- Japan

- /

- Medical Equipment

- /

- TSE:3593

Hogy Medical (TSE:3593) One-Off ¥733M Loss Challenges Defensive Margin Narrative

Reviewed by Simply Wall St

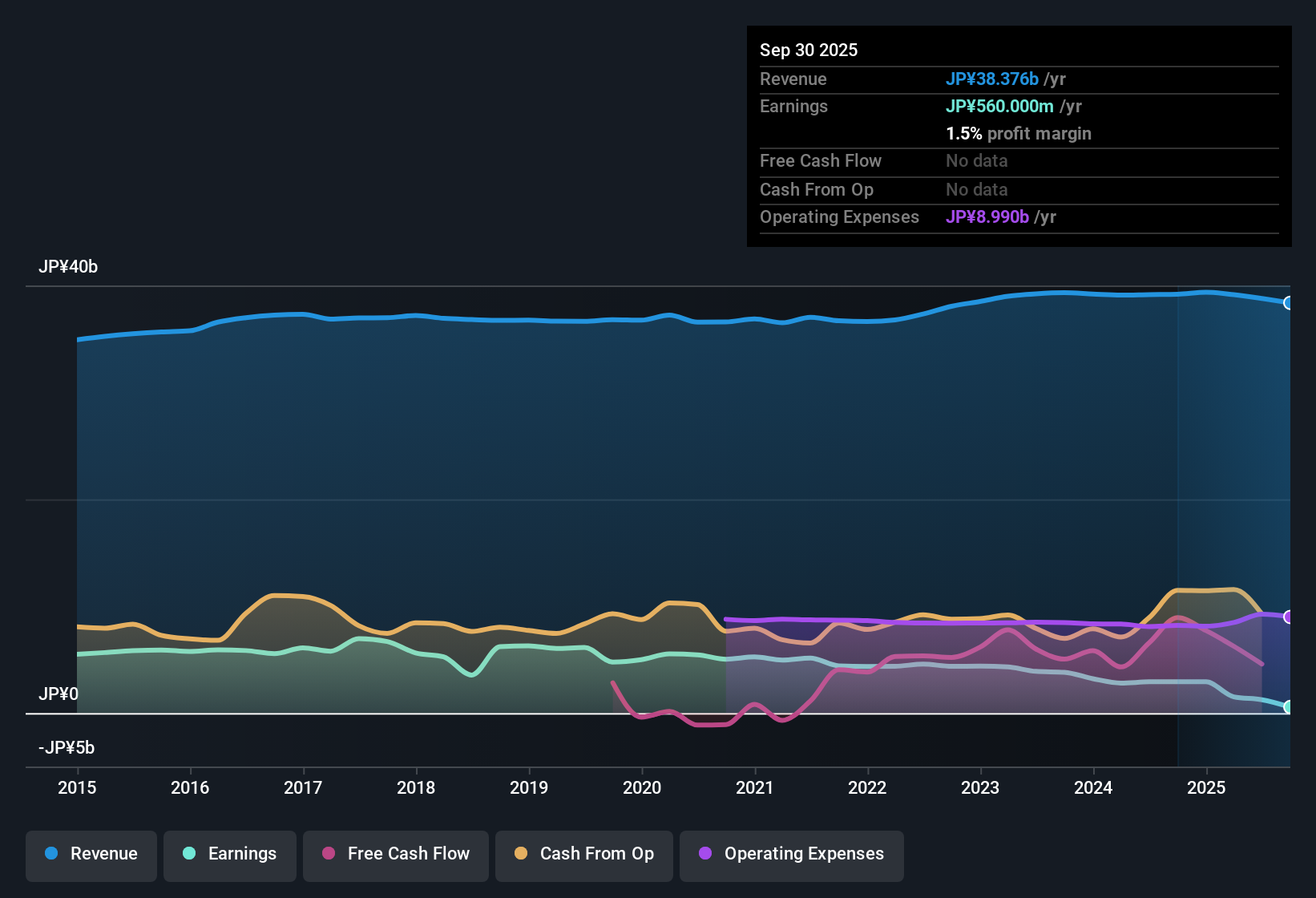

Hogy MedicalLtd (TSE:3593) booked a one-off loss of ¥733.0 million over the twelve months to September 30, 2025, dragging net profit margins down to 3.2% from last year’s 7.5%. Earnings have declined by 18.7% per year over the past five years, and the company now trades on an 88.1x Price-To-Earnings Ratio, which is well above the Japanese medical equipment industry average of 15.8x and the peer average of 22.6x. Despite these setbacks, forecasts call for earnings to rebound, with growth expected to outpace the wider market even as shares remain below the estimated fair value of ¥6,286.4 per share.

See our full analysis for Hogy MedicalLtd.Next up, we’ll see how these results compare against the most widely followed narratives. Some long-held market assumptions may be reinforced, while others could be challenged by the latest data.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off ¥733.0 Million Loss Adds Pressure to Margins

- This ¥733.0 million one-time loss marks a stark blow to profitability, taking net profit margins down to 3.2%, which is much lower than the company’s typical range in prior years.

- Although the prevailing market view frames Hogy MedicalLtd as a defensive, steady play within healthcare, this sharp margin hit creates tension for the “safe haven” thesis.

- While defensive stocks usually ride out market dips with stable profits, the scale of this loss challenges the notion that this business is immune from shocks.

- Healthcare sector tailwinds such as demographic demand might support gradual recovery, but sudden large charges like this are not typically part of the “defensive” sector story.

Forecast 16.3% EPS Growth Outpaces Market, But Revenue Lags

- Earnings are projected to rebound by 16.3% per year, outpacing the wider Japanese market growth forecast of 8%, even as revenue is only expected to rise by 3.2% per year compared to the market average of 4.5%.

- The prevailing market view heavily supports the potential for above-market profit growth, with

- a forecasted uptick in EPS creating headroom for sentiment to turn positive faster than the steady but slower revenue trend alone might suggest,

- yet the lower projected revenue growth means future upside depends on effective cost controls and not just topline expansion.

Trading at 88.1x P/E Despite Share Price Below DCF Fair Value

- Hogy MedicalLtd’s P/E of 88.1x remains far above both the Japanese medical equipment average (15.8x) and peer average (22.6x), while its share price of ¥5,090 still trades below its DCF fair value estimate of ¥6,286.40.

- This creates a complex setup, since the prevailing market view argues that premium healthcare valuations are justified by defensive appeal.

- However, the combination of a lofty P/E with a discounted price to DCF fair value means that while some investors may find long-term value, others could shy away from these expensive headline multiples in the near term.

- The gap suggests patient investors could be rewarded if the profit recovery materializes, but it puts pressure on future execution to close that value disconnect.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hogy MedicalLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a projected rebound in earnings, Hogy MedicalLtd’s inconsistent margins, slow revenue growth, and high valuation signal risks for investors seeking steady performance.

If you value consistent progress and fewer surprises, use our stable growth stocks screener (2116 results) to focus on companies delivering reliable results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hogy MedicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3593

Hogy MedicalLtd

Engages in the manufacture and sale of medical consumables, medical equipment, and medical nonwoven products in Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives