House Foods Group (TSE:2810): Evaluating Valuation After Lowered Earnings and Sales Guidance

Reviewed by Simply Wall St

House Foods Group (TSE:2810) drew attention after management issued updated guidance that lowered its expectations for net sales and operating profit for the next fiscal year. This is a material update that investors are now assessing closely.

See our latest analysis for House Foods Group.

Despite the lowered earnings guidance this quarter, House Foods Group’s share price has managed to hold relatively steady in recent months, with the total shareholder return over the past year sitting at 4.7%. While the company’s three-year total return shows some progress at just under 10%, performance over five years remains in the red. This highlights that investor sentiment is still mending from longer-term headwinds. Short-term momentum looks subdued as investors weigh the implications of the revised outlook alongside a steady dividend policy.

If you’re exploring what’s trending beyond established names, this could be the right moment to broaden your perspective and discover fast growing stocks with high insider ownership

Still, with the latest outlook now public and shares trading near their recent range, the question for investors becomes clear: does the current price represent an undervalued opportunity, or is the market already factoring in future growth prospects?

Price-to-Earnings of 21.4x: Is it justified?

House Foods Group’s shares currently trade on a price-to-earnings (P/E) ratio of 21.4x, which is above both the industry average and our calculated fair multiple. This suggests the stock may be priced at a premium.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of the company’s earnings. It is especially meaningful for food and consumer companies, where stable earnings and reliable cash flows are highly valued by the market.

At 21.4x earnings, House Foods Group is more expensive than the JP Food industry average of 16.4x. Importantly, our analysis suggests the fair P/E ratio should be closer to 17x. This indicates a market premium that may not be fully supported by projected growth rates for the company or its broader sector.

If investor sentiment shifts toward normalized earnings multiples, there could be room for the P/E ratio to contract and valuation to follow. Explore the SWS fair ratio for House Foods Group

Result: Price-to-Earnings of 21.4x (OVERVALUED)

However, subdued revenue growth and a recent dip below analyst price targets could pose challenges to the current valuation narrative for House Foods Group shares.

Find out about the key risks to this House Foods Group narrative.

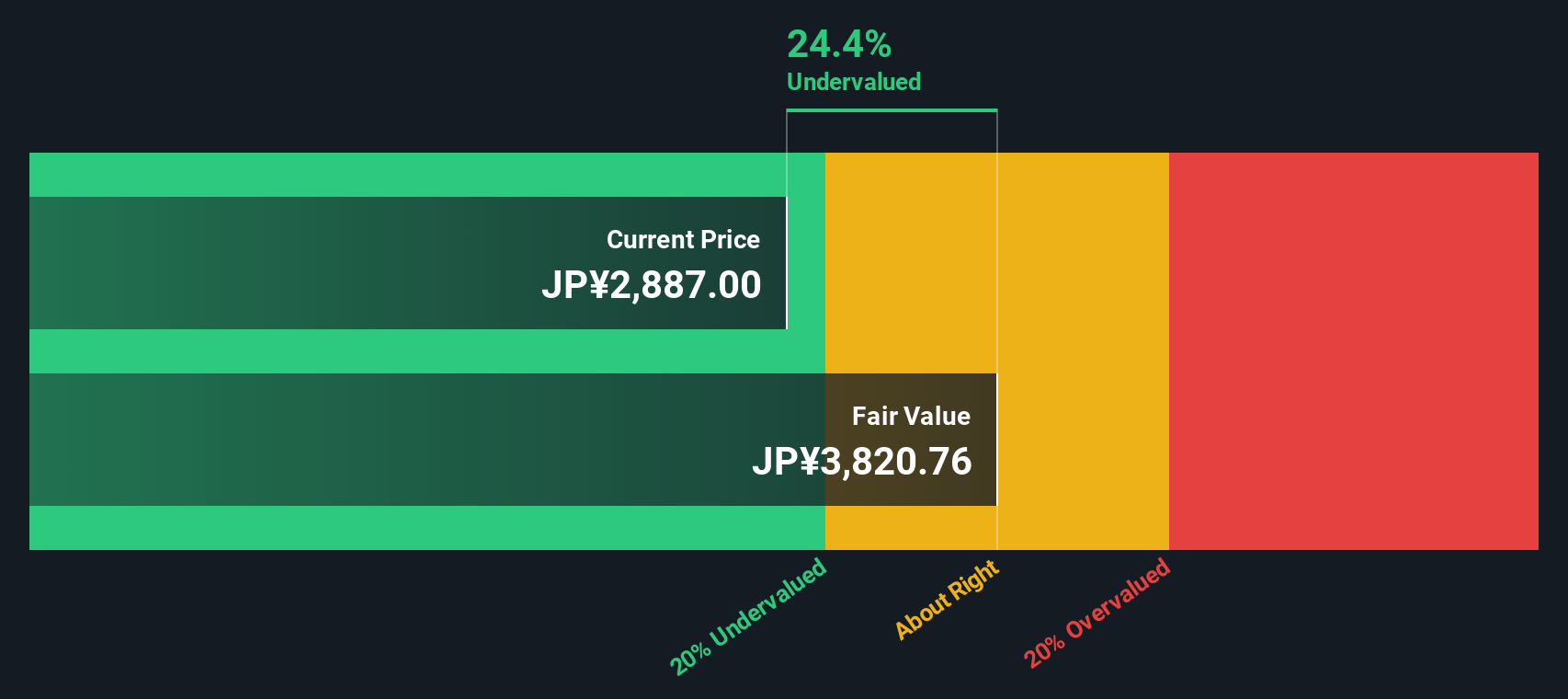

Another View: Discounted Cash Flow Suggests Upside

While the price-to-earnings ratio points to House Foods Group looking expensive, our DCF model paints a different picture. Based on future cash flows, the SWS DCF model values the shares around ¥3,838. This means the current price trades at a notable discount. Could the market be missing something here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out House Foods Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own House Foods Group Narrative

You might see the numbers differently or have your own research insights. You can easily start building your own narrative in just a few minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding House Foods Group.

Looking for More Investment Ideas?

There’s a world of opportunities beyond the headlines. Don’t let great investments pass you by. Let these hand-picked ideas open new doors in your strategy:

- Capitalize on reliable income with these 18 dividend stocks with yields > 3% to uncover stocks boasting attractive yields above 3% and strong dividend track records.

- Seize the momentum in digital finance by checking out these 82 cryptocurrency and blockchain stocks, where companies are at the forefront of blockchain innovation and next-gen payment solutions.

- Tap into healthcare’s technological edge by using these 31 healthcare AI stocks and target firms leading advancements in medical AI, diagnostics, and treatment platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if House Foods Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2810

House Foods Group

Engages in the manufacture, sale, import, and export of spices, seasonings, and processed foods in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives