- Japan

- /

- Medical Equipment

- /

- TSE:4543

Terumo (TSE:4543) Valuation in Focus After FDA Clearance for US Cardiovascular Imaging Debut

Reviewed by Simply Wall St

Terumo (TSE:4543) just earned FDA 510(k) clearance for its OPUSWAVE Dual Sensor Imaging System, including the DualView imaging catheter. This launch marks Terumo’s entry into US cardiovascular imaging with an OFDI and IVUS dual approach.

See our latest analysis for Terumo.

Terumo’s new FDA clearance adds to a year of steady product launches and clinical partnerships. However, momentum in the share price has remained muted, with a 1-year total shareholder return of -10.3% and a year-to-date share price return of -14.6%. Despite these recent headwinds, long-term holders have still benefited from a 38.5% total shareholder return over five years. This suggests the company’s innovation continues to offer value for patient investors.

If Terumo’s breakthrough has you thinking bigger, this might be the perfect moment to seek out healthcare innovators through our curated list: See the full list for free.

With fresh product breakthroughs and a sizable discount to analyst price targets, investors now face a classic dilemma: is Terumo currently undervalued, or are these catalysts all baked into the share price already?

Most Popular Narrative: 22.1% Undervalued

The narrative consensus sees Terumo's fair value significantly above its last close, highlighting the disconnect between current market sentiment and projected financial strength. The following insight from the narrative provides a window into what analysts believe could power the next leg up.

Pricing initiatives, particularly in the Cardiovascular and Neurovascular segments, have been more effective than anticipated. Price increases are being embedded into contracts, and further price improvements are expected through contract renewals. This is supporting higher gross and operating margins despite expected headwinds from tariffs.

Want to know the numbers behind this bullish outlook? The secret lies in analyst expectations for margin expansion and top-line growth few competitors can match. Curious about the assumptions driving such a large gap between current price and target value? Unlock the full reasoning behind this potentially pivotal upgrade.

Result: Fair Value of ¥3,288.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff impacts and slower innovation investment could become headwinds and challenge the upbeat outlook for Terumo's earnings trajectory.

Find out about the key risks to this Terumo narrative.

Another View: What Do Multiples Suggest?

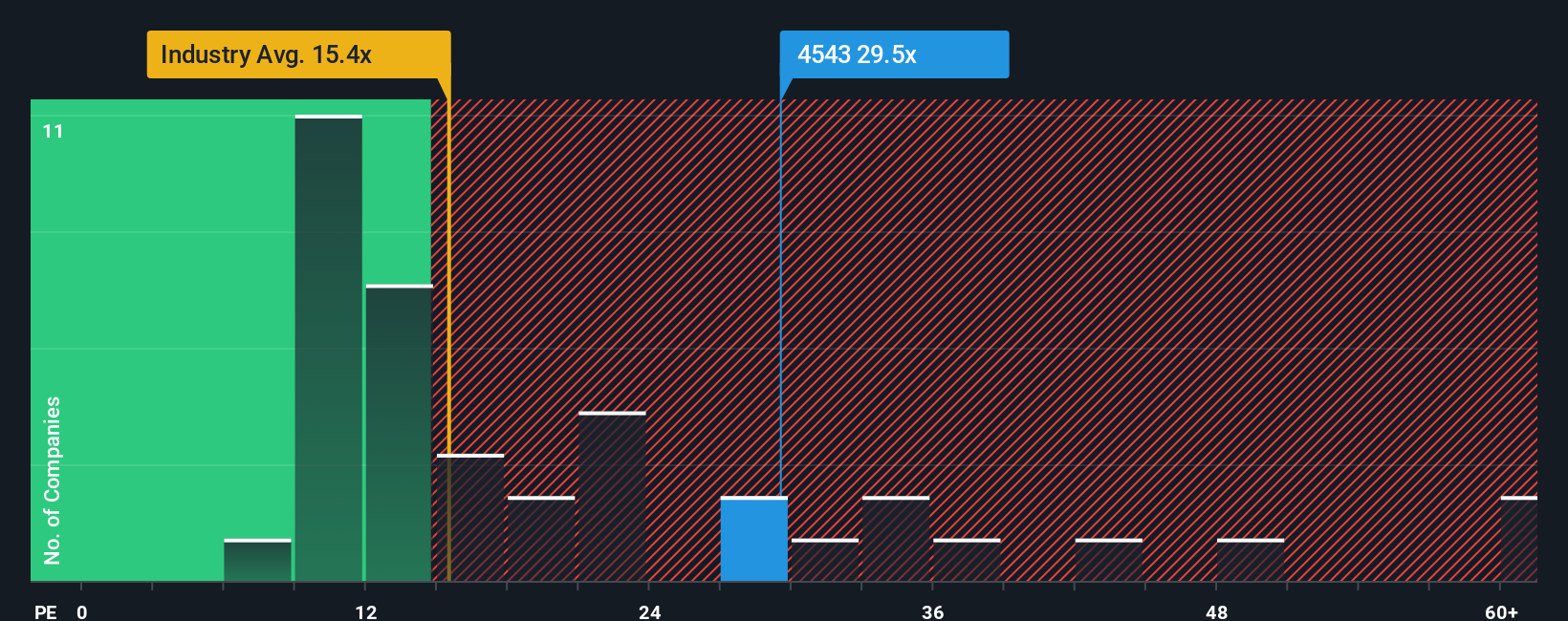

Looking through a comparative lens, Terumo’s price-to-earnings ratio stands at 30.2x, which is significantly higher than both the industry average of 15.5x and direct peers at 22.1x. This makes the stock look expensive versus most competitors. Its fair ratio of 31.2x suggests the market might justify a premium. Does this premium reflect genuine opportunity, or could it expose investors to downside if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Terumo Narrative

If this perspective does not resonate with you, or you want to draw your own conclusions, you can easily craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Terumo.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Jump ahead of the crowd by pinpointing stocks with dynamic fundamentals and the potential for outstanding returns.

- Capture growth by targeting high-yielding opportunities linked to future technologies with these 28 quantum computing stocks.

- Secure steady income streams by tapping into these 17 dividend stocks with yields > 3%, which features reliable payers with attractive yields above 3%.

- Uncover underappreciated gems and get a head start with these 873 undervalued stocks based on cash flows, based on real cash flow analysis and value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives