Kagome (TSE:2811) Margin Decline Reinforces Caution on Non-Recurring Gains

Reviewed by Simply Wall St

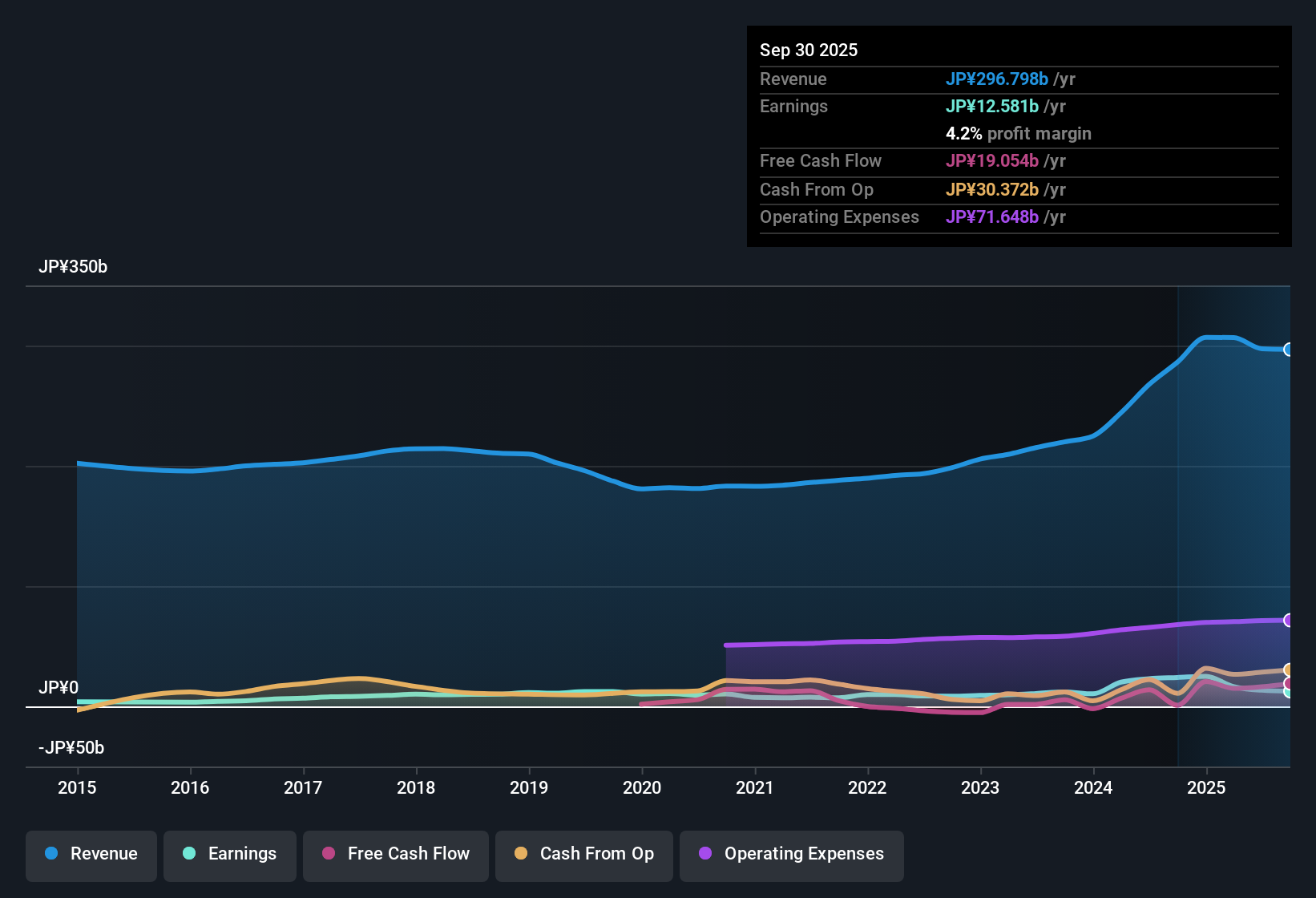

Kagome (TSE:2811) delivered a net profit margin of 4.2%, down sharply from last year’s 8.4%, a period that was notably boosted by a one-off gain of ¥9.2 billion. Earnings are forecast to grow at 5.1% per year, lagging behind the broader Japanese market’s 7.9% expectation, while revenue is projected to decline by 0.9% per year over the next three years. For investors, the key issues this quarter are margin compression and the impact of non-recurring gains.

See our full analysis for Kagome.Next, we will see how these headline numbers compare to the market narratives that shape investor sentiment; some expectations will be confirmed while others could be upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Discount to Peers Despite Industry Premium

- Kagome's price-to-earnings ratio is 19.1x, which is notably below its peer average of 29.4x, but trades at a premium to the Japanese food industry average of 16.2x.

- Despite claims that valuation metrics favor the company, the position is nuanced:

- Trading beneath peers supports optimistic views that the stock may be undervalued locally and suggests potential upside if markets re-rate it upward.

- The premium to the broader food industry average challenges the idea of a clear bargain and raises the bar for future performance to justify higher multiples.

Earnings Growth Trails Behind Market Pace

- Annual earnings growth is forecast at 5.1% for Kagome, trailing the Japanese market's broader expectation of 7.9% per year.

- Bulls often focus on positive growth, but the slower rate casts doubt on claims of outperformance over the wider market:

- While growth is expected, the company needs to accelerate to close the gap with the market, or risk investor capital flowing elsewhere in search of stronger returns.

- This growth differential challenges bullish hopes that current momentum is enough to sustain future re-rating or higher investor interest unless fundamentals materially improve.

One-Off Gain Skews Margin Story

- Last year’s net profit margin of 8.4% was significantly boosted by a one-off gain of ¥9.2 billion, but has now fallen to 4.2% without such extraordinary items.

- Narrative optimism around the recent profit figures is tempered by the realization that margins may not be sustainable:

- Reliance on one-off gains highlights the importance of recurring profit sources rather than non-operating income to support ongoing shareholder returns.

- With future results likely to reflect normalized margins, investors should scrutinize underlying operations and not just headline profit swings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kagome's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kagome’s below-market earnings growth and uncertain profit margins suggest challenges for investors seeking reliable compounding and consistent performance.

If you want more predictable growth and fewer margin surprises, check out stable growth stocks screener (2113 results) to find companies delivering steady results across different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kagome might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2811

Kagome

Manufactures, purchases, and sells vegetable drinks and food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives