Fewer Investors Than Expected Jumping On Pickles Holdings Co.,Ltd. (TSE:2935)

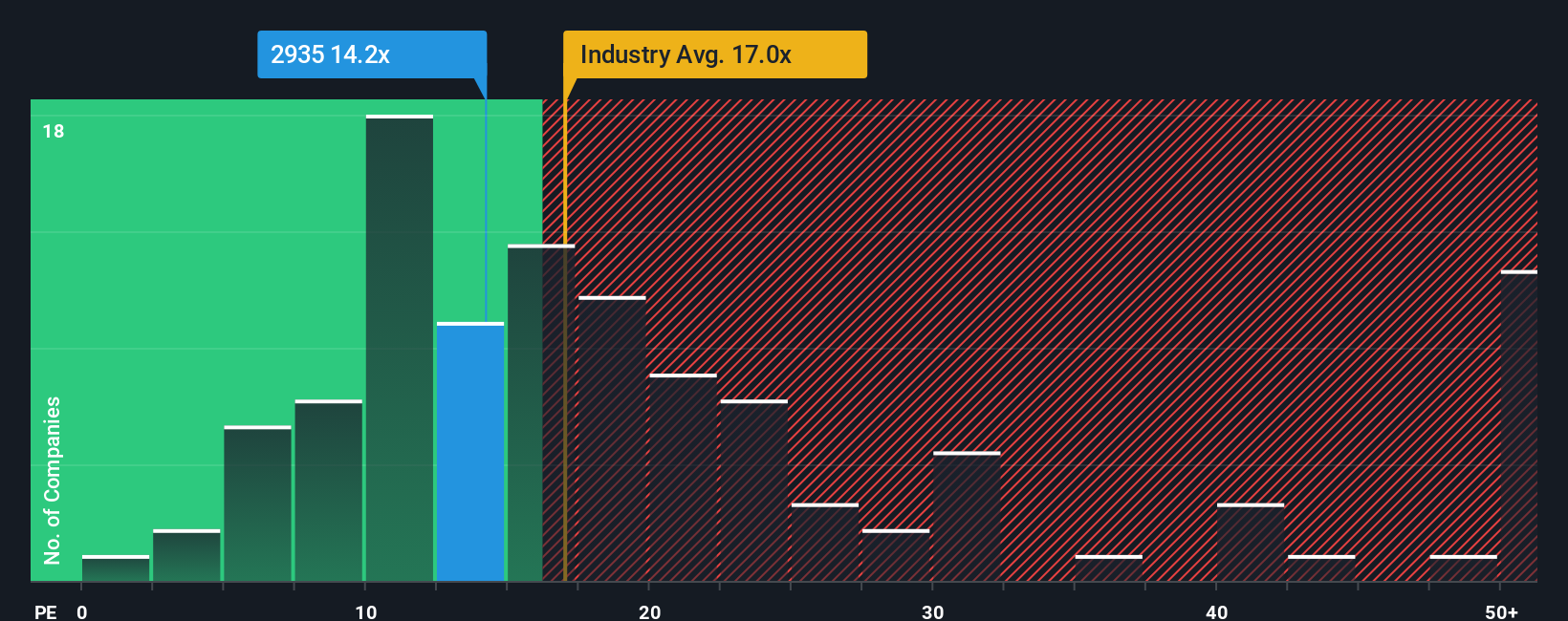

With a median price-to-earnings (or "P/E") ratio of close to 15x in Japan, you could be forgiven for feeling indifferent about Pickles Holdings Co.,Ltd.'s (TSE:2935) P/E ratio of 14.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Pickles HoldingsLtd as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Pickles HoldingsLtd

How Is Pickles HoldingsLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Pickles HoldingsLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 38% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 13% each year over the next three years. With the market only predicted to deliver 9.6% per annum, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Pickles HoldingsLtd is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Pickles HoldingsLtd's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Pickles HoldingsLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Pickles HoldingsLtd is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2935

Pickles HoldingsLtd

Through its subsidiaries, manufactures and sells pickles in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives