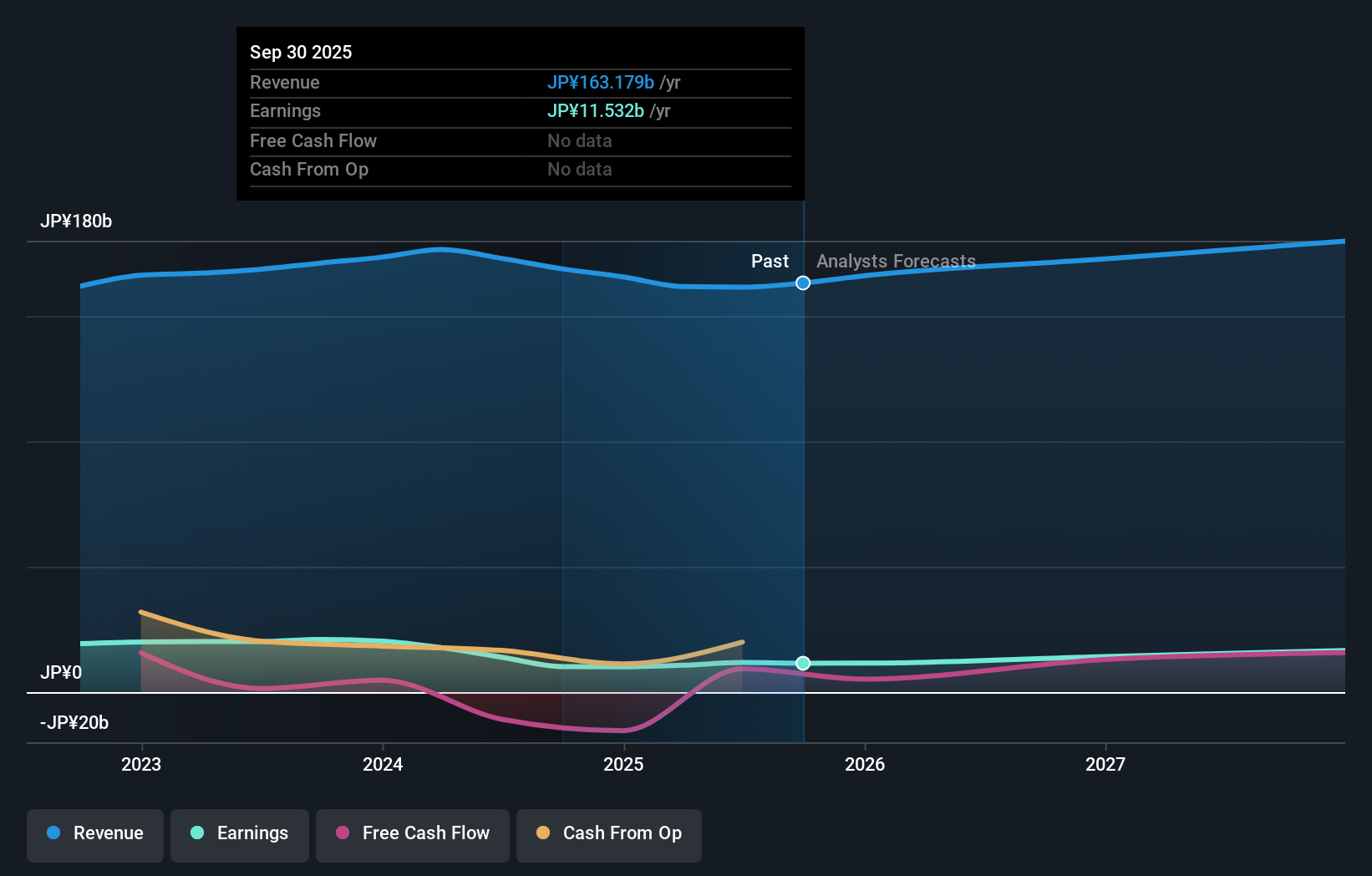

- In recent news, Kobayashi Pharmaceutical reported year-over-year declines in both sales and profits following earlier product recalls and compensation costs, despite a rise in net income on a special loss basis.

- The company’s robust equity ratio has helped steady its outlook, but ongoing risks from recall-related expenses remain a central challenge for management and investors.

- We’ll explore how continued recall costs and risk exposure shape the investment narrative for Kobayashi Pharmaceutical today.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Kobayashi Pharmaceutical's Investment Narrative?

Kobayashi Pharmaceutical’s recent news underscores a shifting balance of risks and catalysts demanding closer attention from shareholders. While the company’s solid equity ratio and an unchanged outlook suggest some resilience, the confirmation of a year-over-year decline in both sales and profits, paired with lingering recall-related costs, casts a more immediate shadow over recovery. Lawsuits, especially a high-profile derivative case seeking billions of yen in damages, amplify the uncertainty and further strain management’s efforts to stabilize results. Although previous analyses focused on long-term governance reforms and potential earnings growth, the reality of ongoing legal and compensation expenses may slow, or complicate, near-term improvements and post-recall momentum. These material exposures now sit behind recent share price moves and are reshaping the most important short-term catalysts, from regulatory reactions to potentially heavier financial liabilities.

But beneath the surface, those recall costs remain a risk investors should not underestimate. Kobayashi Pharmaceutical's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Kobayashi Pharmaceutical - why the stock might be worth over 2x more than the current price!

Build Your Own Kobayashi Pharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kobayashi Pharmaceutical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kobayashi Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kobayashi Pharmaceutical's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kobayashi Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4967

Kobayashi Pharmaceutical

Manufactures and sells OTC pharmaceuticals, guasi-drugs, deodorizing air fresheners, and sanitary products in Japan, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives