Kagome Co., Ltd.'s (TSE:2811) Business Is Yet to Catch Up With Its Share Price

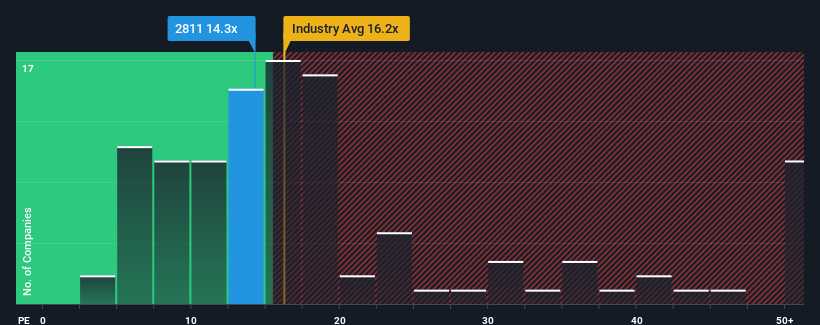

There wouldn't be many who think Kagome Co., Ltd.'s (TSE:2811) price-to-earnings (or "P/E") ratio of 14.3x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Kagome as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Kagome

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Kagome's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 109% last year. The strong recent performance means it was also able to grow EPS by 190% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 5.1% per year over the next three years. With the market predicted to deliver 9.7% growth per year, that's a disappointing outcome.

In light of this, it's somewhat alarming that Kagome's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Kagome's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kagome currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Kagome that you need to take into consideration.

If these risks are making you reconsider your opinion on Kagome, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kagome might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2811

Kagome

Manufactures, purchases, and sells vegetable drinks and food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives