- Japan

- /

- Medical Equipment

- /

- TSE:7575

Japan Lifeline (TSE:7575) Margin Improvement Reinforces Bullish Narrative on Discount Valuation

Reviewed by Simply Wall St

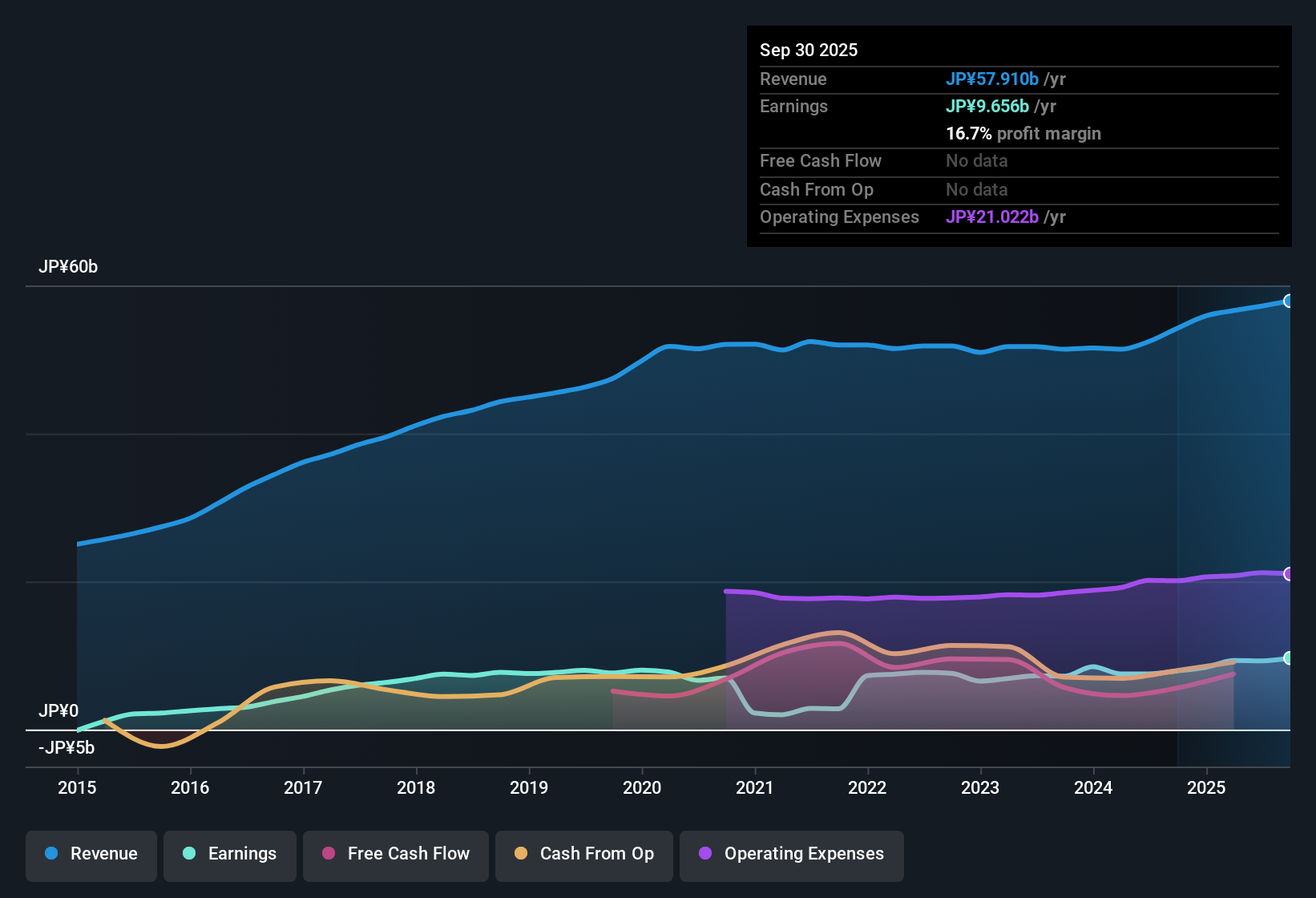

Japan Lifeline (TSE:7575) posted earnings growth of 22% over the past twelve months, well above its five-year average of 16.9% per year. Net profit margin also improved to 16.7% from last year’s 14.6%, while the company’s Price-To-Earnings ratio of 10.6x stands out as a clear discount to both the industry average of 15.4x and the peer average of 19.8x. With high quality earnings and attractive multiples, investors are likely to be encouraged by sustained profit expansion and a robust rewards profile.

See our full analysis for Japan Lifeline.Next, we will see how these headline results compare to the established narratives investors follow and where the numbers might challenge the consensus story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Guidance Slows but Stays Positive

- Forward guidance points to earnings growing at 6.7% per year and revenue rising at 4.1% per year, both coming in slightly below the average Japanese market projections.

- What stands out from recent discussion is that Japan Lifeline’s expected earnings and revenue growth, although slower than the national average, are underpinned by consistent historical delivery and improving margins.

- A multi-year average profit growth of 16.9% and margin expansion to 16.7% reinforce the story of reliable performance.

- The latest market view notes that the company’s role in a growing medical devices sector and focus on stable, high-quality results add resilience despite softer forecasts.

High Quality Profits Hold Up

- Net profit margin for the year reached 16.7%, moving up from last year’s 14.6%. This puts Japan Lifeline among the margin leaders in its peer group.

- The prevailing market analysis highlights that investors tracking the sector will likely view the improved margin as an affirmation of operational strength, particularly in a defensive industry where stability matters.

- The strengthened profit margin, cited alongside a decade-long track record of consistent gains, points to quality earnings that can withstand typical swings in demand.

- With medical device demand set to benefit from Japan’s aging population, there is added potential for margins to remain robust even if revenue growth moderates.

Discounted Valuation vs Industry

- Japan Lifeline’s price-to-earnings ratio stands at 10.6x, well below the broader industry average of 15.4x and the peer average of 19.8x. This comes despite ongoing strong net profitability.

- Many observers argue that this sizable valuation gap could attract value-focused investors, especially given sector tailwinds and the company’s persistent profitability.

- The discounted multiple offers a cushion versus potential sector volatility, making Japan Lifeline relatively appealing as a defensive holding.

- Even with forecast growth slowing, the company’s ability to maintain high earnings quality provides support for the narrative that the current valuation is conservative rather than a red flag.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Japan Lifeline's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Japan Lifeline’s outlook for earnings and revenue growth has slowed, falling behind market averages and raising questions about future momentum.

If you’re searching for investments with more consistent growth prospects, discover steadier performers through stable growth stocks screener (2119 results) who have delivered reliable expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7575

Japan Lifeline

A medical device company, engages in manufacturing and sale of medical device in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives