- Japan

- /

- Healthtech

- /

- TSE:3939

Despite delivering investors losses of 27% over the past 5 years, Kanamic NetworkLTD (TSE:3939) has been growing its earnings

While it may not be enough for some shareholders, we think it is good to see the Kanamic Network Co.,LTD (TSE:3939) share price up 17% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 30%, which falls well short of the return you could get by buying an index fund.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, Kanamic NetworkLTD actually managed to increase EPS by an average of 17% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

The modest 1.4% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 26% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

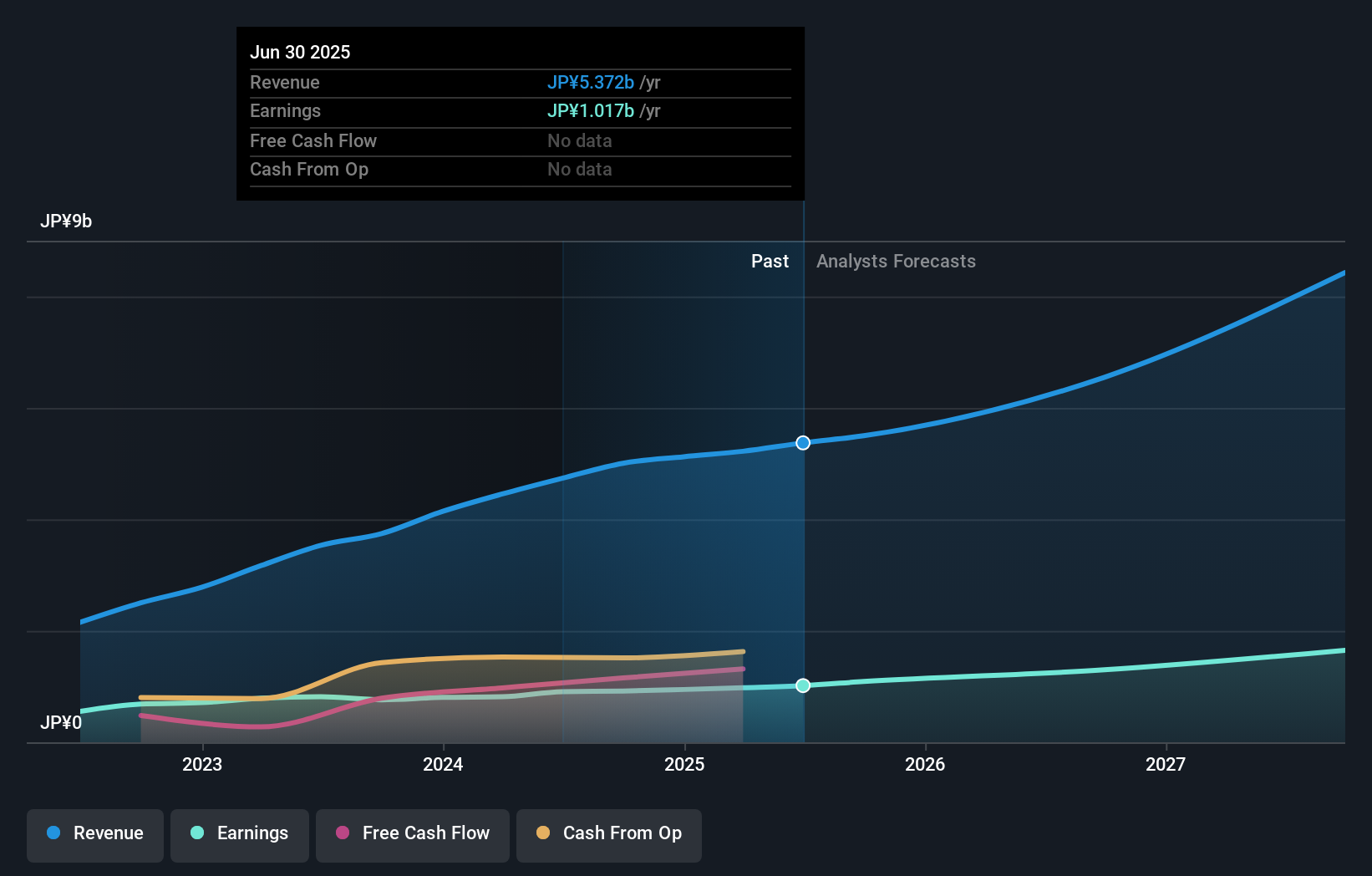

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Kanamic NetworkLTD has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Kanamic NetworkLTD will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Kanamic NetworkLTD, it has a TSR of -27% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Kanamic NetworkLTD shareholders are up 12% for the year (even including dividends). But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. So this might be a sign the business has turned its fortunes around. Is Kanamic NetworkLTD cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Kanamic NetworkLTD may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kanamic NetworkLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3939

Kanamic NetworkLTD

Operates as an application and communication service provider in the elderly care and medical care fields in Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives