- Japan

- /

- Personal Products

- /

- TSE:4967

Assessing Kobayashi Pharmaceutical’s (TSE:4967) Valuation Following Product Recall Impacts and Ongoing Risk Concerns

Reviewed by Simply Wall St

Kobayashi Pharmaceutical (TSE:4967) faced declines in sales and profits over the past year, largely driven by product recalls and compensation expenses. Although net income climbed due to a special loss, the company’s outlook is unchanged as recall risks continue to affect its prospects.

See our latest analysis for Kobayashi Pharmaceutical.

While product recall worries have unsettled investors, Kobayashi Pharmaceutical’s share price has managed a 5% gain over the past month, reflecting some renewed optimism. Still, its one-year total shareholder return sits at just 4.1%, and long-term returns remain sharply negative. Momentum is therefore tentative rather than sustained.

If current events around Kobayashi have you rethinking your strategy, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With past losses still fresh and recall risks ongoing, investors may wonder if Kobayashi Pharmaceutical is trading at an attractive price or if the market has already factored in any recovery and future growth potential.

Price-to-Earnings of 35x: Is it justified?

Kobayashi Pharmaceutical is trading at a price-to-earnings (P/E) ratio of 35x, which is notably higher than its peers and industry averages. At the recent close of ¥5,435, the market is assigning a valuation premium in spite of the recall headwinds and ongoing business challenges.

The P/E ratio is a widely used benchmark for comparing how much investors are willing to pay for each yen of the company’s earnings. A higher P/E can signal market optimism for future earnings growth or a strong brand, but it can also indicate overvaluation if underlying performance does not justify the multiple.

In this case, Kobayashi Pharmaceutical’s earnings multiple stands out for being well above both the peer average (26x) and the JP Personal Products industry average (24.2x). Additionally, the company’s estimated “fair” P/E ratio is only 23.7x, implying the current valuation may be demanding relative to fundamentals and sector norms.

Explore the SWS fair ratio for Kobayashi Pharmaceutical

Result: Price-to-Earnings of 35x (OVERVALUED)

However, recall-related costs and ongoing business challenges could quickly disrupt any renewed optimism. This could leave the stock vulnerable to further downside risks.

Find out about the key risks to this Kobayashi Pharmaceutical narrative.

Another View: What Does Our DCF Model Say?

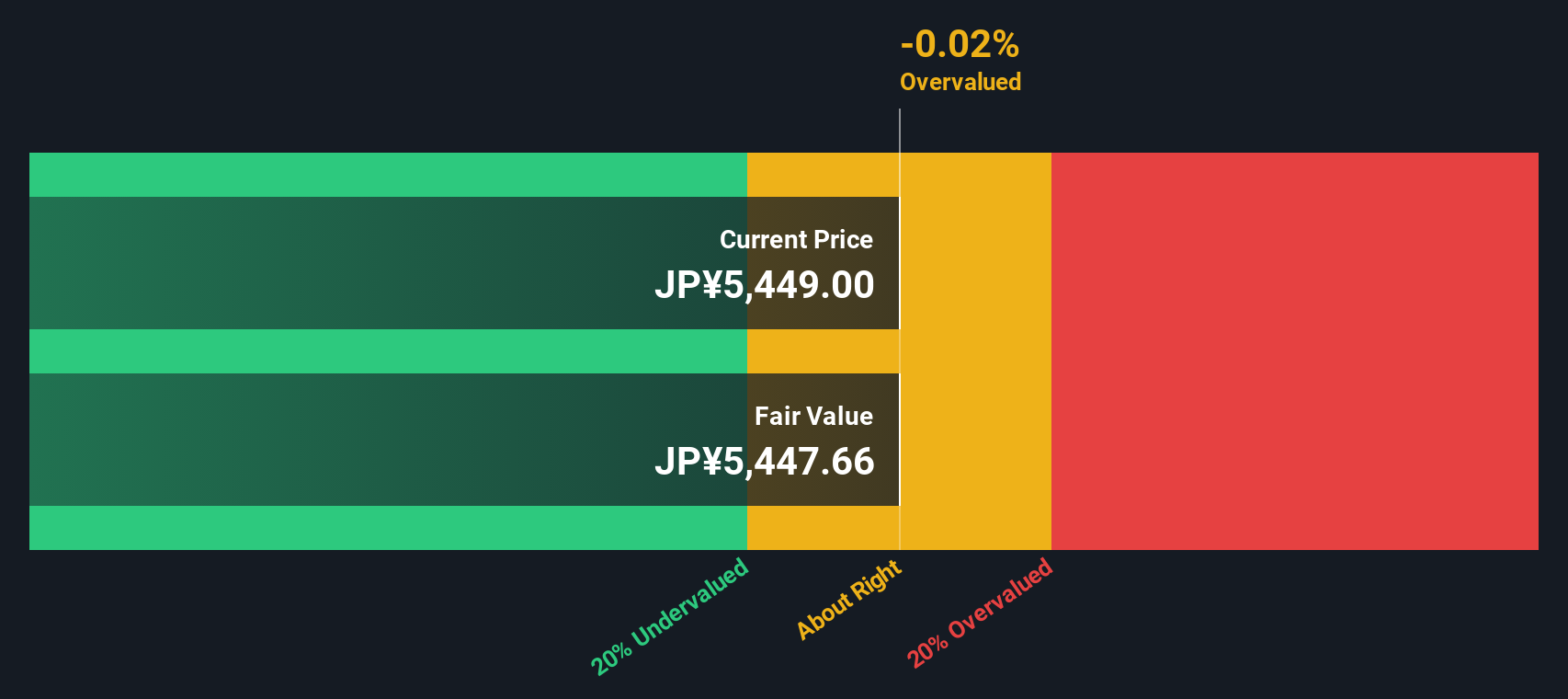

While the high price-to-earnings ratio suggests Kobayashi Pharmaceutical is priced for optimism, our DCF model points to shares trading almost exactly in line with fair value. This method factors in future cash flows and offers a different lens on whether current pricing truly reflects recovery potential. Could the market’s outlook shift as new data emerges?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kobayashi Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kobayashi Pharmaceutical Narrative

If you have a different perspective or want to form your own conclusions, you can shape your own view by diving into the data and insights. Do it your way.

A great starting point for your Kobayashi Pharmaceutical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to push your investing further? Don’t let a single stock define your portfolio when there is a whole universe of potential winners waiting for you. Start your next search here and tap into opportunities that others might overlook. Your future self will thank you.

- Capture value-focused opportunities by scanning these 874 undervalued stocks based on cash flows, where the market may have missed strong fundamentals.

- Uncover the fastest-rising innovations and gain early exposure by accessing these 27 AI penny stocks, which power tomorrow’s technology breakthroughs.

- Boost your passive income prospects and secure future yield with these 15 dividend stocks with yields > 3%, offering high and reliable returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kobayashi Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4967

Kobayashi Pharmaceutical

Manufactures and sells OTC pharmaceuticals, guasi-drugs, deodorizing air fresheners, and sanitary products in Japan, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives