- Japan

- /

- Healthcare Services

- /

- TSE:2784

Alfresa Holdings (TSE:2784) Valuation Spotlight After Upgraded Profit Outlook and Dividend Boost

Reviewed by Simply Wall St

Alfresa Holdings (TSE:2784) grabbed investor interest after the company revised its full-year profit guidance sharply upward. This revision was driven by anticipated gains from selling investment securities and a reduction in cross-shareholdings. At the same time, Alfresa announced a higher second quarter dividend.

See our latest analysis for Alfresa Holdings.

With excitement around the profit outlook and a lifted dividend, Alfresa’s momentum has picked up. This is reflected in a 1-month share price return of 8.5% and a healthy 1-year total shareholder return of 6.5%. Investors have started to notice this trend. Longer-term returns above 50% over three years signal that optimism has been building beyond just the recent news.

If these kinds of healthcare catalysts have you searching for the next opportunity, it might be the perfect moment to check out See the full list for free.

But with shares up and analyst targets largely met, is Alfresa still undervalued based on future earnings potential? Or has the recent rally already factored in all the good news for investors?

Price-to-Earnings of 17x: Is it justified?

Alfresa Holdings is trading at a Price-to-Earnings ratio of 17x, which positions the company above the average level of its sector peers and the broader industry landscape. With its last closing price of ¥2,320.5, the stock appears more expensive than many of its counterparts based on this popular metric.

The Price-to-Earnings (P/E) ratio measures what investors are willing to pay today for a yen of future earnings. For companies like Alfresa, especially in healthcare, this ratio helps gauge whether growth expectations are already priced in or if the market anticipates stronger profit performance ahead.

Alfresa’s P/E of 17x is notably higher than the peer average of 13.9x and the Japan Healthcare industry average of 14.9x. While the market’s premium may suggest optimism about future profitability or operational strength, it could also mean investors are paying up for perceived stability. When compared to the estimated fair P/E ratio of 20.1x, Alfresa actually trades at a discount to its modeled fair valuation. This could indicate that the market may eventually re-rate the stock higher to reflect stronger fundamentals.

Explore the SWS fair ratio for Alfresa Holdings

Result: Price-to-Earnings of 17x (ABOUT RIGHT)

However, slowing revenue growth or broader market corrections could quickly cool recent optimism around Alfresa's share price momentum and current valuation premium.

Find out about the key risks to this Alfresa Holdings narrative.

Another View: Discounted Cash Flow Perspective

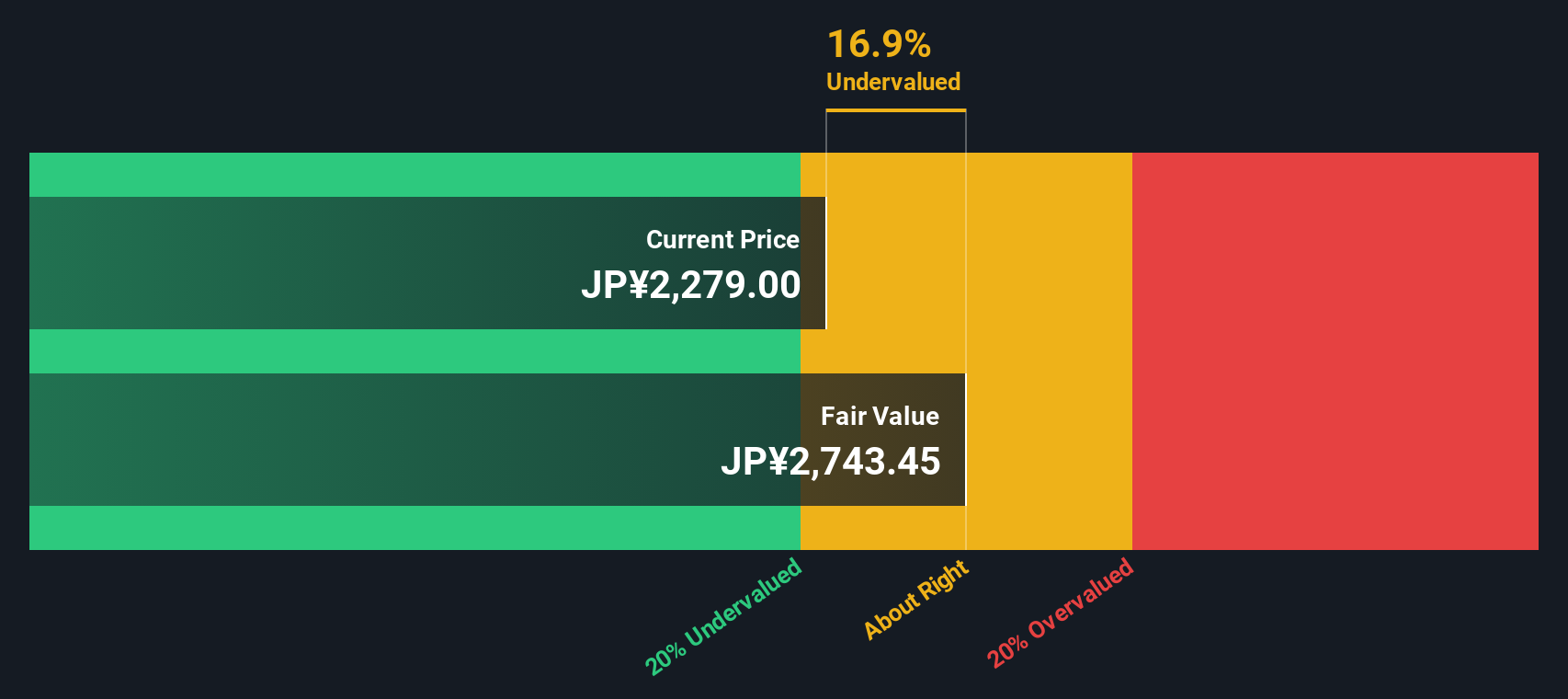

Looking at Alfresa from the perspective of our DCF model provides a different picture. The SWS DCF model suggests the stock trades about 15.5% below its fair value estimate. This indicates a potential undervaluation, even though recent price action appears strong. Which approach will the market trust next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alfresa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alfresa Holdings Narrative

If you have your own perspective or wish to dig into the numbers independently, it only takes a few minutes to craft your own view on Alfresa. Do it your way

A great starting point for your Alfresa Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when the market is full of dynamic stocks? Find your next favorite by using these powerful tools.

- Grow your passive income stream by checking out these 16 dividend stocks with yields > 3%, which offers consistently high yields and robust financial health.

- Unleash the potential of artificial intelligence innovation and get ahead with these 25 AI penny stocks, leading the way in disruptive tech.

- Catch massive price swings early by targeting these 3592 penny stocks with strong financials, featuring resilient growth drivers and unique market momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2784

Alfresa Holdings

Through its subsidiaries, engages in the manufacture, wholesale, marketing, and import/export of pharmaceuticals, diagnostic reagents, and medical devices/equipment in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives