- Japan

- /

- Healthtech

- /

- TSE:2413

Is M3’s (TSE:2413) Share Buyback a Vote of Confidence or Capital Discipline in Action?

Reviewed by Sasha Jovanovic

- M3, Inc. recently announced the progress of its share repurchase program, with 196,000 shares bought back under a Board-approved plan targeting up to 20 million shares and a maximum budget of ¥20 billion.

- This move signals management's positive outlook on the company and could support shareholder value by reducing the number of shares outstanding.

- We'll explore how the ongoing buyback program, by reducing share count, may shape M3's investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is M3's Investment Narrative?

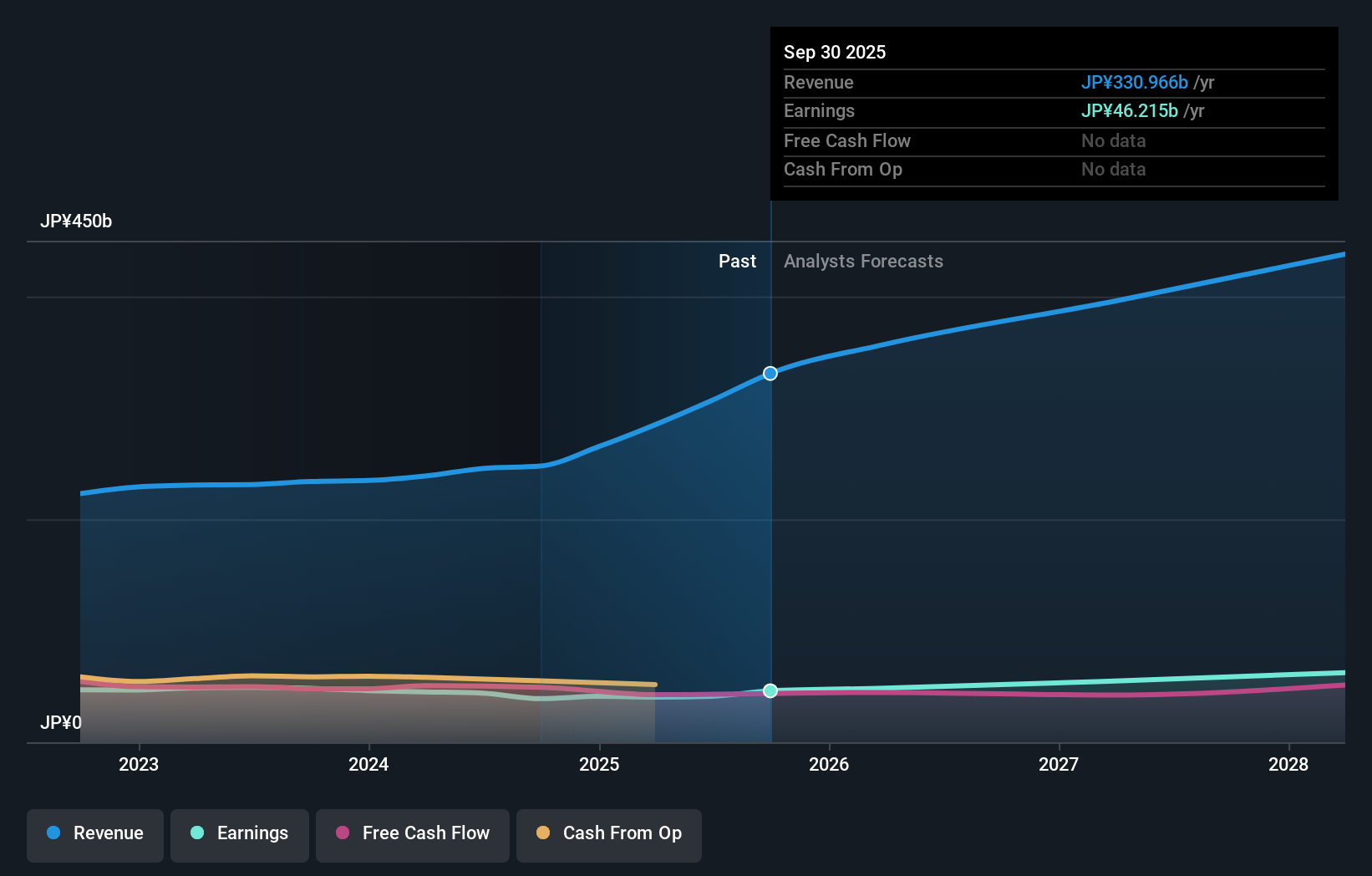

For anyone looking at M3, the broad story hinges on whether its digital health platform can keep driving both sustainable growth and profitability despite a competitive industry and lofty valuation multiples. The company’s latest buyback update, 196,000 more shares repurchased, reinforces management’s effort to return capital to shareholders and instill confidence, potentially supporting the share price by reducing supply. However, the modest size of this most recent tranche, versus the total program, means it likely only nudges the short-term narrative rather than changing key business risks or immediate catalysts. Core concerns such as earnings momentum, integration of new partnerships, and M3’s premium price-to-earnings multiple all remain front and center. The repurchase activity may briefly ease volatility, but doesn’t address deeper questions around valuation and competitive pressures.

But as reassuring as buybacks can be, premium pricing always deserves a closer look. M3's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on M3 - why the stock might be worth as much as ¥1925!

Build Your Own M3 Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M3 research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free M3 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M3's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2413

M3

Provides medical-related services to physicians and other healthcare professionals through the internet.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives