Exploring High Growth Tech Stocks In Asia For Potential Portfolio Strength

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and fluctuating market indices, Asian markets continue to capture attention with their dynamic tech sector, despite facing challenges such as trade tensions and regulatory changes. In this environment, identifying high-growth tech stocks requires a keen focus on innovation potential, resilience to market volatility, and alignment with broader technological trends that can drive sustained growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 30.57% | 29.38% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.12% | 34.05% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 42.36% | 53.04% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Jinyu Bio-technology (SHSE:600201)

Simply Wall St Growth Rating: ★★★★★☆

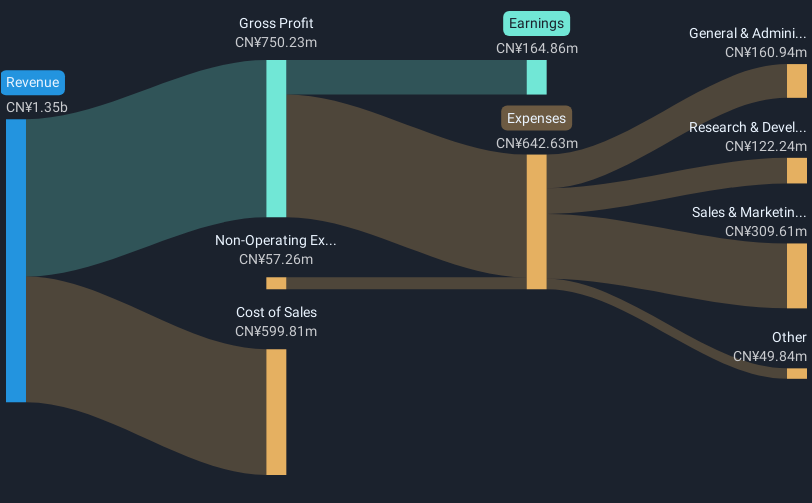

Overview: Jinyu Bio-technology Co., Ltd. focuses on the research, development, production, and sale of veterinary products in China with a market capitalization of approximately CN¥7.81 billion.

Operations: Jinyu Bio-technology Co., Ltd. specializes in veterinary products, concentrating on research, development, production, and sales within China. The company operates with a market capitalization of approximately CN¥7.81 billion.

Jinyu Bio-technology, amidst a challenging year with a 42.9% dip in earnings, still projects robust future growth with an expected annual earnings increase of 48.5%. This rate outpaces the Chinese market's average of 25.3%, underscoring its potential resilience and adaptive strategies in the biotech sector. Despite a recent stagnation in share repurchases, with no new shares bought as per the last update from December 2024, Jinyu maintains a competitive edge through significant R&D investments aimed at pioneering advancements in bio-technology. Moreover, its revenue growth forecast at 27.6% annually suggests an aggressive expansion strategy that could redefine its market standing and influence within Asia’s high-tech landscape.

- Get an in-depth perspective on Jinyu Bio-technology's performance by reading our health report here.

Understand Jinyu Bio-technology's track record by examining our Past report.

State Power Rixin Technology (SZSE:301162)

Simply Wall St Growth Rating: ★★★★★☆

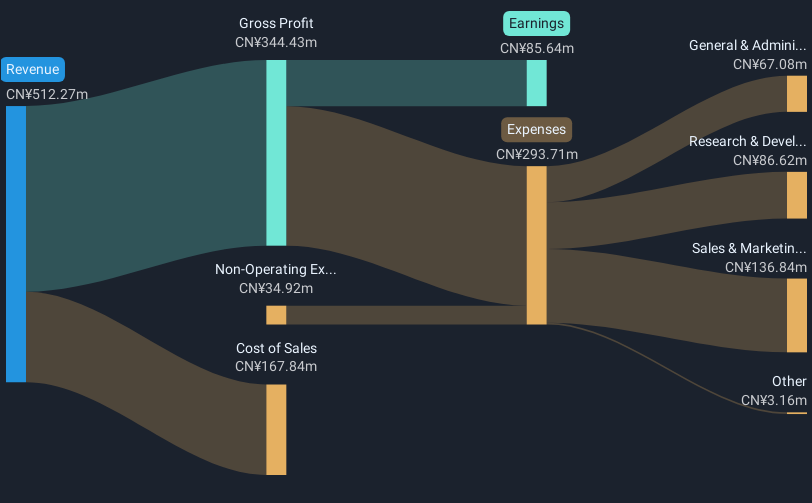

Overview: State Power Rixin Technology Co., Ltd. offers data services and application solutions for the energy industry both in China and internationally, with a market cap of CN¥5.11 billion.

Operations: State Power Rixin Technology specializes in providing comprehensive data services and application solutions tailored to the energy sector across domestic and international markets. The company operates with a focus on leveraging technology to enhance efficiency within the energy industry.

State Power Rixin Technology, despite its recent exclusion from the S&P Global BMI Index, demonstrates robust growth metrics that overshadow broader market trends. With a notable 26.3% annual revenue increase and an even more impressive 32.1% rise in earnings, the company outpaces the Chinese market's average growth rates of 13.2% and 25.3%, respectively. These figures reflect a strategic emphasis on innovation and market expansion, underscored by significant R&D investments which have cultivated advanced technological solutions poised for further growth in Asia's competitive tech landscape.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★☆

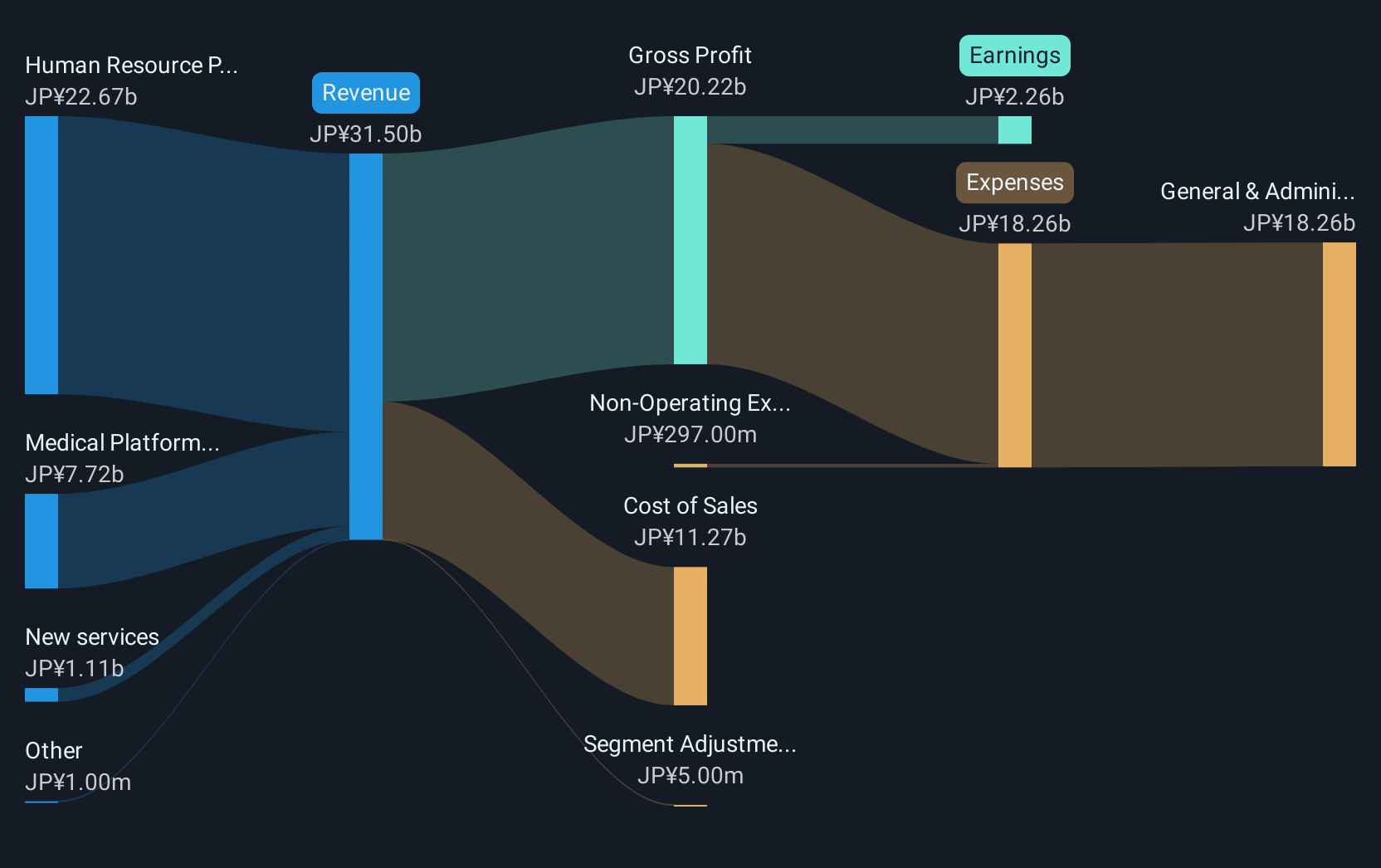

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market cap of ¥94.37 billion.

Operations: The company generates revenue primarily through its Human Resource Platform Business, contributing ¥21.11 billion, and its Medical Platform Business, adding ¥7.35 billion. The New Services segment also contributes to the overall revenue with ¥849 million.

Medley's strategic maneuvers, including a recent share repurchase program and mergers with subsidiaries, underscore its proactive stance in bolstering market position and shareholder value. With an annual revenue growth forecast at 17.4% and earnings expected to surge by 22.5%, the company is outpacing average market projections significantly. These financial dynamics are complemented by a robust R&D commitment, positioning Medley well within Asia’s competitive tech landscape despite recent extraordinary losses from corporate restructuring.

- Click to explore a detailed breakdown of our findings in Medley's health report.

Evaluate Medley's historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 519 Asian High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301162

State Power Rixin Technology

Provides data services and application solutions for energy industry in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives