- Japan

- /

- Healthtech

- /

- TSE:3628

Data HorizonLtd (TSE:3628) shareholders are up 16% this past week, but still in the red over the last three years

Data Horizon Co.,Ltd. (TSE:3628) shareholders will doubtless be very grateful to see the share price up 51% in the last quarter. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 68% in the last three years. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

The recent uptick of 16% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Because Data HorizonLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Data HorizonLtd grew revenue at 17% per year. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 19% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

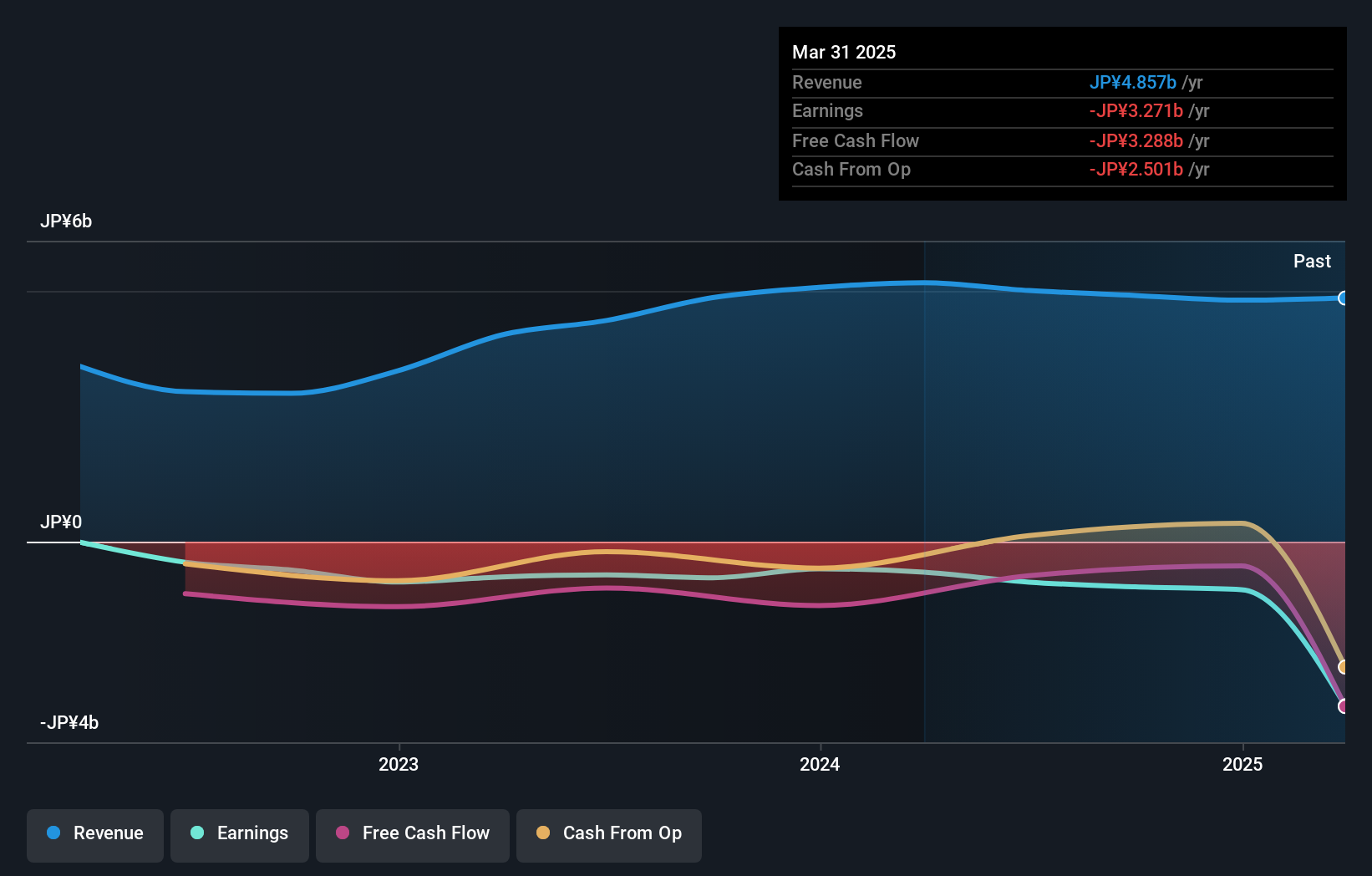

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Data HorizonLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Data HorizonLtd has rewarded shareholders with a total shareholder return of 5.8% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.7% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Data HorizonLtd better, we need to consider many other factors. Take risks, for example - Data HorizonLtd has 4 warning signs (and 3 which are concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3628

Slight risk and slightly overvalued.

Market Insights

Community Narratives