- Japan

- /

- Personal Products

- /

- TSE:4927

Why Investors Shouldn't Be Surprised By Pola Orbis Holdings Inc.'s (TSE:4927) P/E

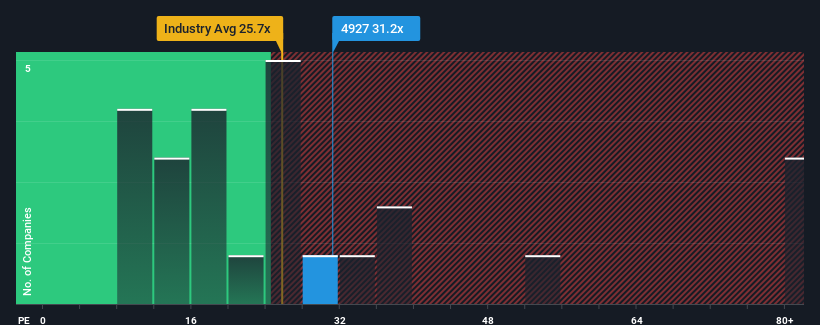

Pola Orbis Holdings Inc.'s (TSE:4927) price-to-earnings (or "P/E") ratio of 31.2x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Pola Orbis Holdings as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Pola Orbis Holdings

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Pola Orbis Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 43% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.6% per year, which is noticeably less attractive.

With this information, we can see why Pola Orbis Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Pola Orbis Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Pola Orbis Holdings is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4927

Pola Orbis Holdings

Through its subsidiaries, develops, manufactures, and sells cosmetics and related products in Japan, Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives