- Japan

- /

- Personal Products

- /

- TSE:4920

These 4 Measures Indicate That Nippon Shikizai (TSE:4920) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Nippon Shikizai, Inc. (TSE:4920) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Nippon Shikizai

What Is Nippon Shikizai's Net Debt?

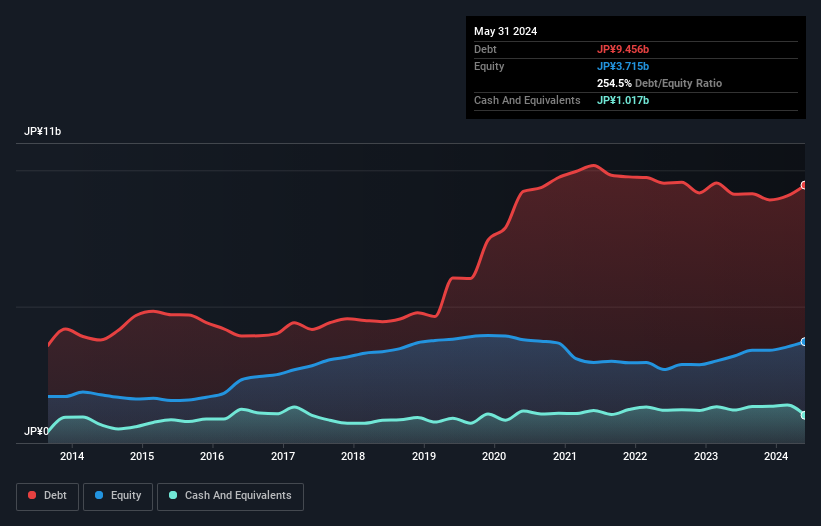

As you can see below, Nippon Shikizai had JP¥9.46b of debt, at May 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had JP¥1.02b in cash, and so its net debt is JP¥8.44b.

How Healthy Is Nippon Shikizai's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nippon Shikizai had liabilities of JP¥7.48b due within 12 months and liabilities of JP¥6.76b due beyond that. Offsetting these obligations, it had cash of JP¥1.02b as well as receivables valued at JP¥3.42b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥9.80b.

The deficiency here weighs heavily on the JP¥3.17b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Nippon Shikizai would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a net debt to EBITDA ratio of 5.9, it's fair to say Nippon Shikizai does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 4.3 times, suggesting it can responsibly service its obligations. The good news is that Nippon Shikizai grew its EBIT a smooth 32% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Nippon Shikizai will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Nippon Shikizai actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We feel some trepidation about Nippon Shikizai's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Nippon Shikizai is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Nippon Shikizai (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shikizai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4920

Nippon Shikizai

Researches and develops, manufactures, and sells cosmetics in Japan and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives