A Look at Japan Tobacco (TSE:2914) Valuation After Dividend Hike and New Earnings Forecasts

Reviewed by Simply Wall St

Japan Tobacco (TSE:2914) sent a clear signal to shareholders by raising its year-end dividend guidance and laying out fresh earnings forecasts for 2025. The updated dividend, now set at JPY 130 per share, exceeds previous expectations and was announced together with the company’s revenue and profit targets for the coming year.

See our latest analysis for Japan Tobacco.

The upbeat dividend news and fresh forecasts came as Japan Tobacco’s momentum continues to build. Its share price has climbed 21.63% year-to-date. Over the past year, total shareholder return has reached 20.74%. The three- and five-year total returns are 108% and 221% respectively, underscoring the company’s resilience and robust recovery.

If you’re feeling inspired by Japan Tobacco’s recent performance, it’s a great opportunity to cast a wider net and discover fast growing stocks with high insider ownership

With Japan Tobacco’s stock posting impressive multi-year returns and upbeat guidance now public, the key question for investors is whether all the good news is already reflected in the price or if there is still a genuine buying opportunity.

Most Popular Narrative: 1% Undervalued

The current narrative sets Japan Tobacco’s fair value at ¥4,974, nearly identical to its last closing price of ¥4,925. This suggests the market is in line with consensus expectations. This close alignment puts the spotlight squarely on the assumptions and projections that are driving analysts’ confidence in their target.

"Analysts assume that profit margins will increase from 5.9% today to 17.0% in 3 years time. Analysts expect earnings to reach ¥645.1 billion (and earnings per share of ¥367.81) by about September 2028, up from ¥194.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥710.6 billion in earnings, and the most bearish expecting ¥524.0 billion."

Can margins really triple in just a few short years? Behind this call are some daring profit forecasts and a debate among analysts that may surprise you. The full narrative reveals which numbers drive the remarkably precise fair value, as well as what is fueling all the disagreement.

Result: Fair Value of ¥4,974 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Japan’s shrinking tobacco market and delayed profitability in reduced-risk products could quickly challenge the optimistic outlook.

Find out about the key risks to this Japan Tobacco narrative.

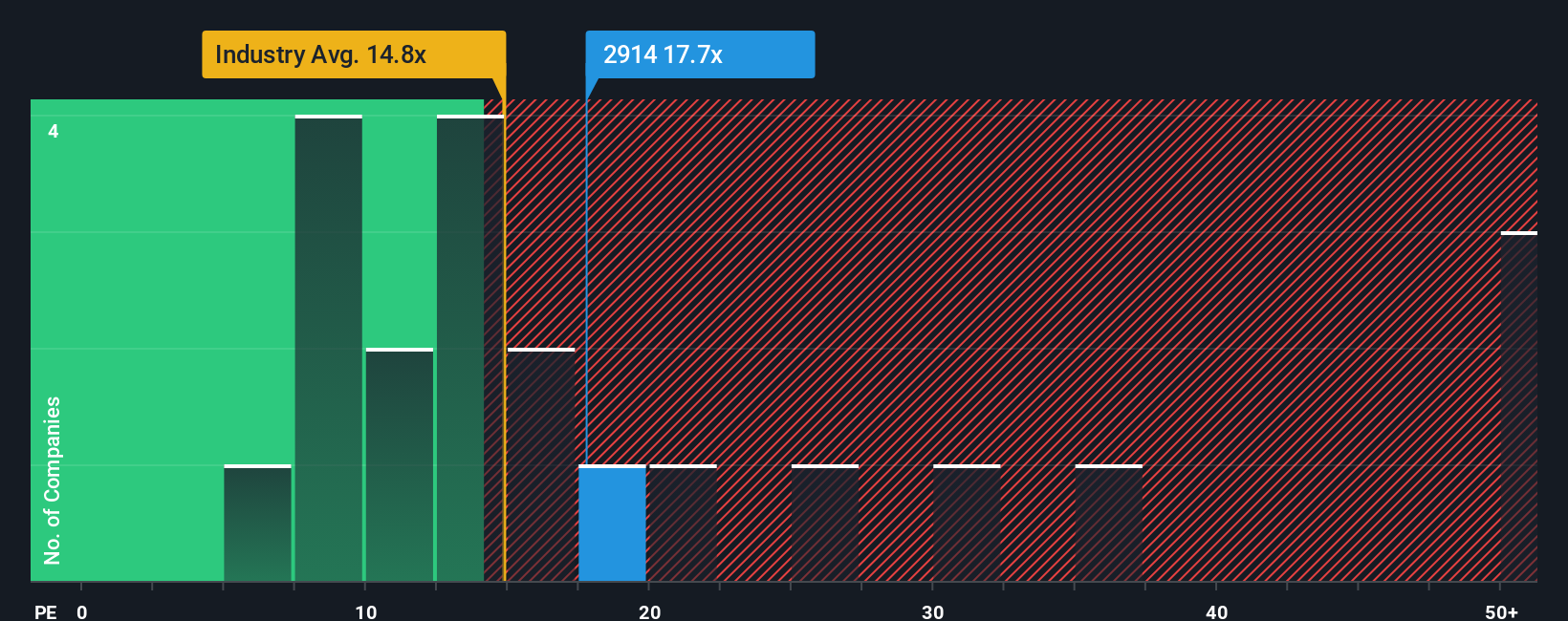

Another View: Market Multiples Paint a Different Picture

Looking through a price-to-earnings lens, Japan Tobacco trades at 45.1x, which is significantly higher than both its peer average (31.4x) and the broader Asian Tobacco industry (15x). Even when compared to the fair ratio of 39.4x, the current multiple suggests that investors are paying a notable premium for growth and stability that is not guaranteed.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Japan Tobacco Narrative

If the numbers or assumptions above do not quite match your view, why not dig into the data and craft your own narrative in just a few minutes? Do it your way

A great starting point for your Japan Tobacco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not limit themselves to just one opportunity. Expand your horizons and uncover companies redefining their industries with the help of our hand-picked screeners below.

- Supercharge your portfolio by targeting companies offering robust cash flow potential with these 856 undervalued stocks based on cash flows that others may be overlooking.

- Tap into the explosive rise of machine learning and automation by using these 26 AI penny stocks featuring innovators pushing AI boundaries.

- Secure consistent passive income and stability by focusing on these 21 dividend stocks with yields > 3% with yields above 3% to boost your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2914

Japan Tobacco

A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives