Bull-Dog Sauce (TSE:2804) Posts 809% Earnings Surge on One-Off Gain, Raising Questions on Sustainability

Reviewed by Simply Wall St

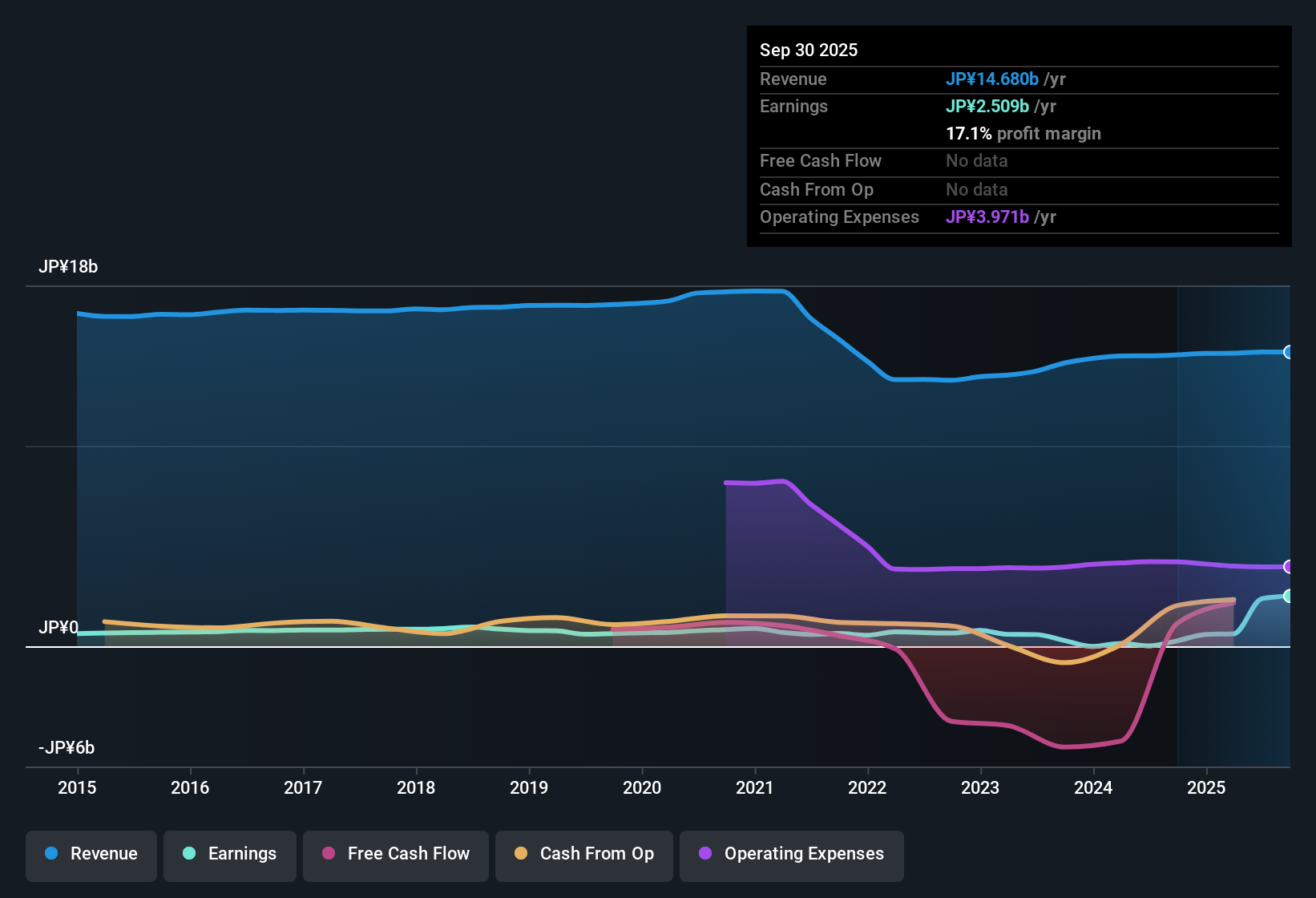

Bull-Dog Sauce (TSE:2804) posted an impressive 809.1% jump in yearly earnings, propelled by a one-off gain of ¥2.8 billion, which sent net profit margins soaring to 17.1% from last year’s 1.9%. Over the past five years, earnings have grown at an average pace of 14.1% per year, highlighting a trend of sustained profitability. While these headline results appear strong, it is clear that the most recent boost in net income reflects exceptional factors rather than ongoing business improvement.

See our full analysis for Bull-Dog Sauce.Next, we will see how these standout numbers compare to the consensus narratives the market follows and where investor expectations might need a reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

Multi-Year Profit Growth Legitimized by 14.1% CAGR

- Bull-Dog Sauce’s annual earnings growth averaged 14.1% across the past five years, demonstrating profitability durability beyond just the current period’s spike.

- The company’s track record of compounding profit growth heavily supports the case for viewing it as a stable, long-term performer, with

- a clear throughline of multi-year margin improvements (even if this year was distorted upward), and

- historical consistency that lends credibility to optimistic narratives, regardless of this year's one-off gain.

One-Off Gain Drives 17.1% Net Margin Peak

- This year’s substantial net margin climb to 17.1% is mainly attributable to a ¥2.8 billion non-recurring gain, rather than core operating improvement.

- While prevailing market analysis points to the company’s defensive appeal, the heavy tilt of recent profit toward a singular one-time windfall brings a cautionary sign for investors weighing long-term quality of earnings, and

- underscores that ongoing growth may look more modest when exceptional items are excluded from future results.

Deep Discount to DCF Fair Value Despite Peer-Challenging P/E

- Bull-Dog Sauce trades at a 10.4x Price-to-Earnings ratio, well below both the JP food industry average (16.4x) and peer average (20.8x). However, the current share price of ¥2022 stands at a significant premium to its DCF fair value of ¥654.60.

- This apparent value gap invites investors to consider that, although the company appears inexpensive on relative earnings, the large divergence from DCF fair value raises questions about whether current profitability is sustainable or simply inflated by the recent one-time gain. The low P/E makes the stock look attractive relative to peers, but the share price’s distance above intrinsic value points to caution on long-term upside without recurring earnings improvement.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bull-Dog Sauce's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bull-Dog Sauce’s recent results rely on a one-off profit boost, raising doubts about the sustainability and true value behind its current market price.

If a lofty share price without recurrent earnings concerns you, use these 880 undervalued stocks based on cash flows to focus on stocks trading at genuine discounts to their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bull-Dog Sauce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2804

Bull-Dog Sauce

Manufactures and sells brown sauces and other seasonings in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives