- Japan

- /

- Medical Equipment

- /

- TSE:7747

Strong Profit Growth and Efficiency Gains Might Change the Case for Investing in Asahi Intecc (TSE:7747)

Reviewed by Sasha Jovanovic

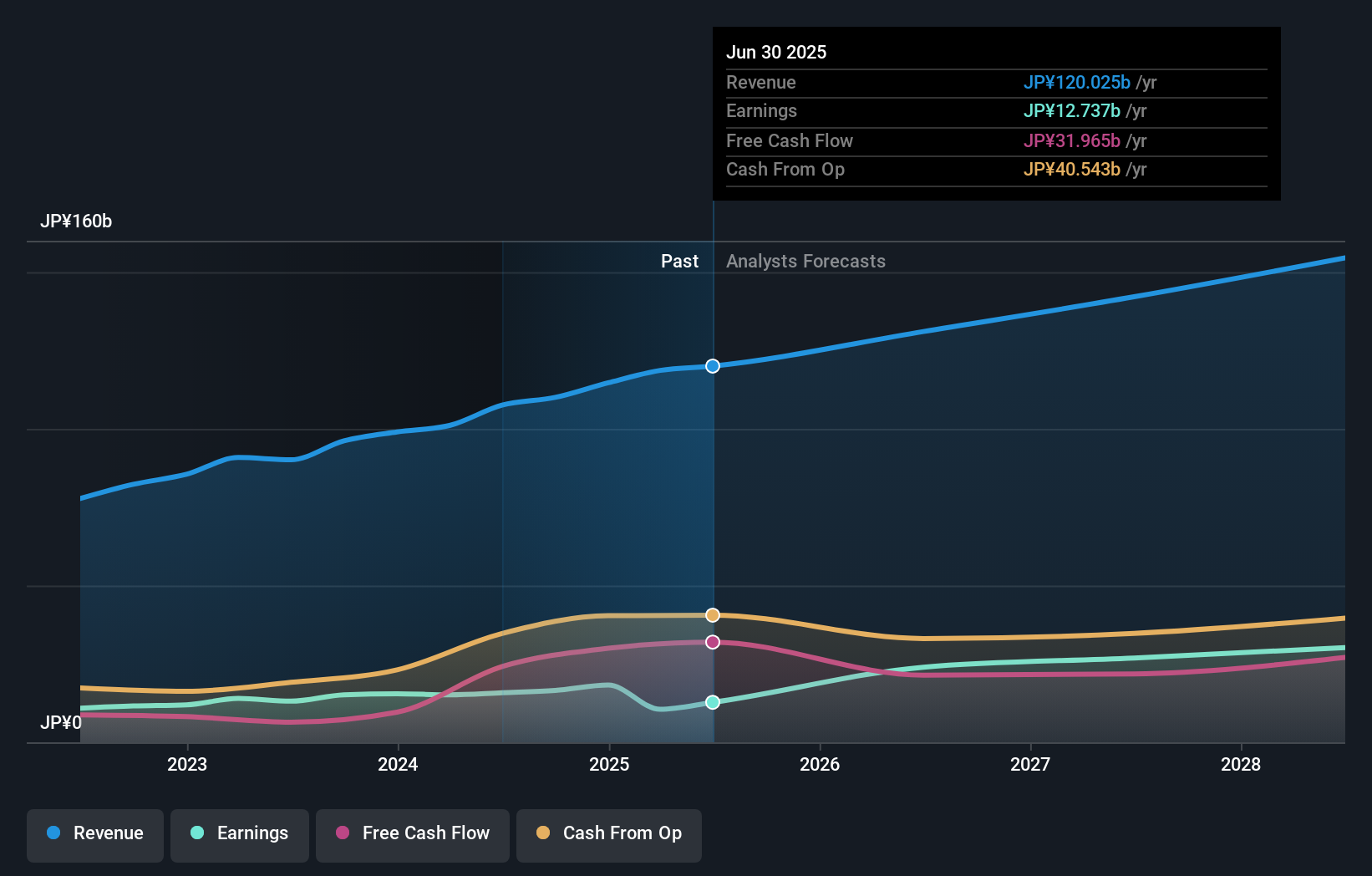

- Asahi Intecc Co., Ltd. recently reported strong financial results for the quarter ending September 30, 2025, with net sales up 15.6% and operating profit rising 34% year-over-year.

- A very large increase in comprehensive income highlights the positive impact of management’s operational efficiency and focus in the specialized medical technology sector.

- We'll explore how rising operating profit and stronger efficiency shape Asahi Intecc’s overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Asahi Intecc's Investment Narrative?

Owning Asahi Intecc means believing that demand for precise and minimally invasive medical devices will continue to grow, and that operational focus will translate into sustainable performance. The latest quarter's surge in both sales and operating profit is a clear boost to near-term confidence, suggesting that the company may now enter earnings season with improved momentum. This strong result could shift priorities from concerns over profit margin softness and industry underperformance, back to the pace and quality of revenue growth. However, questions remain about the stock’s high price-to-earnings ratio compared to peers, executive team inexperience, and the lingering impact of one-off items on earnings credibility. If the market views these latest results as the start of a trend rather than a one-off rebound, it could reduce skepticism and spark renewed interest, but any slip in efficiency or execution could quickly temper this optimism.

Yet with a high valuation and new faces at the helm, execution risks remain very real for shareholders.

Exploring Other Perspectives

Explore another fair value estimate on Asahi Intecc - why the stock might be worth just ¥2553!

Build Your Own Asahi Intecc Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Intecc research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Asahi Intecc research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Intecc's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7747

Asahi Intecc

Engages in the development, manufacture, and sale of medical devices in Japan, the United States, Europe, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives