- Japan

- /

- Personal Products

- /

- TSE:4922

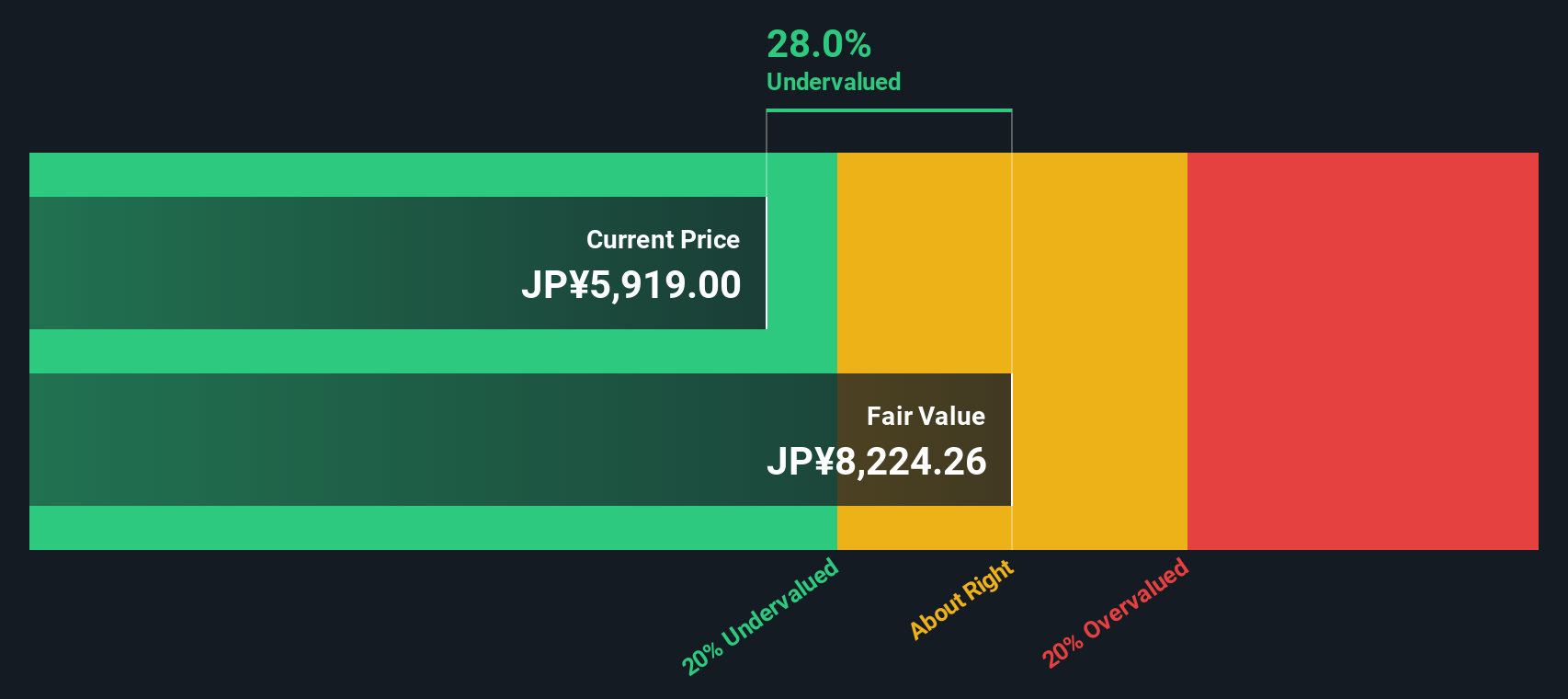

KOSÉ (TSE:4922) Valuation: Is There Real Upside After Recent Share Price Decline?

Reviewed by Simply Wall St

KOSÉ (TSE:4922) shares have faced some consistent pressure this year, and the stock recently marked a 25% drop year-to-date. Investors may be weighing long-term prospects as the company adapts to shifts in the cosmetics market.

See our latest analysis for KOSÉ.

After a tough start to the year, KOSÉ’s one-year total shareholder return sits at -22.5%, and the share price has steadily lost ground as momentum has faded further in recent weeks. While some short-term volatility followed shifting trends in global beauty spending, investors seem to be reassessing growth expectations as broader market sentiment weakens.

If you’re curious to spot other pockets of momentum in the market, this could be a great time to widen your search and discover fast growing stocks with high insider ownership

With shares now trading at a notable discount to both intrinsic value and analyst targets, the question for investors is whether KOSÉ offers real upside at current levels or if the market is signaling caution for a reason.

Price-to-Earnings of 39x: Is it justified?

KOSÉ trades at a price-to-earnings (P/E) ratio of 39x, placing it at a significant premium compared to both its industry peers and where the market typically prices similar companies.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of earnings. For KOSÉ, this elevated multiple often signals expectations of robust earnings growth or premium brand strength in the market.

However, at 39x, KOSÉ’s P/E notably exceeds the JP Personal Products industry average of 24.4x as well as the company’s own fair price-to-earnings ratio estimate of 26.7x. This suggests the current market price incorporates higher growth assumptions than either the broader sector or SWS’s valuation model would suggest, and it may be a level the market could eventually rebalance toward.

Explore the SWS fair ratio for KOSÉ

Result: Price-to-Earnings of 39x (OVERVALUED)

However, persistent revenue growth uncertainty and weak multi-year returns could challenge any near-term recovery in KOSÉ’s share price. This may keep sentiment cautious.

Find out about the key risks to this KOSÉ narrative.

Another View: Discounted Cash Flow Analysis

While KOSÉ’s price-to-earnings looks expensive compared to peers, the SWS DCF model provides a different perspective. It values shares at ¥8,688.61 compared to the current price of ¥5,118. This suggests the stock is trading about 41% below fair value according to this approach. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KOSÉ for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KOSÉ Narrative

If you see things differently or enjoy drawing your own conclusions from the numbers, you can put together your own view in just a few minutes using our tools, and Do it your way.

A great starting point for your KOSÉ research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the momentum in your portfolio by researching under-the-radar stocks and emerging themes before others catch on. Fresh opportunities are always waiting for those who take action.

- Maximize your returns by targeting steady income through these 15 dividend stocks with yields > 3%, where high-yielding stocks combine with strong financials to provide reliable payouts.

- Tap into future healthcare breakthroughs with these 31 healthcare AI stocks and stay ahead in one of the world’s fastest-evolving sectors.

- Boost your growth strategy by searching for tomorrow’s standouts with these 882 undervalued stocks based on cash flows that are trading below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOSÉ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4922

KOSÉ

Manufactures and sells cosmetics and cosmetology products primarily in Japan and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives