- Japan

- /

- Medical Equipment

- /

- TSE:7780

Menicon's (TSE:7780) Shareholders Will Receive A Bigger Dividend Than Last Year

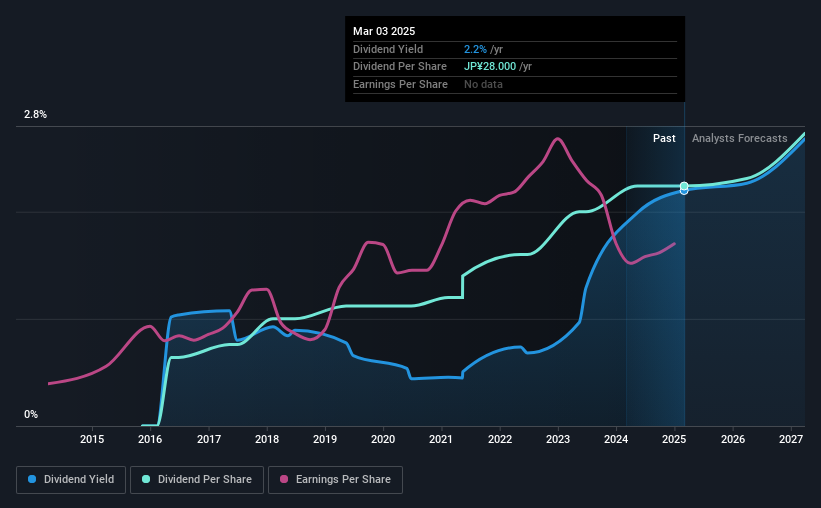

Menicon Co., Ltd. (TSE:7780) will increase its dividend from last year's comparable payment on the 27th of June to ¥28.00. This will take the dividend yield to an attractive 2.2%, providing a nice boost to shareholder returns.

View our latest analysis for Menicon

Menicon's Future Dividend Projections Appear Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Menicon is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

The next year is set to see EPS grow by 18.8%. If the dividend continues on this path, the payout ratio could be 40% by next year, which we think can be pretty sustainable going forward.

Menicon Doesn't Have A Long Payment History

Menicon's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2016, the annual payment back then was ¥8.00, compared to the most recent full-year payment of ¥28.00. This means that it has been growing its distributions at 15% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Menicon May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately, Menicon's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. While growth may be thin on the ground, Menicon could always pay out a higher proportion of earnings to increase shareholder returns.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Menicon will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Menicon that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7780

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives