- South Korea

- /

- Software

- /

- KOSDAQ:A058970

High Growth Tech Stocks To Watch In Asia November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns about AI valuations and economic uncertainties, the Asian tech sector stands out as a dynamic area of interest, particularly in light of recent declines in key indices like Japan's Nikkei 225 and China's CSI 300. In such a volatile environment, identifying high-growth tech stocks involves examining companies that not only innovate but also demonstrate resilience amid shifting market sentiments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 28.39% | 33.59% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

EMRO (KOSDAQ:A058970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EMRO, Incorporated is a company that specializes in providing supply chain management software both in South Korea and internationally, with a market capitalization of ₩446.18 billion.

Operations: The company generates revenue through its supply chain management software solutions, serving both domestic and international markets. With a market capitalization of ₩446.18 billion, its business model focuses on leveraging technology to optimize supply chain processes for clients globally.

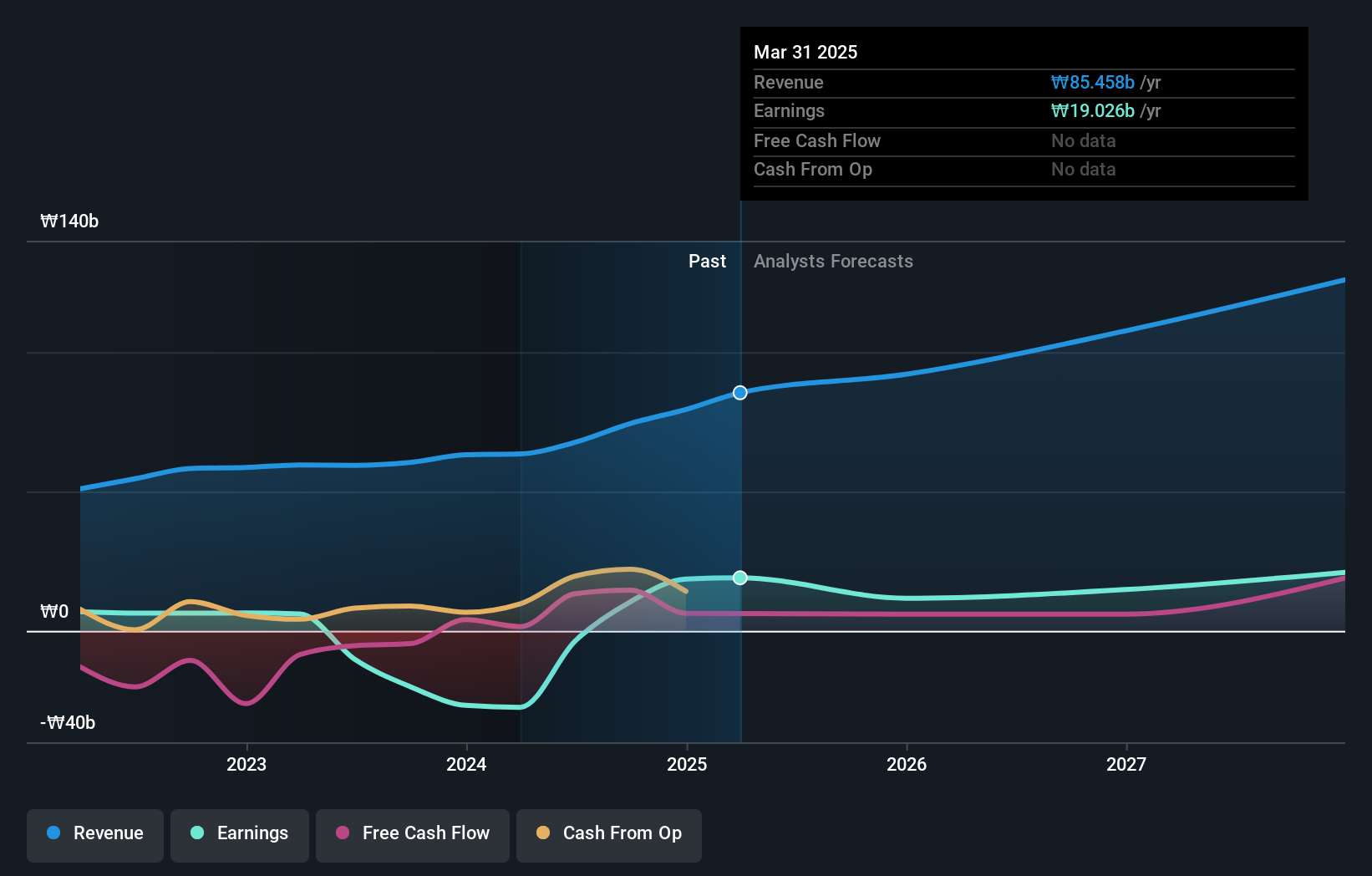

EMRO, amidst a challenging backdrop with a 46.2% dip in earnings last year, contrasts sharply with its robust revenue growth forecast at 18.7% annually, outpacing the Korean market's 10.3%. This juxtaposition highlights resilience and potential in harnessing market opportunities more effectively than many peers. Despite lower profit margins now at 6.5% compared to last year's 14.1%, the company is poised for significant earnings recovery, projected at an impressive annual increase of 54.6%. The recent introduction of their AI-based BOM collaboration solution underscores EMRO's commitment to innovation and may catalyze future business expansions, leveraging their high level of non-cash earnings which signify strong underlying operational efficiency.

- Navigate through the intricacies of EMRO with our comprehensive health report here.

Understand EMRO's track record by examining our Past report.

Guo Tai Epoint SoftwareLtd (SHSE:688232)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guo Tai Epoint Software Co., Ltd provides software and information technology solutions in China, with a market capitalization of approximately CN¥8.54 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to approximately CN¥1.94 billion.

Guo Tai Epoint SoftwareLtd, navigating through a challenging period marked by a net loss of CNY 106.63 million for the nine months ending September 2025, contrasts with its ambitious share repurchase plan valued at CNY 50 million. Despite recent setbacks reflected in a significant earnings drop of 58.7% over the past year, the company's strategic focus on R&D is evident from its consistent investment in innovation, aiming to reverse current trends and leverage emerging market opportunities. This approach underscores its resilience and potential to capitalize on evolving tech landscapes in Asia, particularly as it aims to enhance shareholder value through equity incentives and bolster operational efficiencies moving forward.

CareNet (TSE:2150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CareNet, Inc., along with its subsidiaries, operates in the pharmaceutical digital transformation and medical platform sectors in Japan, with a market capitalization of ¥46.55 billion.

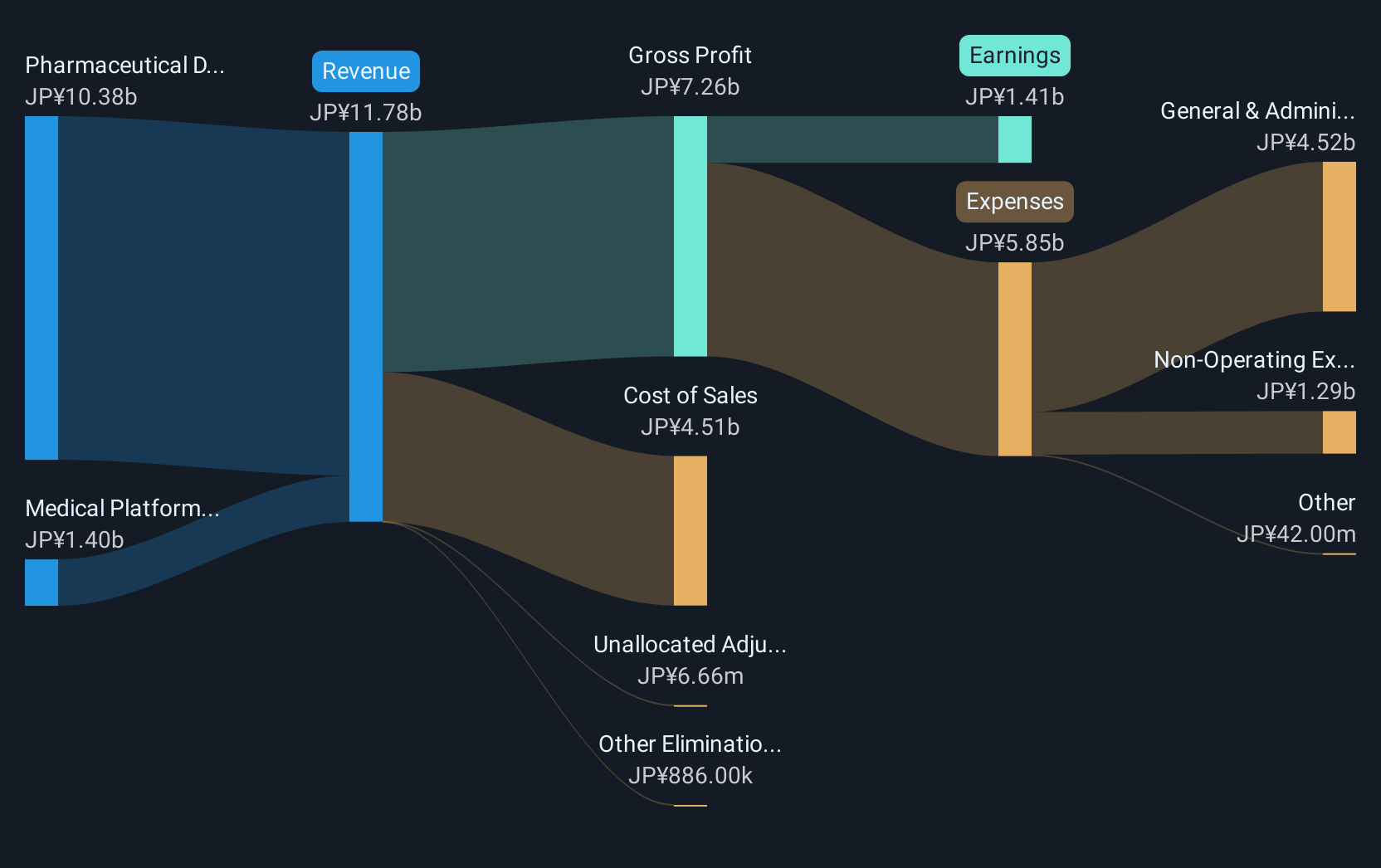

Operations: The company generates revenue primarily from its Pharmaceutical DX Business, contributing ¥10.38 billion, and its Medical Platform Business, adding ¥1.40 billion.

CareNet's strategic maneuvers, including a recent acquisition by BPEA EQT for ¥47.4 billion, underscore its robust positioning in Asia's high-growth tech sector. This move, coupled with an 11.4% annual revenue growth and a significant 21.4% forecast in earnings growth, highlights its dynamic market adaptation. Innovations are further supported by substantial R&D investments, aligning with industry shifts towards enhanced digital healthcare solutions. These developments not only reflect CareNet's adaptability but also fortify its market presence amidst evolving technological landscapes.

Summing It All Up

- Unlock our comprehensive list of 194 Asian High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMRO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A058970

EMRO

Provides supply chain management software in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success