How Investors May Respond To Japan Tobacco (TSE:2914) Analyst Upgrade and Heated Tobacco Expansion

Reviewed by Sasha Jovanovic

- Japan Tobacco recently held a board meeting, where it resolved to enter into an absorption-type split contract with Shionogi as part of its ongoing portfolio optimization.

- In addition, an analyst at JPMorgan upgraded Japan Tobacco’s rating, citing increased market share in the heated tobacco segment and effective reinvestment strategies supporting ongoing gains.

- We'll now explore how JPMorgan's endorsement of Japan Tobacco's heated tobacco growth ambitions could affect the company's investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Japan Tobacco Investment Narrative Recap

To consider Japan Tobacco as a potential holding, an investor needs confidence in the company’s ability to offset shrinking combustible volumes in its core markets by scaling up heated tobacco and other reduced-risk alternatives. The recent JPMorgan upgrade and board-approved operational split with Shionogi both reinforce the narrative that growth in the heated tobacco segment could be the most important near-term catalyst, but these developments do not fundamentally alter the overarching risk from ongoing market contraction in combustibles.

Among the recent highlights, Japan Tobacco’s nationwide launch of Ploom AURA and new EVO heated tobacco sticks stands out as especially relevant, aligning directly with the optimism around segment share gains acknowledged by JPMorgan. This launch supports the company’s efforts to address evolving consumer preferences, although the RRP segment still represents a substantial financial commitment and is a drag on group earnings until targeted breakeven is achieved.

Yet, against these efforts to drive growth in heated products, it is important for investors to be mindful of the underlying drag from continued declines in the core Japanese combustibles market...

Read the full narrative on Japan Tobacco (it's free!)

Japan Tobacco's outlook predicts ¥3,783.8 billion in revenue and ¥645.1 billion in earnings by 2028. This is based on a 4.5% annual revenue growth rate and a ¥451.1 billion increase in earnings from the current ¥194.0 billion.

Uncover how Japan Tobacco's forecasts yield a ¥4812 fair value, in line with its current price.

Exploring Other Perspectives

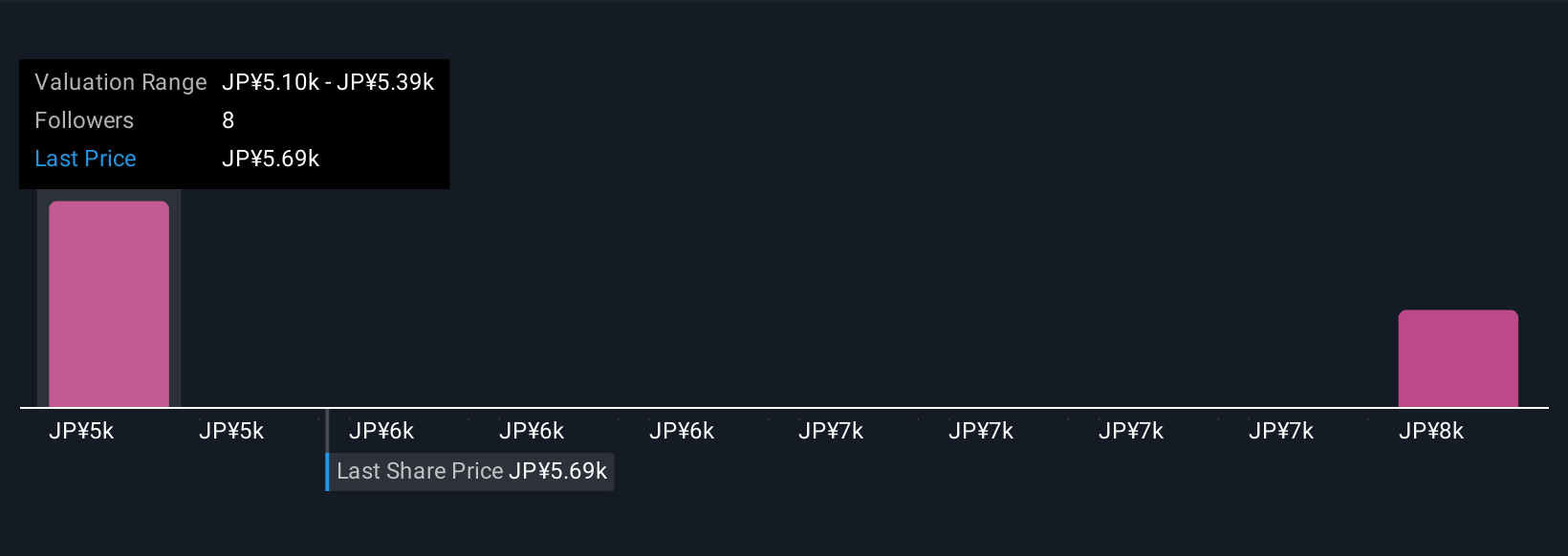

Simply Wall St Community members set fair value estimates ranging from ¥4,811 to ¥8,053 across two perspectives, highlighting broad disagreement on Japan Tobacco’s outlook. Ongoing high investment requirements for reduced-risk products are a key factor community members should weigh when forming an opinion.

Explore 2 other fair value estimates on Japan Tobacco - why the stock might be worth as much as 63% more than the current price!

Build Your Own Japan Tobacco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Tobacco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Japan Tobacco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Tobacco's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2914

Japan Tobacco

A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives