The board of JMS Co.,Ltd. (TSE:7702) has announced that it will pay a dividend on the 28th of June, with investors receiving ¥8.50 per share. This means the annual payment is 3.3% of the current stock price, which is above the average for the industry.

View our latest analysis for JMSLtd

JMSLtd Doesn't Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before this announcement, JMSLtd was paying out 306% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

If the company can't turn things around, EPS could fall by 28.9% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 289%, which could put the dividend under pressure if earnings don't start to improve.

JMSLtd Has A Solid Track Record

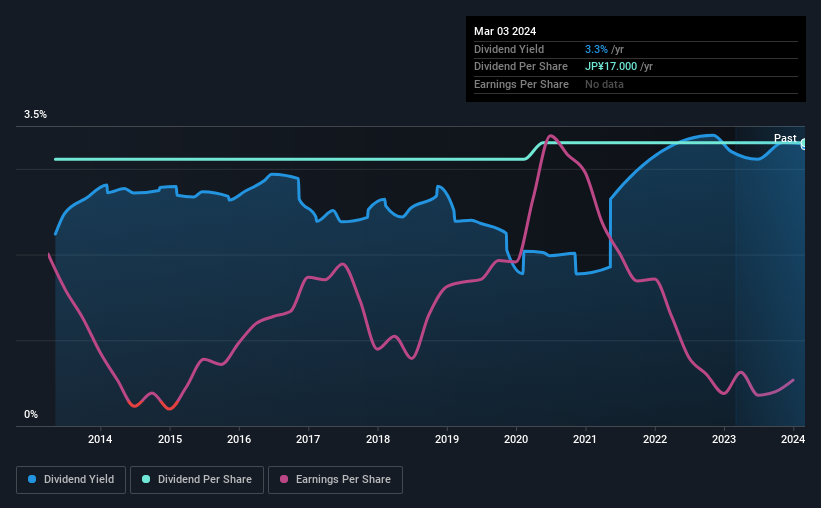

The company has an extended history of paying stable dividends. Since 2014, the annual payment back then was ¥16.00, compared to the most recent full-year payment of ¥17.00. Its dividends have grown at less than 1% per annum over this time frame. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. JMSLtd's earnings per share has shrunk at 29% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

JMSLtd's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about JMSLtd's payments, as there could be some issues with sustaining them into the future. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for JMSLtd you should be aware of, and 2 of them make us uncomfortable. Is JMSLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7702

JMSLtd

Engages in the manufacture, sale, export, and import of medical devices and pharmaceuticals in Japan, North America, Europe, China, South Korea, Thailand, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026